Running a small business comes with its challenges, especially when it comes to attracting new customers. One of the most effective ways to draw in potential clients is through enticing freebies that create lasting impressions.

From educational resources to engaging events, these freebies not only showcase your expertise in the area of personal finance but also build trust and rapport with your audience. Whether you’re offering downloadable guides or hosting free workshops, the possibilities are endless. Dive into these 28 creative small business freebies ideas that can enhance customer engagement and boost your promotional strategies while keeping things fresh and fun.

1. Financial Literacy eBooks

Offer a free eBook that provides insights into personal finance basics. Topics can range from budgeting tips to investment fundamentals. This not only positions your brand as an authority but also gives potential customers a taste of valuable content that may convert them into loyal clients.

Think about making it visually appealing with infographics and case studies to illustrate your points. You could also include worksheets to help them apply what they learn.

– List a few must-have sections like:

– Budgeting Essentials

– Saving Strategies

– Investment Basics

By providing practical tools, you can engage customers more effectively and keep them coming back for more.

Plus, don’t forget to promote it on social media with engaging visuals!

Financial Literacy eBooks

Editor’s Choice

The Motley Fool Investment Guide: Third Edition: How the Fools Beat Wall…

Sex and Unisex: Fashion, Feminism, and the Sexual Revolution

Stocking Stuffers for Men, Gifts for Him, Multitool Pen Christmas Birthd…

2. Webinars on Smart Investing

Hosting free webinars can be a game changer for your small business. You can cover a variety of topics related to finance, such as retirement planning, stock market basics, or real estate investing strategies. This interactive format allows you to connect with your audience in real-time.

To make the most of it, consider inviting industry experts as guest speakers or creating a panel discussion. Engage participants with Q&A sessions to foster a sense of community and involvement.

– Set clear goals:

– What do you want attendees to learn?

– How will you follow up with them afterward?

Promote your webinar on platforms like Instagram and Facebook with eye-catching graphics that highlight key takeaways without any text.

Webinars on Smart Investing

Editor’s Choice

The Microsoft Office 365 Bible: The Most Updated and Complete Guide to E…

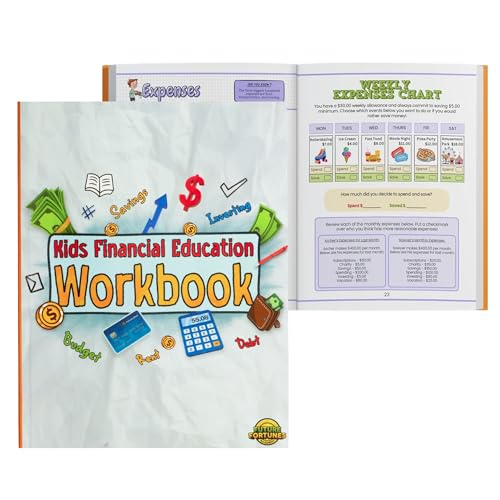

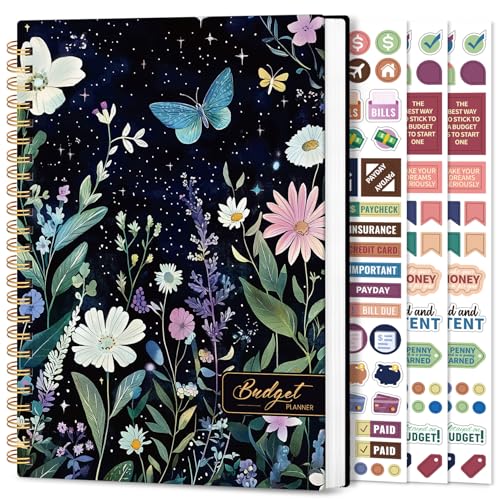

3. Printable Budget Planners

Create and offer a set of free printable budget planners that customers can use to track their expenses and savings. This is a practical tool that shows your commitment to their financial well-being. You can design planners that cater to different financial goals, such as saving for a vacation or paying off debt.

To add more value, include tips about budgeting along with motivational quotes to keep users inspired.

