Managing bills can often feel like a daunting task, but it doesn’t have to be!

With the right organizational strategies and digital tools, you can create a budget that keeps your finances in check while reducing stress.

From apps to spreadsheets, there are plenty of creative ways to track your spending and ensure you never miss a payment. Let’s explore some innovative monthly bills organization ideas that can make budgeting a breeze.

1. Utilize Budgeting Apps

Budgeting apps are like your personal finance assistants right in your pocket!

Apps such as Mint, YNAB (You Need A Budget), and PocketGuard not only help you track your monthly bills but also categorize your spending. These apps provide real-time updates, letting you know when bills are due and how much you have left to spend in each category.

Consider these tips when using budgeting apps:

– Regularly input your transactions to keep everything up-to-date.

– Set reminders for upcoming bills to avoid late fees.

– Use the app’s categorization features to identify areas where you can cut back.

The visual dashboards most apps provide can also be a delightful way to see your financial health at a glance.

2. Automate Payments

Set it and forget it! Automating your bill payments can save you time and protect you from late fees.

By scheduling automatic payments for your recurring bills—like utilities, rent, and subscriptions—you don’t have to worry about missing payment dates. Just make sure to keep an eye on your account balance to avoid overdrafts.

Here are some automation tips:

– Choose the right date for automatic payments, ideally after your paycheck hits.

– Monitor your account for any irregular fees or changes in service.

– Regularly review your subscriptions to ensure you still need all of them.

Automation can take a significant amount of mental load off your shoulders and make your financial life much simpler.

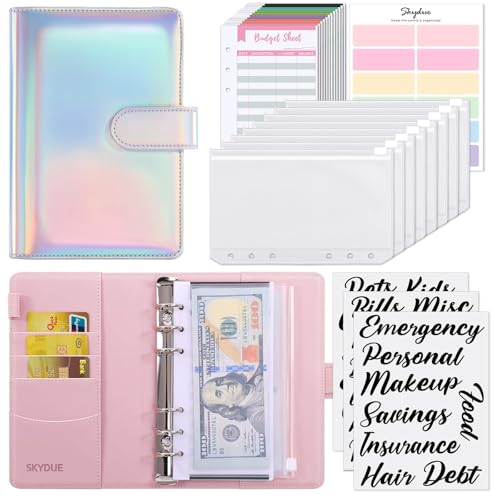

3. Create a Dedicated Bill Organizer

A dedicated bill organizer can be a lifesaver for managing your finances effectively.

This can be a simple binder or even a digital folder where you keep all your utility, credit card, and subscription bills neatly arranged. Using dividers for easy access can significantly reduce the stress of searching for documents.

Here’s how to set up your bill organizer:

– Label sections clearly: Bills, Receipts, and Paid.

– Keep a calendar or monthly planner inside to jot down due dates.

– Review it weekly to stay on top of your financial obligations.

Having a centralized location for your bills ensures you have everything you need at hand, making bill paying as smooth as possible.

4. Use a Spreadsheet for Bill Tracking

If you love numbers, a Bills Tracking Spreadsheet might be just the thing for you!

Using software like Microsoft Excel or Google Sheets, you can customize a spreadsheet that tracks your bill amounts, due dates, and payment status. With formulas, you can even calculate your remaining budget at the end of the month.

Consider these ideas for your spreadsheet:

– Create categories for each type of bill (utilities, credit, etc.).

– Use color-coding to highlight paid vs unpaid bills.

– Include a section for notes, like changes in billing amount or payment confirmation.

Not only will this give you a clear view of your finances, but it is also satisfying to see those bills marked as paid!

