Managing your finances doesn’t have to be a boring chore. A budgeting notebook can become your go-to tool for tracking expenses, setting savings goals, and planning your financial future.

For freelancers, juggling projects and payments can make financial planning a challenge. The right notebook setup can transform your money management into an enjoyable habit.

Let’s uncover 25 creative budgeting notebook ideas that not only help you stay organized but also make the process visually appealing. These ideas are perfect for anyone looking to streamline their financial journey while keeping it personal and fun!

1. Monthly Expense Tracker

Kick things off with a dedicated monthly expense tracker. This straightforward layout makes it easy to jot down every purchase and see where your money goes.

You can divide the page into categories like groceries, rent, utilities, and entertainment. Use colored pens to create bars or charts showing your spending habits. This visual element adds a vibrant touch, making it easier to recognize patterns.

Tips:

– Set aside a section for notes on unexpected expenses.

– Use symbols (like stars or hearts) to highlight significant spending incidents.

– Review your tracker at the end of the month for insights on how to adjust your budget for next month.

Monthly Expense Tracker

Editor’s Choice

2026 Budget Planner – Monthly Budget Book from JAN 2026 – DEC 2026 with …

Amazon$8.49

Amazon$8.49

200 PCS Washable Markers for Kids, Colored Markers Bulk for School, Thin…

Amazon$31.99

Amazon$31.992. Income Tracker

For freelancers, tracking multiple income sources can be tricky. An income tracker helps you capture every paycheck or project payment in one spot.

Structure your notebook with columns for date, client name, project description, and amount earned. Highlighting different income streams in various colors not only keeps you organized but also adds a personal flair.

Suggestions:

– Include a running total at the bottom of the page.

– Add monthly goals for income to keep you motivated and on track.

– Use monthly stickers or stamps to mark completed projects.

Income Tracker

Editor’s Choice

iBayam Journal Planner Pens Colored Pens, Office School Supplies, Fine P…

Amazon$8.10

Amazon$8.10

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.483. Bill Payment Checklist

Avoid late fees with a bill payment checklist. This helpful feature can be a monthly checklist or a dedicated page for each bill type.

You can create a visually striking layout with checkboxes next to each bill. Color-code bills based on due dates or importance. This not only adds a fun element but also keeps your finances in check.

Tips:

– Use highlighters to mark bills paid and upcoming due dates.

– Consider adding a section for notes about each bill, like changes in amounts or payment methods.

– Incorporate motivational quotes to keep you inspired while tracking payments.

Bill Payment Checklist

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Eastern Wolf 8 Pads Sticky Notes 3×3 Self-Stick Notes 8 Bright Multi Col…

Amazon$5.59

Amazon$5.59

Soucolor Art Brush Markers Pens for Adult Coloring Books, 36 Colors Numb…

Amazon$6.99

Amazon$6.994. Savings Goals Planner

Everyone loves a good savings goal, right? A savings goals planner can help you visualize what you’re working towards.

Divide your notebook into sections for different savings goals, like travel, emergency fund, or big purchases. Use jars or piggy banks sketches to represent each goal and fill them in as you save. This visual approach encourages you to keep going!

Ideas:

– Assign a small reward for each savings milestone you hit.

– Use different colors or patterns for each savings category.

– Write down your reasons for saving to keep you motivated.

Savings Goals Planner

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

Amazon$9.49

Amazon$9.49

Aesthetic Monthly Planner Stickers – 1100+ Beautiful Design Accessories …

Amazon$9.99

Amazon$9.995. Weekly Budget Planner

Plan your week with a dedicated weekly budget planner. This format helps break down your expenses day by day, ensuring you don’t overspend.

Create sections for daily expenses, savings, and any additional goals. Adding a small area for reflection at the end of the week can help you evaluate what worked and what didn’t.

Tips:

– Use different colors for income and expenses to highlight the cash flow.

– Incorporate small motivational quotes to inspire you each week.

– Keep it flexible; if something didn’t go as planned, use that space to adjust for the upcoming week.