– Include sections for:

– Monthly Income

– Expenses Tracker

– Savings Goals

Promote these planners as a ‘limited-time offer’ to create urgency. They can be effectively shared on Pinterest as visually appealing graphics that direct users to your website for the download.

Printable Budget Planners

Editor’s Choice

Aesthetic Monthly Planner Stickers – 1100+ Beautiful Design Accessories …

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Handmade Flexible Record Template, Reusable Planner Stencils for Journal…

4. Free Financial Checkup Sessions

Offer complimentary financial checkup sessions to small business owners or individuals looking to improve their financial situation. This personalized approach allows you to showcase your expertise while providing significant value to potential customers.

During these sessions, you can analyze their current financial status and provide tailored advice. Consider preparing a checklist beforehand to ensure you cover the key areas.

– Points to discuss:

– Current budget assessment

– Debt management strategies

– Investment opportunities

Promote these sessions through social media platforms with inviting visuals that highlight the benefits of having a financial checkup.

Free Financial Checkup Sessions

Editor’s Choice

How to Adult: Personal Finance for the Real World

Mr. Pen Mechanical Switch Calculator – 12 Digit Large LCD Display, Pink …

The Financial Planning Workbook: A Family Budgeting Guide (Christian Fin…

5. Debt Reduction Guides

Create in-depth guides focusing on debt reduction strategies. This could cover various aspects such as the snowball method, debt consolidation options, and negotiation tips for lowering interest rates. By providing these resources for free, you position your business as a trustworthy source for financial education.

Make sure to include real-life examples and success stories to inspire users.

– Key sections could include:

– Understanding Your Debt

– Creating a Repayment Plan

– Utilizing Support Resources

These guides can be shared through social channels and email newsletters, complete with visuals that capture attention and drive engagement.

Debt Reduction Guides

Editor’s Choice

Norton 360 Premium 2026 Ready, Antivirus software for 10 Devices with Au…

Financial Literacy: How to Gain Financial Intelligence, Financial Peace …

TRUSTS, ASSET PROTECTION, AND ESTATE PLANNING: Ultimate Guide 2 in 1 Edi…

6. Social Media Challenges

Launch a financial literacy challenge on social media where participants can engage and learn together. For example, a 30-day savings challenge encourages users to set aside a small amount daily, promoting positive financial habits.

Use interactive posts and stories to keep participants involved. Encourage them to share their experiences and tag your business for more exposure!

– Challenge elements may include:

– Daily saving prompts

– Community support through comments

– Weekly tips about financial literacy

This not only boosts engagement but also helps you build a community around your brand, increasing loyalty.

Boost your financial savvy with a fun social media challenge! A 30-day savings goal not only builds positive habits but also connects your community. Engage, share, and watch your small business thrive!

Social Media Challenges

Editor’s Choice

Fahlo Elephant Tracking Bracelet – Track a Real Elephant’s Journey �…

Sooez 100 Envelopes Money Saving Challenge, Savings Challenges Book with…

Summit Designs Million Dollar Formula Wall Art Motivational Money Quote …

7. Monthly Financial Newsletters

Curate a monthly newsletter offering tips, articles, and resources related to personal finance. Subscribers appreciate consistent updates that keep them informed about financial trends and strategies.

You can include interviews with financial experts, budget tips, or links to valuable financial tools. This sets your small business up as an ongoing resource for your audience.

– Consider adding sections like:

– Featured Tools of the Month

– Case Studies

– Upcoming Events

Make your newsletter visually appealing with infographics and illustrations that grab attention and maintain interest.

Monthly Financial Newsletters

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Aquasoft YouDesign Calendar 6 – Create your own photo calendar software …

Marketing Plan Template & Example: How to write a marketing plan

8. Free Financial Workshops

Host free workshops in your community focusing on various financial topics. This personal approach can help build strong connections and trust with potential clients. Whether in-person or virtual, create a comforting environment where participants feel valued and heard.

Workshops could cover areas like retirement planning, budgeting for families, or debt management.

– Plan interactive activities:

– Group discussions on financial challenges

– Hands-on exercises for budgeting

– Role-playing to practice negotiating with creditors

Promote these workshops using visuals of past events to entice newcomers to join.