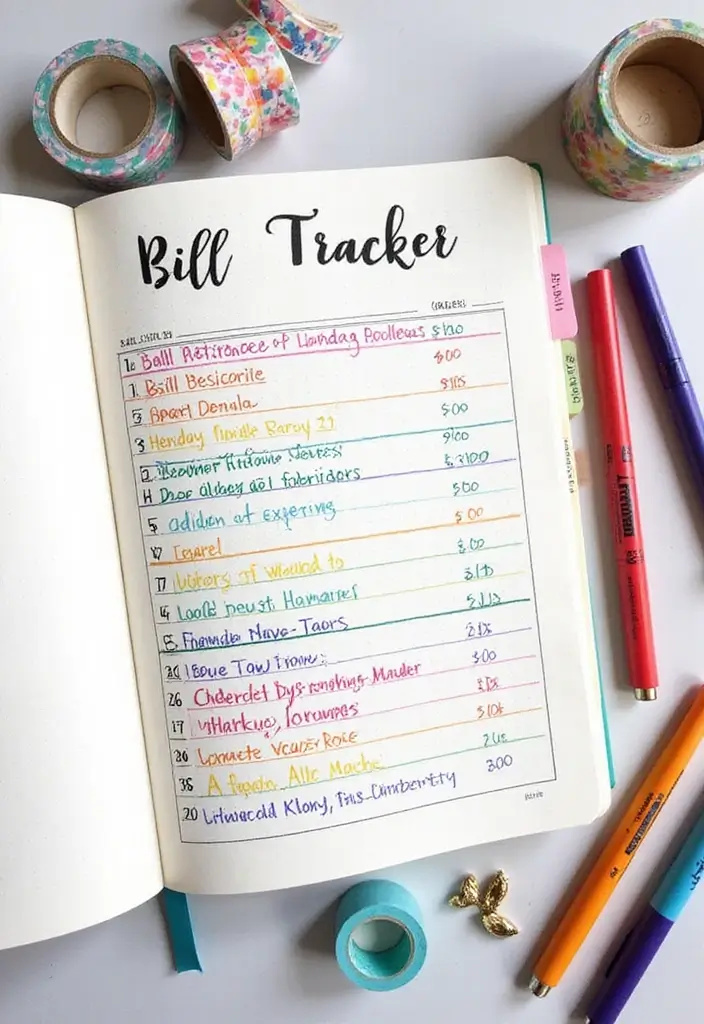

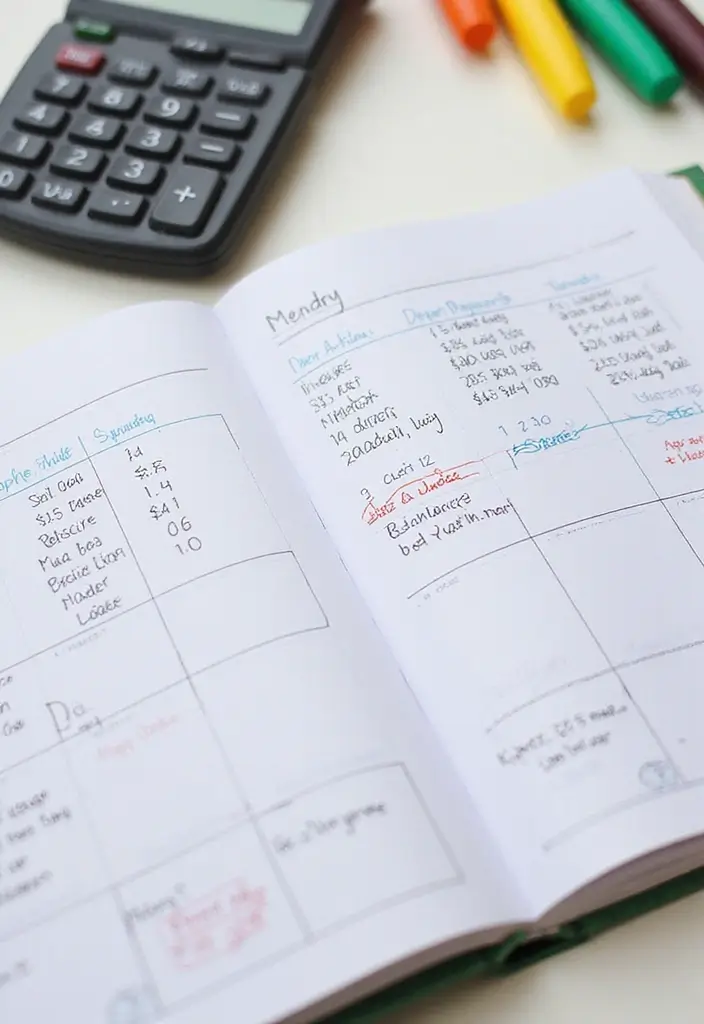

5. Set Up a Bill Tracker Journal

If you’re a fan of pen and paper, why not start a bill tracker journal?

This can be as simple or elaborate as you want—use a bullet journal format to track your bills, due dates, and payment statuses. You can even add creative elements like stickers or colorful pens to make the process enjoyable!

for maintaining your journal include:

– Dedicate a specific time each week to update it.

– Create monthly layouts to visualize your expenses.

– Include motivational quotes to keep you inspired about staying on top of your finances.

This tactile method can lead to a stronger connection with your finances and ensure you’re always aware of your spending.

6. Share Financial Responsibilities

When living with a partner or family, sharing financial responsibilities can lighten the load for everyone involved.

Set up a system where each person is responsible for different bills. For instance, one person can handle the electricity while another takes care of the internet. This not only distributes the workload but can also foster accountability.