A weekly budget planner is your personal financial compass. Navigate your expenses, set goals, and reflect on your week’s journey—because every penny counts on the road to financial freedom!

Weekly Budget Planner

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

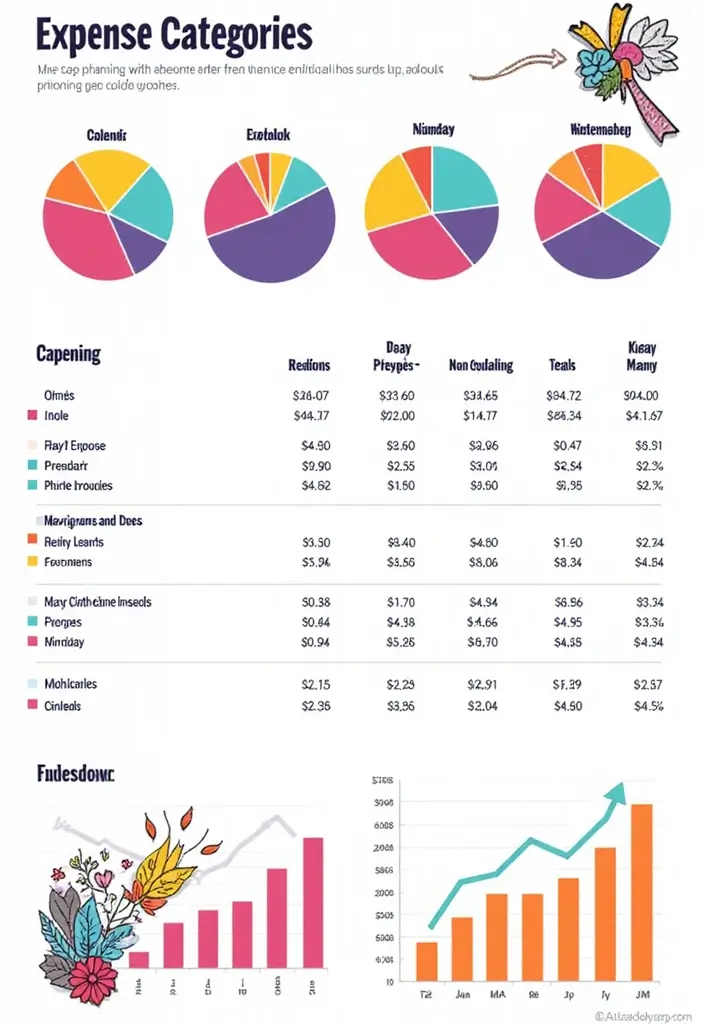

Amazon$8.486. Expense Categories Breakdown

Understanding how you spend your money across categories is crucial. An expense categories breakdown can help you see where you might be overspending.

Divide your notebook into sections for major categories like housing, food, entertainment, and transportation. List subcategories under each to dive deeper into your spending habits. Visual elements like pie charts or bar graphs can add a fun twist while clearly showing your expenditure.

Suggestions:

– Review this section monthly to adjust your budget based on your findings.

– Use different colors for each category to make it visually appealing.

– Add stickers or doodles next to each category to express your personality.

Expense Categories Breakdown

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

Amazon$6.39

Amazon$6.397. Debt Tracker

Managing debt can feel overwhelming, but a well-organized debt tracker can simplify the process. Create a dedicated page to list all your debts, including creditor, balance, interest rate, and minimum payment.

Visually tracking your progress towards paying off each debt can be therapeutic. You can use a thermometer or a bar graph to visually represent your journey.

Tips:

– Update it regularly to see how far you’ve come.

– Consider adding a ‘motivation column’ where you write down why you want to be debt-free.

– Celebrate small wins by marking off paid debts with colorful markers.