Free Financial Workshops

Editor’s Choice

The Financial Planning Workbook: A Family Budgeting Guide (Christian Fin…

Mini Portable Projector 4K WiFi 6 BT 5.2 Upgraded Portable Projector Ful…

Pacon Presentation Boards, Single Wall, White, 48″ x 36″, 4 Count

9. FAQs Resource Page

Develop a free resource page addressing commonly asked questions about personal finance. This not only provides immediate value to your audience but also helps you cater to their specific concerns.

Topics can range from credit scores to savings accounts, providing a one-stop solution for your audience. Include links to relevant articles and resources for deeper dives into each topic.

– Make it user-friendly by categorizing questions such as:

– Credit & Debt

– Savings & Loans

– Investment Basics

Promote the page via social media platforms with captivating visuals that illustrate the importance of financial knowledge.

10. Interactive Quizzes

Create engaging quizzes related to personal finance that help users assess their knowledge or financial planning skills. This not only entertains but also educates your audience.

Questions could cover areas like budgeting strategies, investment awareness, or saving habits. People love to share their results, which can help amplify your online presence.

– Structure your quiz to include:

– Scoring system to provide feedback

– Suggestions based on results

– Links to your services or additional resources

Market these quizzes using lively graphics and fun visuals that capture the essence of learning while having fun.

Interactive Quizzes

Editor’s Choice

Cheatwell Games Quiz Cube Music Quiz | Trivia Game with 744 Music Questi…

SUNEE Budget Planner – Deluxe Monthly Budget Book with 12-Pockets for Bi…

11. Financial Resource Library

Build a library of free resources available to your audience, including templates, worksheets, and guides. This positions your brand as a comprehensive resource for financial education.

You can organize the library by categories such as budgeting, debt management, and investing. People appreciate having a variety of tools at their fingertips, increasing their likelihood of returning to your site.

– Valuable resources could include:

– Expense tracking templates

– Sample financial plans

– Checklists for financial goals

Promote your resource library with engaging visuals and clear calls to action that encourage visitors to check it out.

A well-stocked financial resource library is your secret weapon—offering templates and guides that turn complex finance into simple steps. Empower your audience and watch them return for more small business freebies ideas!

Financial Resource Library

Editor’s Choice

Crap I Don’t Want To Forget: Crap I Don’t Want To Forget Because I am Ge…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

12. Free Personal Finance Apps

If you’re tech-savvy, consider creating a simple personal finance app offering basic budgeting tools or expense tracking. Free access allows users to experience the value of your services firsthand, increasing the chances of them opting for premium features later.

Ensure the app is user-friendly and visually appealing, encouraging daily use.

– Features to consider:

– Monthly budgeting templates

– Transaction categorization

– Visual spending graphs

Promote the app across your channels with eye-catching graphics highlighting how it can simplify users’ financial lives.

Free Personal Finance Apps

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

13. Referral Programs

Encourage existing customers to refer new clients by offering incentives like discounts on services or free resources. This word-of-mouth strategy can significantly boost your customer engagement and marketing outreach.

Ensure the referral process is simple and straightforward to encourage participation.

– Consider elements like:

– Trackable referral links

– Clear communication about rewards

– Social media shoutouts for referrers

Visuals can play a huge role here. Use graphics to illustrate how easy it is to refer friends and the benefits of doing so.

14. Free Financial Guides for Specific Audiences

Identify specific audiences such as students, families, or retirees, and create tailored financial guides for them. This personalized approach enhances relevance and can greatly increase customer engagement.

For instance, a guide for students might focus on student loans and budgeting while a family-oriented guide may cover saving for college or retirement planning.

– Key components might include:

– Challenges specific to each audience

– Practical solutions and tips

– Resource links for further assistance

Promote these targeted guides through social media ads and visuals that resonate with each audience, increasing the likelihood of sharing.

Free Financial Guides for Specific Audiences

Editor’s Choice

Financial Literacy: How to Gain Financial Intelligence, Financial Peace …

15. Community Financial Events

Plan free community events focused on financial education, such as credit workshops, budgeting classes, or guest speaker sessions. This creates an opportunity for people to learn in a friendly, supportive environment.

Collaborating with local businesses or organizations can help you attract a larger audience while sharing resources and expertise.