Here are a few tips for effective collaboration:

– Have regular meetings to discuss finances and future plans.

– Use shared digital tools, like Google Sheets or budgeting apps, to track payments.

– Clearly communicate if someone is running into issues making payments.

Sharing financial duties can create a supportive environment where everyone works together towards common goals.

7. Track Bill Due Dates with a Calendar

A classic yet highly effective method of keeping track of your bills is using a calendar.

You can opt for a digital calendar, like Google Calendar, or go old-school with a physical wall or desk calendar. Marking due dates clearly can prevent any last-minute panics when bills come due.

Consider these strategies for calendar tracking:

– Color-code different types of bills for easy recognition.

– Set reminders a week before due dates for preparation.

– Review your calendar at the beginning of each month to plan your budget accordingly.

By keeping due dates visually in front of you, you’re much less likely to miss a payment.

8. Use Envelope Budgeting for Cash Bills

Envelope budgeting is an old-school method that can still be highly effective today, especially if you manage cash bills.

Essentially, you divide your cash into envelopes designated for specific categories; once the envelope is empty, you can’t spend any more in that category until next month.

Here’s how to get started with envelope budgeting:

– Create envelopes for each spending category: groceries, dining out, bills.

– Withdraw the cash you’ve budgeted for each category at the start of the month.

– Stick to the cash in each envelope—no sneaking from one to another!

This method provides a tangible way to see your spending and keeps your budget in check.

9. Implement a Bill Payment System

Establishing a smooth bill payment system can dramatically ease your monthly financial stress.

Start by creating a list of all your bills, their due dates, and payment amounts. Then decide on your payment channels—whether it’s online banking, checks, or cash.

Here’s a step-by-step guide to your bill payment system:

– Sort bills by due dates, and prioritize those that are most urgent.

– Choose a specific day each month to pay bills, making it a part of your routine.

– Use alarms or reminders to ensure you don’t forget your designated bill payment day.

By creating a system, you’ll minimize confusion and chaos surrounding bill payments.

10. Use Financial Apps for Reminders

Besides budgeting, financial apps can also serve as reminder systems for your bills.

Apps like BillMinder or Prism not only track your bills but also send you reminders as due dates approach. Customizable notifications ensure that you always stay one step ahead.

to maximize these apps include:

– Adjust notification settings to suit your preferences—daily, weekly, or monthly.

– Use the app’s features to categorize bills, making it easier to manage.

– Check in with the app regularly to stay updated on your spending.

Incorporating reminder apps can create a seamless flow in your monthly budgeting efforts.

11. Leverage Online Banking Tools

Many banks offer online tools that can make managing your bills easier than ever.

From automatic payments to transaction histories, online banking can help you keep an eye on all your financial activities. You can even set up alerts for when your balance dips below a certain amount.

for using online banking effectively:

– Familiarize yourself with your bank’s features and tools.

– Set up balance alerts to avoid overdrafts.

– Regularly review your transaction history to identify any unnecessary fees.

By utilizing your bank’s online tools, you can simplify your financial management process significantly.

12. Review Bills Monthly

Taking some time to review your bills each month can lead to significant savings.

During your review, check for any discrepancies, unnecessary charges, or subscriptions you no longer use. You’d be surprised how many services you might be paying for that you’ve forgotten about!

How to conduct your monthly review:

– Gather all your bills and expenses for the month.

– Cross-reference them with your bank statements for accuracy.

– Make a note of any recurring charges you might want to cancel.

This proactive approach can help you stay in control of your finances and potentially lower your monthly expenses.

13. Use Visual Aids for Budgeting

Visual aids can enhance your understanding of your financial situation tremendously.

Creating a visual representation of your budget – like charts, graphs, or infographics – can make managing your money more engaging.

Consider these methods for visual budgeting:

– Create pie charts to visualize where your money is going each month.

– Use bar graphs to compare your spending against your budget.

– Design infographics that illustrate your financial progress or goals.

Visual aids make budgeting not just informative, but also fun!

14. Host a Finance Night

Gathering friends or family for a finance night can inject some fun into budgeting!

This relaxed atmosphere allows you to share tips, tools, and strategies for managing bills. You could even create a fun game out of setting budgets and discussing bills.

Here’s how to make it engaging:

– Prepare snacks and drinks to keep it casual.

– Share your favorite budgeting apps or tools.

– Introduce games that challenge each other on saving tips.

A finance night can foster community support and lighten the load of financial discussions.

Budgeting doesn’t have to be a chore! Turn your finance night into a fun gathering—complete with snacks, games, and shared tips. Who knew organizing bills could strengthen friendships too?