Debt Tracker

Editor’s Choice

Debt Payoff Planner Spiral Bound Letter Size Debt Payoff Tracker 8.5×11…

Amazon$11.99

Amazon$11.99

Pentonic Glitter Gel Pens, 10 Count, 10 Assorted Colors, 1.0 mm Bold Poi…

Amazon$3.59

Amazon$3.59

200PCS Motivational Stickers, Inspirational Positive Affirmation Sticker…

Amazon$7.99

Amazon$7.998. Financial Vision Board

Incorporate a financial vision board into your budgeting notebook to clarify your financial aspirations. This creative space lets you visualize your goals—like buying a house, going on vacations, or starting a business.

Fill the page with cut-out images from magazines, printouts, or even your own drawings. Frame your financial goals with positive affirmations that keep you motivated.

Ideas:

– Change or update your vision board every few months as goals evolve.

– Use different colors and textures to make it engaging.

– Share your vision board with a friend or mentor for accountability.

Financial Vision Board

Editor’s Choice

100pcs Inspirational Stickers, Motivational Quote Sticker for Water Bott…

Amazon$3.59

Amazon$3.59

Sundaymot Arts and Crafts Supplies for Kids, 2000+Pcs DIY Craft Kits, Ag…

Amazon$22.92

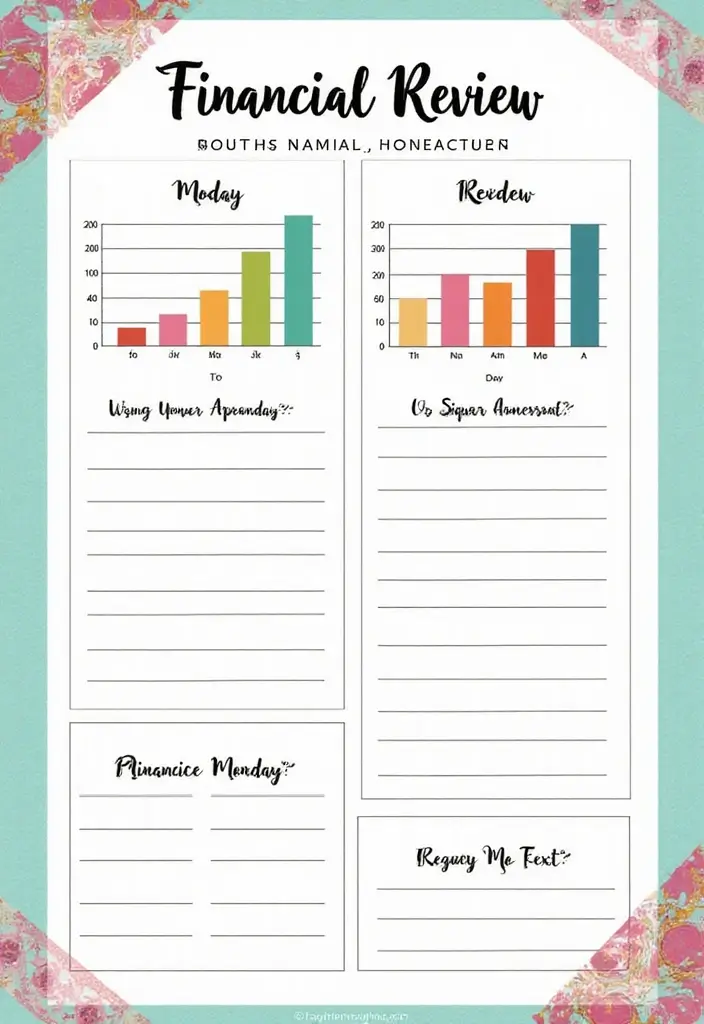

Amazon$22.929. Financial Review Templates

Incorporating financial review templates into your budgeting notebook can help you assess your progress regularly. Create a monthly or quarterly review section that helps you evaluate your spending, savings, and overall financial health.

You can use charts or graphs to visually represent your financial journey over time, making it easier to spot trends. Include prompts to encourage reflection on your financial successes and areas for improvement.

Suggestions:

– Use questions like, “What did I learn about my spending habits?” to prompt deeper thought.

– Consider incorporating a space for future goals and strategies to achieve them.

– Keep this section colorful and visually engaging to inspire frequent use.