– Consider incorporating:

– Networking opportunities

– Refreshments to create a welcoming atmosphere

– Handouts with key learnings

Visually appealing flyers and social media graphics can attract attention and encourage attendance at these events.

Community Financial Events

Editor’s Choice

CLOKOWE Mini Projector with WiFi and Bluetooth, Built-in Apps, Smart Por…

CreativeWare Bark Beverage Dispenser, 2.5 Gallon, Clear, (Pack of 1)

Easel Whiteboard – Magnetic Portable Dry Erase 36 x 24 Tripod Height Adj…

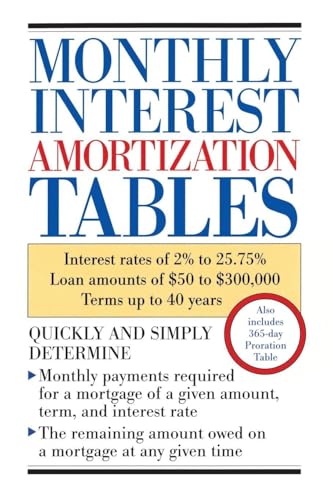

16. Free Access to Financial Tools

Offer free access to financial tools like loan calculators or budgeting apps directly on your website. These tools give potential clients a taste of what you provide and how it can benefit them.

Ensure that the tools are easy to use and visually appealing. Provide a simple guide or video tutorial on how to utilize them effectively.

– Types of tools to consider:

– Mortgage calculators

– Savings goal planners

– Expense breakdown tools

Create engaging banners to advertise these free tools on your website and social media channels to attract more users.

17. Seasonal Financial Challenges

Design seasonal financial challenges that encourage users to develop better financial habits. For instance, a holiday budgeting challenge during the festive season can help people manage expenses effectively.

You can create fun graphics and trackers that participants can share on social media, increasing visibility and engagement with your brand.

– Consider incorporating elements like:

– Daily saving goals

– Group accountability through social media

– Fun prizes for those who complete the challenge

Promote these challenges with lively visuals that capture the holiday spirit and the excitement of saving money.

Seasonal Financial Challenges

Editor’s Choice

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

18. Exclusive Membership Content

Create a members-only section on your website where subscribers can access exclusive content ranging from advanced guides to in-depth video tutorials. This strategy not only enhances perceived value but encourages email sign-ups for your newsletter.

You can also offer a free trial period to incentivize sign-ups.

– Membership features to consider:

– Monthly Q&A sessions

– Exclusive financial workshops

– A forum for members to share experiences

Promote this exclusive content effectively with visuals that highlight the benefits of joining your community.

Exclusive content isn’t just a perk; it’s a magnet for engagement! Turn your website into a treasure trove of financial wisdom and watch your subscriber list grow.

Exclusive Membership Content

Editor’s Choice

iCrimp Manual Expanding Tool Kit with Auto-Rotation Expansion Heads, Ext…

19. Personalized Email Courses

Set up a series of free email courses covering essential financial topics. Each email can provide valuable insights and actionable strategies over a set period, keeping subscribers engaged and eager for more.

Topics can include budgeting 101, saving for retirement, or understanding credit scores.

– Structure your courses to include:

– Weekly lessons with key takeaways

– Engaging quizzes to reinforce learning

– Additional resources for deeper dives

Promote these email courses on your website and social media with fun graphics that highlight what subscribers can expect.

20. Collaborative Free Resources

Collaborate with other small businesses or financial experts to create free resources or webinars. This not only expands your reach but also adds value to your offerings, as audiences appreciate diverse perspectives.

You can create joint guides, run webinars together, or share resources that benefit both parties.

– Ideas for collaboration could include:

– Joint webinars on investing trends

– Co-authored financial planning guides

– Cross-promoting each other’s resources

Promote these collaborative efforts with vibrant visuals showcasing both brands, emphasizing partnership and community.

Collaborative Free Resources

Editor’s Choice

DocSafe Fireproof Document Box with Lock&Shoulder Strap, Hard-Shell Ca…

TOUCAN 360-Degree Video Conference Camera, 1080p HD Webcam with 4 Noise …

21. Free Giveaways

Host free giveaways on social media, offering valuable resources like financial consults, eBooks, or access to exclusive webinars. This tactic not only creates excitement but also improves your brand’s visibility.