15. Explore Coupons and Discounts

Finding ways to cut costs can relieve some of the financial pressure.

Using coupons or looking for discounts on bills—like cable and internet—can drastically reduce your monthly expenses. Many companies offer loyalty programs or discounts for bundled services, which can save you a significant amount over time.

Actionable steps include:

– Sign up for newsletters from your service providers for exclusive offers.

– Use coupon websites to find deals on monthly subscriptions.

– Be on the lookout for seasonal promotions.

These strategies can add up, leaving you with more money in your pocket at the end of the month.

16. Create an Emergency Fund

Having an emergency fund can provide a safety net when unexpected bills arise.

Set aside a small amount of money each month to build this fund. Aim for at least three to six months’ worth of expenses, which can cover you in case of job loss or unexpected emergencies like medical expenses.

Steps to establish your emergency fund:

– Open a separate savings account to keep it distinct from your spending money.

– Set a monthly savings goal, no matter how small.

– Avoid using this fund unless it’s truly an emergency.

Creating this cushion will bring peace of mind and improve your financial stability.

17. Review Your Subscriptions Regularly

Subscriptions can pile up and drain your budget without you even realizing it.

Taking the time to regularly review your subscriptions can reveal services you no longer use or need. From streaming services to monthly boxes, each cancellation can free up valuable funds.

Consider these review tips:

– List all your subscriptions with their monthly costs.

– Identify which ones you genuinely use and enjoy.

– Set a reminder to do this quarterly to keep your budget in check.

By staying on top of your subscriptions, you can easily save money every month.

18. Track Your Spending in Real-Time

Keeping an eye on your spending in real-time can prevent overspending.

Using budgeting apps or keeping a daily log can help you stay accountable for every dollar spent. This process allows you to identify patterns in your spending and make adjustments when necessary.

Here’s how to track spending effectively:

– Record every purchase immediately or set aside time each day to input transactions.

– Categorize spending to see where your money goes most.

– Review this log weekly to spot trends and make necessary changes.

Real-time tracking can empower you to take control of your finances.

19. Take Advantage of Budgeting Workshops

Many communities offer free or low-cost budgeting workshops that can provide valuable insights into financial management.

Participating in these workshops can teach you effective strategies for tracking bills, managing expenses, and creating a budget that works for your lifestyle.

Steps to find a workshop near you:

– Check local libraries or community centers for upcoming events.

– Look for online webinars that you can attend from home.

– Network with others to gather tips from their financial journeys.

These workshops can inspire you to take charge of your finances while connecting with others facing similar challenges.

Unlock your financial potential! Join a budgeting workshop and discover effective strategies for tracking bills and managing expenses. Your stress-free budget awaits!

20. Evaluate Your Utilities Annually

Regularly evaluating your utility providers can save you significant money over time.

Annually check if you’re getting the best rates for your electricity, water, and internet services. Often, companies offer better deals to new customers that you can take advantage of.

Here’s how to do an annual review:

– Compare rates from different providers.

– Call your current providers to ask about any potential deals or discounts.

– Don’t hesitate to switch if you find a better option.

By keeping a close eye on your utilities, you can ensure you’re not overpaying.

Don’t let your bills run the show! A simple annual review of your utilities could save you hundreds – so compare, ask, and switch for a stress-free budget!

21. Implement Financial Goals

Setting clear financial goals can help keep your budget on track and motivate you to save.

Whether it’s a vacation fund, new appliances, or paying off debt, defining specific goals creates a roadmap for your financial future.

for setting effective financial goals include:

– Make your goals SMART: Specific, Measurable, Achievable, Relevant, Time-bound.

– Break larger goals into smaller, manageable steps.

– Regularly review and adjust your goals as needed.

By having defined goals, you can enhance your focus on managing monthly bills effectively.

22. Use a Virtual Assistant

Consider employing a virtual assistant to help manage your finances.

For those who are overwhelmed by billing tasks, hiring someone to handle reminders, tracking, and payments can free up a significant amount of time and stress.

Here are some points to consider when hiring a virtual assistant:

– Look for someone with experience in financial management.

– Clearly define your expectations and tasks needed.

– Monitor their work to ensure it aligns with your financial goals.

This solution allows you to focus on other priorities while having your bills managed efficiently.

23. Customize Alerts for Due Dates

Setting up customizable alerts can be a game-changer for keeping track of due dates.

Whether it’s through apps or email notifications, these reminders can safeguard against missed payments.

for using alerts effectively:

– Set alerts for a week in advance and on the day of the due date.

– Customize alerts for different bill categories based on importance.

– Use multiple channels: emails, texts, or app notifications for redundancy.