Financial Review Templates

Editor’s Choice

iBayam Journal Planner Pens Colored Pens, Office School Supplies, Fine P…

Amazon$8.10

Amazon$8.10

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

TRUSTS & ASSET PROTECTION STRATEGIES that WORK: How to Protect Your Asse…

Amazon$19.99

Amazon$19.9910. Shopping List and Budget

Keep your shopping trips organized with a shopping list and budget page. Create sections for different stores or types of purchases, along with a budget for each category. This helps you stay focused and on track while shopping.

You can add a column for prices to keep you within your budget and avoid impulse buys. Using creative designs for your list can also make shopping more enjoyable!

Tips:

– Highlight items you already have at home to avoid unnecessary purchases.

– Use fun drawings or stickers to mark essential items.

– Review your list after shopping to reflect on your decisions and adjust future budgets.

Shopping List and Budget

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

200 PCS Funny Holographic Stickers for Adults, Waterproof Vinyl Sarcasti…

Amazon$11.99

Amazon$11.99

Hebayy 90 Sheets Fastcheck Grocery List Magnet Pad, 110 Printed Common F…

Amazon$8.99

Amazon$8.9911. Tax Preparation Checklist

Freelancers must be diligent during tax season. A tax preparation checklist can help ensure you don’t miss any crucial steps. List all necessary documents, forms, and deadlines to keep yourself organized.

Adding a timeline for when to gather documents and submit forms can reduce stress. Consider using a fun layout with doodles that represent taxes to keep it lighthearted.

Ideas:

– Create a ‘completed’ section to check off tasks as you finish them.

– Include notes on potential deductions to keep in mind.

– Personalize with reminders for estimated tax payment dates.

Tax Preparation Checklist

Editor’s Choice

Mega Brand Writing Instruments – Scribble Stuff 5 Count Metallic Gel Pen

Amazon$4.90

Amazon$4.9012. Financial Health Checkup

A financial health checkup is like a wellness check for your money. Design a page that helps you evaluate your financial well-being. Include prompts about savings, debt, income, and expenses to help you gauge where you stand.

This can be a wonderful tool for self-reflection and identifying areas where you may need to focus. Use fun colors or icons to differentiate between sections, and don’t hesitate to add personal notes.

Suggestions:

– Consider a rating system for each section to visualize where you excel and where you need improvement.

– Review this regularly to ensure you’re on the right path.

– Make it a habit to discuss this with an accountability partner for extra motivation.