Create simple entry requirements encouraging shares and likes to increase the reach.

– Effective points for giveaways might be:

– Follow and tag friends

– Share a post on their stories

– Comment on what they hope to learn

Use lively images and graphics to showcase your giveaway prizes, generating buzz around your brand.

Free Giveaways

Editor’s Choice

Social Media Marketing Workbook: How to Use Social Media for Business (2…

Virtual Architect Ultimate Home Design with Landscaping and Decks

AZEN 30 Sets Bulk Gifts, Hand Cream and Lip Balm Bulk Set with Organza B…

22. Financial Podcasts

Start a podcast focused on financial education. Offering bites of wisdom and financial tips through audio can cater to people who prefer learning while on the go. This format is highly engaging and can reach a wide audience.

You could cover topics, interview experts, or dive deep into financial trends and strategies.

– Structure your episodes to include:

– Expert interviews

– Listener Q&A sessions

– Practical tips to implement right away

Promote your podcast with catchy graphics and audiograms that highlight interesting snippets to attract new listeners.

Turn your financial expertise into a podcast! Share tips, interview experts, and engage listeners on the go. It’s not just about numbers; it’s about starting conversations that matter!

Financial Podcasts

Editor’s Choice

FIFINE Studio Condenser USB Microphone Computer PC Microphone Kit with A…

23. Blog Content Series

Create a dedicated blog series addressing specific financial challenges or themes. This recurring content will keep readers coming back and engaged with your brand. Provide valuable tips and real-world examples in each post.

– Consider themes like:

– Saving for retirement

– Mastering credit scores

– Budgeting for families

Promote each new post with visuals that highlight the key points to entice clicks and shares.

Blog Content Series

Editor’s Choice

Virtual Architect Ultimate Home Design with Landscaping and Decks

Letter E initial Diary 120 pages Daily Journal Pop Art Inspired Bright C…

The One Hour Content Plan: The Solopreneur’s Guide to a Year’s Worth…

24. Free Financial Assessments

Offer complimentary financial assessments that guide potential customers through analyzing their current situation. This hands-on approach shows genuine care for their financial well-being while subtly promoting your services.

– Structure the assessment to include:

– Overview of their income and expenses

– Suggestions for improvement

– Resources for further learning

Promote this assessment with bright visuals that represent financial growth and support.

25. Engaging Social Media Tips

Provide daily or weekly financial tips through your social media platforms. This consistent engagement keeps your audience informed and encourages them to reach out for further guidance.

You can utilize various formats such as infographics, videos, or polls to make the content engaging.

– Tip categories may include:

– Monthly saving challenges

– Budgeting tips

– Investment strategies

Use colorful visuals and engaging graphics that capture attention and encourage shares.

Engaging Social Media Tips

Editor’s Choice

Clip on Ring Light, Kimwood Rechargeable 60 LED Selfie Ring Light for Ph…

Label Maker Machine with Tapes, Label Maker Waterproof-labels, Rechargea…

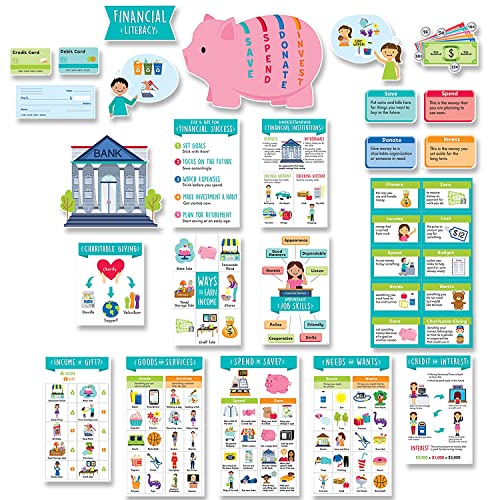

26. Free Financial Workshops for Kids

Host financial literacy workshops specifically aimed at children or teenagers. Teaching them about money management early on fosters good habits and positions your brand as a caring community member.

Engage them with fun activities like games or role-playing scenarios to keep the learning process enjoyable.