Having multiple alerts ensures you’re always informed and prevents any late fees from creeping into your budget.

Stay ahead of your bills organization game! Set customizable alerts to keep your budget stress-free and never miss a due date again. A little reminder goes a long way!

24. Create a Bill Payment Schedule

A consistent bill payment schedule keeps you organized and ensures nothing falls through the cracks.

Create a calendar that outlines when each bill is due, including exact amounts, so you can allocate your funds efficiently each month.

Here’s how to create an effective schedule:

– List all your bills in order of due dates.

– Color-code them in your calendar for easy identification.

– Review this schedule at the beginning of each month to prepare your budget.

Having a clear schedule encourages discipline and accountability regarding your financial commitments.

25. Host a Budgeting Brunch

Turn budgeting into a fun social activity by hosting a budgeting brunch!

Invite friends over for a meal while discussing financial strategies. Sharing experiences can lead to valuable insights and support.

To make it enjoyable:

– Prepare an easy brunch menu for your guests.

– Create an agenda to keep discussions focused yet fun.

– Share your favorite budgeting tips and tools with each other.

This relaxing atmosphere encourages open conversations about finances and can even spark new ideas for improving your budgeting strategies!

26. Conduct Annual Budget Reviews

Conducting an annual budget review is essential to ensure you’re on track with your financial goals.

This review can highlight areas where you’ve succeeded and pinpoint places that need improvement. It allows for adjustments to your budget based on any changes in income or expenses.

How to do an effective budget review:

– Gather all financial statements from the year.

– Compare your budget versus actual spending in each category.

– Set new financial goals based on your findings.

An annual review can provide clarity and direction for your financial journey ahead.

27. Stay Educated on Financial Management

Keeping yourself informed about financial management can enhance your budget organization.

Read books, attend workshops, or follow financial blogs to gain new insights and strategies. The more you learn, the more confident you’ll feel in managing your money.

Consider these educational resources:

– Follow reputable finance blogs or YouTube channels.

– Enroll in online courses about budgeting and financial literacy.

– Join online forums or local groups to share and gain knowledge.

Staying educated can empower you to make smart financial decisions and lead to a more stress-free budget.

Conclusion

Organizing your monthly bills doesn’t have to be overwhelming; it can be empowering!

By implementing some of these ideas, you can create a budget that minimizes stress and enhances your financial management skills.

So, which of these strategies will you try first? Let your journey towards a stress-free budget begin!

Frequently Asked Questions

What are some effective digital tools for monthly bills organization?

There are several fantastic digital tools that can help streamline your monthly bills organization! Apps like Mint and You Need A Budget (YNAB) are great for tracking expenses and bills in one place. These budgeting apps allow you to categorize your spending and set reminders for due dates, making it easier to stay on top of your finances.

Additionally, tools like BillMinder and Prism not only track bills but also send you alerts as due dates approach. Using these apps can transform your budgeting experience into a stress-free process!

How can I automate my bill payments effectively?

Automating your bill payments is a game-changer for stress-free money management! To set it up, simply log into your bank’s online banking platform or the specific billing websites for your services. Look for the option to set up automatic payments for regular bills such as utilities, rent, or subscriptions.

Make sure to keep an eye on your account balance to avoid overdrafts. This way, you can enjoy peace of mind knowing your bills are taken care of without the hassle of manual payments each month!

What are some creative ways to share financial responsibilities in a household?

Sharing financial responsibilities can lighten the load for everyone! One effective approach is to create a bill-sharing system where each person takes responsibility for specific bills. For example, one partner could manage utilities while the other handles internet or cable services.

You might also consider using a shared spreadsheet or budgeting app where everyone can see their responsibilities and track payments. This transparency fosters accountability and teamwork, making budgeting a more collaborative effort!

How can I effectively review my monthly bills to save money?

Reviewing your monthly bills doesn’t just keep you organized; it can also lead to significant savings! Set aside some time each month to go through your bills carefully. Look for any discrepancies, unnecessary charges, or subscriptions you might no longer use. You’d be surprised at how many people pay for services they’ve forgotten about!

Additionally, consider contacting service providers to negotiate better rates or explore discounts. Regular reviews can help you identify areas where you can cut costs and improve your overall budget!

What are some budgeting strategies to manage unexpected expenses?

Managing unexpected expenses can be tricky, but having a solid strategy in place can help! Start by creating an emergency fund that covers at least three to six months’ worth of expenses. This fund acts as your safety net when those surprise bills pop up.

You can also implement a flexible budgeting system where you allocate a certain percentage of your monthly income to variable expenses. This way, you can adjust your budget as needed without derailing your overall financial goals!