Financial Health Checkup

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

Amazon$9.95

Amazon$9.95

Dual Brush Marker Pens for Coloring Books, Tanmit Fine Tip Coloring Mark…

Amazon$6.45

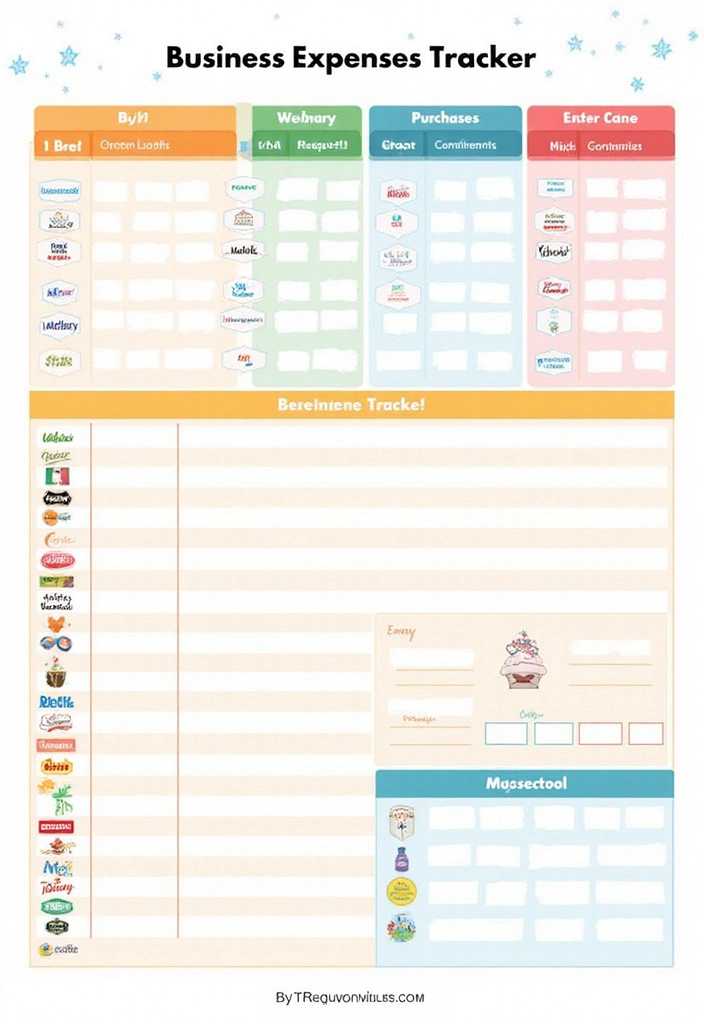

Amazon$6.4513. Business Expenses Tracker

If you’re a freelancer, tracking business expenses is vital for staying organized and maximizing deductions. This page should include sections for various expense categories like supplies, travel, and software.

Detailing each purchase with dates, descriptions, and amounts helps you stay on top of your finances. Consider adding a summary section at the bottom to calculate total expenses for the month or quarter.

Tips:

– Incorporate a ‘notes’ section to remind yourself of business-related tasks.

– Use symbols or colors to differentiate between personal and business expenses.

– Review and adjust categories as needed based on your spending habits.

Tracking your business expenses isn’t just smart—it’s essential! Stay organized, maximize your deductions, and watch your profits grow. Remember, every dollar counts when you’re freelancing!

Business Expenses Tracker

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

NICOOTHBudget Binder Cash Envelopes A6 Money Saving Binder with Zipper e…

Amazon$6.98

Amazon$6.98

Ledger Book: Income and Expense Log Book For Small Business and Personal…

Amazon$6.95

Amazon$6.9514. Goal Setting Pages

Having clear financial goals can guide your budgeting process. Dedicate a page to outline both short-term and long-term goals. Break each goal down into actionable steps that you can track.

Using visuals, like mini vision boards or goal timelines, can make this section more engaging. The process of checking off completed goals adds a sense of accomplishment and motivation.

Ideas:

– Use different colors for short-term (monthly) and long-term (yearly) goals.

– Add inspirational quotes that resonate with your financial journey.

– Regularly revisit and adjust goals as needed to stay aligned with your vision.

[affiai keyword="25 Budgeting Notebook Ideas to Organize Your Money 14. goal setting pages" count="3" template="grid" price="20-10000"]Your goals are your roadmap to financial success! Break them down into actionable steps, and watch as you transform your budgeting notebook into a powerful tool for growth and motivation.

15. Spending Challenge Log

Spending challenges can be a fun way to engage with your budgeting. Create a dedicated log for tracking your progress during a challenge, whether it’s a no-spend month or a savings challenge.

Design a page that can track daily spending, and write notes on your feelings and outcomes as you go through the challenge. The act of journaling can provide valuable insights into your spending habits.

Suggestions:

– Celebrate small milestones to keep motivation high.

– Use visuals to depict your progress, like dollar amounts saved.

– Include a reflection section for lessons learned at the end of the challenge.