– Key focus areas may include:

– Saving money

– Understanding value

– Basic budgeting techniques

Promote these workshops with fun graphics that resonate with kids and parents alike, encouraging participation.

Free Financial Workshops for Kids

Editor’s Choice

Financial Literacy Boot Camp for Teens and Young Adults: Six Steps to Li…

Mind Delights: Good-for-Your-Soul Puzzles and Activities for Adults (Bra…

Stare Junior — The Exciting, Award-Winning Game of Memory and Observat…

27. Interactive Financial Simulations

Develop interactive financial simulations that allow users to experience financial scenarios like budgeting or investing. This hands-on approach provides valuable learning opportunities in a fun, engaging way.

You can create scenarios where users have to make decisions based on their financial goals, teaching them the importance of strategic thinking.

– Consider scenarios like:

– Building a savings plan

– Deciding between spending and saving

– Investing in stocks vs. bonds

Promote these simulations with vibrant visuals that draw participants in, making learning fun and interactive.

Interactive Financial Simulations

Editor’s Choice

The Motley Fool Investment Workbook (Motley Fool Books)

BenQ GP520 4K HDR 2600lm LED Living Room Projector for Home Entertainmen…

Financial Literacy Flash Cards – Great for Teaching Kids Through Middle …

28. Personal Finance Support Groups

Create a platform for personal finance support groups where individuals can share experiences and tips. This community-driven approach fosters a sense of belonging and encourages shared learning, making your brand synonymous with support.

You can host these groups in-person or online, providing a safe space to discuss financial challenges.

– Group characteristics might include:

– Monthly meetups

– Peer-led discussions

– Resource sharing

Promote these support groups with inviting visuals that capture the essence of community and support.

Personal Finance Support Groups

Editor’s Choice

Amazon Basics Sturdy Foldable Plastic Chair, Portable, 350-Pound Capacit…

SUNEE 2026 Wall Calendar 12×12 Inches with 16 Months from September 2025…

Conclusion

Incorporating freebies into your small business strategy not only enhances customer engagement but also establishes your brand as a trusted resource in personal finance.

By implementing these 28 freebie ideas, you can create meaningful connections with your audience, enticing them to learn and engage with your services. Use these strategies to not just attract customers but to keep them coming back for more valuable insights and resources.

Frequently Asked Questions

What Are Some Effective Freebie Ideas for Small Businesses to Attract Customers?

Offering freebies is a fantastic way to attract new customers to your small business! Consider providing financial literacy eBooks, hosting free webinars on smart investing, or creating printable budget planners. These resources not only engage potential clients but also showcase your expertise in personal finance, helping to build trust with your audience.

How Can Free Financial Workshops Help in Customer Engagement?

Free financial workshops can significantly enhance customer engagement by creating a personal connection with your audience. When you offer workshops—whether in-person or online—you provide valuable information while also positioning your brand as a trusted resource. Attendees are more likely to return for your services and recommend you to others, boosting your overall marketing efforts!

What Role Do Social Media Challenges Play in Attracting Customers?

Social media challenges, like a 30-day savings challenge, can create buzz around your brand and encourage community engagement. These interactive initiatives not only educate participants about personal finance but also promote your business as an approachable and fun source of financial education. Plus, they can lead to increased visibility as participants share their progress online!

How Can I Tailor Free Resources to Specific Audiences?

Tailoring free resources to specific audiences—like students, families, or retirees—can greatly enhance their relevance and effectiveness. For instance, creating debt reduction guides specifically for recent graduates can resonate more with that demographic. This personalized approach shows that you understand their unique challenges and are committed to helping them succeed financially.

What Are the Benefits of Offering Free Financial Assessments?

Offering free financial assessments can be a powerful tool for attracting new customers. This hands-on approach allows you to directly engage with potential clients, helping them analyze their current financial situation. It builds trust and demonstrates your genuine care for their financial well-being, which can lead to long-term relationships and increased referrals for your small business.

Related Topics

small business marketing

customer engagement

financial literacy

promotional giveaways

lead generation

free resources

budgeting tools

community workshops

interactive quizzes

financial education

email courses

seasonal challenges