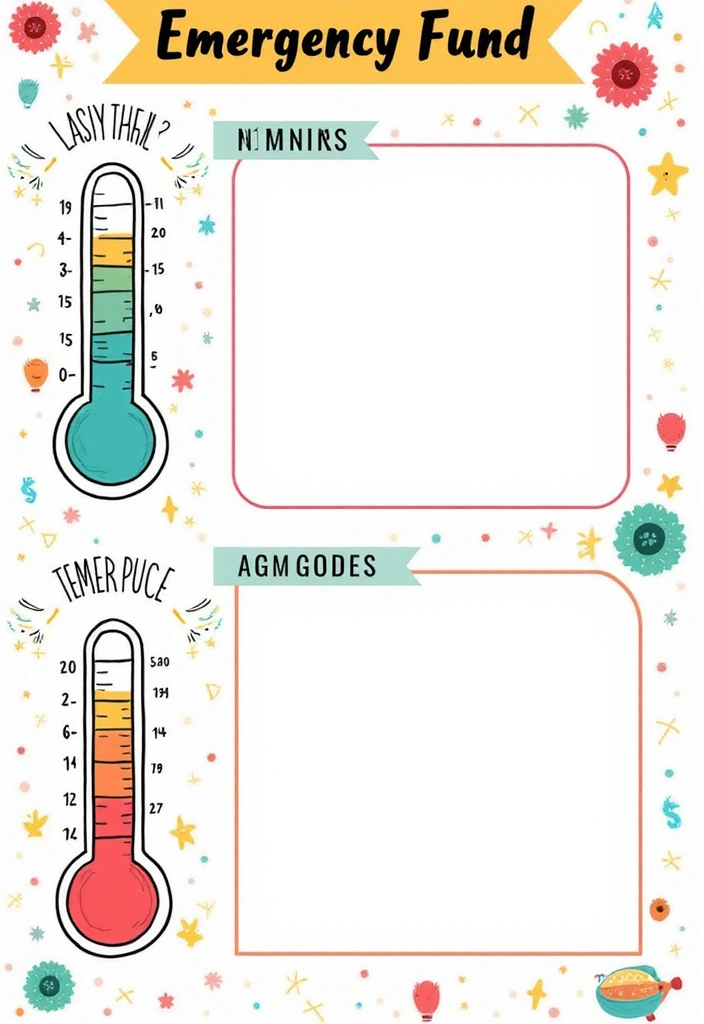

[affiai keyword="25 Budgeting Notebook Ideas to Organize Your Money 15. spending challenge log" count="3" template="grid" price="20-10000"]16. Emergency Fund Planner

Establishing an emergency fund is essential for financial security. Design a section in your notebook specifically for this purpose. Include savings goals and deadlines, and track how much you’re saving each month.

Using visuals like a thermometer chart can help you visualize your progress toward your goal. Plus, having a dedicated emergency fund planning section can motivate you to commit to saving.

Ideas:

– Set a specific amount you want to achieve and break it down into monthly savings targets.

– Use bright colors to represent different milestones along the way.

– Make it a habit to review your fund monthly and adjust the target if necessary.

Emergency Fund Planner

Editor’s Choice

Upgraded 2 in 1 Bedtime/Morning Routine Chart for Kids Toddlers, Magneti…

Amazon$9.99

Amazon$9.99

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Sooez 100 Envelopes Money Saving Challenge, Savings Challenges Book with…

Amazon$6.64

Amazon$6.6417. Financial Education Resources

Building financial literacy is crucial for successful budgeting. Create a dedicated section in your notebook for resources like books, podcasts, and articles that you find helpful.

You can also include notes or key takeaways from each resource for quick reference. Keeping track of your learning journey encourages continuous improvement in your financial skills.

Suggestions:

– Organize resources by category (investing, budgeting, etc.).

– Create colorful bookmarks or tabs to easily access your favorite resources.

– Consider reviewing and updating your resource list regularly to keep it relevant.

Financial Education Resources

Editor’s Choice

Mr. Pen- Transparent Sticky Note Set, 1650 Sheets, Pastel Colors, Tabs, …

Amazon$7.99

Amazon$7.99

2026 Budget Planner – Monthly Budget Book from JAN 2026 – DEC 2026 with …

Amazon$8.49

Amazon$8.49

Why Didn’t They Teach Me This in School?: 99 Personal Money Management P…

Amazon$14.80

Amazon$14.8018. Frugal Living Tips

Incorporating frugal living tips into your budgeting notebook can inspire you to save even more. Create a fun layout where you list your favorite ways to save money, whether it’s cooking at home or DIY projects.

Adding visuals, like doodles or images representing each tip, can make it more engaging. Plus, a frugal living section reminds you to find creatively frugal solutions when handling expenses.

Suggestions:

– Update your list regularly as you discover new tips.

– Use different colors to categorize tips (food, entertainment, etc.).

– Consider adding a ‘success story’ area where you reflect on how these tips have helped you.

[affiai keyword="25 Budgeting Notebook Ideas to Organize Your Money 18. frugal living tips" count="3" template="grid" price="20-10000"]19. Cash Envelope System Layout

The cash envelope system is a popular budgeting strategy that encourages mindful spending. Dedicate a section of your notebook to outline this system, breaking down categories where you’ll use cash envelopes.

Create envelopes within your notebook using decorative paper or stickers for a fun twist. Visualizing your budget this way makes it tangible and helps stick to your limits.

Ideas:

– Label each envelope clearly to avoid confusion.

– Track your spending in each envelope to see how you’re doing.

– Include a reflection section about the effectiveness of this method for you.

Cash Envelope System Layout

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

Amazon$9.95

Amazon$9.95

Pu Leather Cash Envelope Wallet for Women – Reusable Cash Stuffing Walle…

Amazon$4.15

Amazon$4.1520. Paycheck Budgeting

For freelancers, paycheck budgeting can help you allocate your income wisely. Devote a section to outline how much to budget from each paycheck for expenses, savings, and discretionary spending.

This section can feature a dynamic layout where you adjust each category based on your earnings. Using color codes for different categories can add a fun element while keeping everything organized.

Suggestions:

– Consider adding a ‘leftover’ section where you track unallocated funds.

– Regularly update this section based on changing income.

– Reflect on your budgeting success after each pay period.

Paycheck Budgeting

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Oxford Spiral Memo Pads, Top Wire Bound, 3 x 5 Inch Pocket Notepad, Coll…

Amazon$4.72

Amazon$4.72

Paper Mate Colorful Gel Pens – InkJoy Gel Pens Assorted Medium Point (0….

Amazon$9.89

Amazon$9.8921. Motivational Quotes Section

To keep your spirits high, dedicate a section of your notebook for motivational quotes related to finance. These quotes can serve as daily reminders of your goals and aspirations.

Mixing in visuals, like illustrations or doodles, can elevate this section and make it visually appealing. Take time to reflect on why these quotes resonate with you and how they connect to your own financial journey.

Ideas:

– Change out quotes regularly to keep it fresh.

– Share your favorites with friends or fellow freelancers for extra inspiration.

– Consider adding a ‘what this means to me’ area for personal reflections.

Motivational Quotes Section

Editor’s Choice

Muchcute Micro Fineliner Drawing Art Pens: 12 Black Fine Line Waterproof…

Amazon$8.99

Amazon$8.9922. Investment Planning Pages

Investing can be intimidating, but setting up investment planning pages in your notebook can simplify the process. Create sections for different types of investments—stocks, real estate, or retirement accounts.

Tracking your investments helps you understand their performance over time and encourages better decision-making. Adding visuals like graphs or charts can make this section more engaging and easier to comprehend.

Suggestions:

– Include a risk assessment section to evaluate your comfort level with each investment type.

– Track dividends or returns on investments to monitor growth.

– Regularly review and adjust your investment strategies based on your goals.

Investment Planning Pages

Editor’s Choice

RETTACY Graph Grid Paper Notebook, 192 Pages, A5 Medium Size (5.7” x 8….

Amazon$6.39

Amazon$6.39

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

2026 Budget Planner – Monthly Budget Book from JAN 2026 – DEC 2026 with …

Amazon$8.49

Amazon$8.4923. Budgeting Apps and Tools Overview

In today’s digital age, budgeting apps and tools can complement your notebook. Create a section that lists your favorite budgeting apps, along with their pros and cons. This guide serves as a handy reference when deciding which tools to use alongside your physical notebook.

Add visuals or icons representing each app to make this section more engaging. Keeping this updated with new apps you discover or tools you try can help you find the best fit for your financial management.

Tips:

– Include a section for personal notes on which apps worked best for you.

– Share this section with fellow freelancers for collaborative learning.

– Consider reviewing your tools quarterly to assess their effectiveness.

Budgeting Apps and Tools Overview

Editor’s Choice

Knock Knock Weekly Money Tracker Pad, Weekly Spending Tracker Budget Pad…

Amazon$10.00

Amazon$10.0024. Financial Goals Review

Every few months, take a moment to assess your financial goals. Create a section in your notebook dedicated to reviewing their progress. This activity helps you evaluate what’s working and what may need adjustments.

Incorporating visuals, like graphs or charts to illustrate changes, makes this process more exciting. Use this review to set new goals or tweak existing ones based on your current financial situation.

Suggestions:

– Celebrate milestones by adding special notes or decorative elements.

– Include a ‘lessons learned’ section to capture insights from your journey.

– Reflect on how your financial mindset has evolved over time.

[affiai keyword="25 Budgeting Notebook Ideas to Organize Your Money 24. financial goals review" count="3" template="grid" price="20-10000"]25. Personal Reflections and Lessons Learned

Integrating a personal reflections section can add a deeper layer to your budgeting notebook. Use this space to jot down thoughts, experiences, and lessons learned on your financial journey.

Being candid about your successes and setbacks fosters growth and understanding. Adding visual elements like drawings or stickers can keep this section lively and engaging.

Ideas:

– Consider prompts that encourage you to think about what budgeting means to you.

– Make it a habit to write regularly, perhaps at the end of each month.

– Share insights with a mentor or friend for accountability and support.

Reflecting on your financial journey not only builds wisdom; it turns budgeting into a personal story. Embrace the lessons learned and let your budgeting notebook be a canvas for growth!

Personal Reflections and Lessons Learned

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48Conclusion

Budgeting doesn’t have to be dull; it can be a fun and creative outlet! With these 25 budgeting notebook ideas, you can organize your finances in a way that feels personal and motivating.

As you embark on this journey, remember that the key is consistency and reflection. Keep exploring new ideas and find what resonates best with you on your financial journey!

Frequently Asked Questions

What Are Some Creative Budgeting Notebook Ideas for Freelancers?

Freelancers can elevate their financial game with creative budgeting notebook ideas! Consider incorporating an income tracker to manage multiple income sources, or a savings goals planner to visualize your financial aspirations. You might also love having a dedicated debt tracker to keep tabs on any outstanding balances. These personalized touches not only help with organization but also make budgeting a fun and engaging process!

How Can I Use a Budgeting Notebook to Track My Expenses Effectively?

Tracking expenses can be a breeze with a well-structured budgeting notebook! Create a monthly expense tracker where you categorize your spending, helping you see patterns in your finances. Consider adding an expense categories breakdown to pinpoint where you might be overspending. This not only keeps you accountable but also empowers you to make informed financial decisions!

What Should I Include in a Savings Goals Planner?

A savings goals planner is a fantastic way to motivate yourself towards financial success! Start by dividing your notebook into sections for different savings goals, such as travel, emergencies, or investments. Don’t forget to include specific amounts and deadlines for each goal. Visual elements like charts or stickers can make this section even more engaging and help you celebrate your progress along the way!

What Are Some Budgeting Strategies for Freelancers?

Freelancers can benefit from specific budgeting strategies tailored to their unique income situation. One effective method is paycheck budgeting, where you allocate funds from each paycheck to cover expenses, savings, and discretionary spending. Additionally, implementing a cash envelope system can help you manage your spending in different categories. Don’t forget to review your finances regularly with a financial review template to stay on track!

How Can I Make My Budgeting Notebook More Engaging?

Making your budgeting notebook engaging is all about personalization! Incorporate a financial vision board to visualize your goals and dreams. Adding a section for motivational quotes can keep you inspired on tough days. You might also want to include frugal living tips that resonate with you, creating a space that reflects your personality and motivates you to stick with your financial plans!

Related Topics

budgeting notebook

money management

expense tracking

savings planner

freelancer finance

financial tools

debt management

creative budgeting

goal setting

financial literacy

personal finance tips

easy budgeting