Life insurance can sometimes feel like a tough sell, especially to the millennial demographic. This age group values experiences, connections, and meaningful financial planning. To tap into this market, you need innovative strategies that resonate with their values and lifestyle. From leveraging social media to creating engaging content, these marketing ideas will help you stand out in the crowded insurance landscape. Each idea is designed with millennials in mind, focusing on personal finance narratives that align with their journey to stability and security.

The goal is to make life insurance relatable and accessible while building trust with potential clients. Let’s explore these unique marketing strategies that can help you acquire clients and increase your sales effectively.

1. Social Media Campaigns

Harness the power of social media to create campaigns that pique interest. Use platforms like Instagram and TikTok to share relatable stories about the importance of life insurance. Consider using testimonials or stories from real clients to humanize your brand. Short, engaging videos can illustrate common questions or misconceptions about life insurance, making the information easy to digest.

Targeting millennials? Create visually appealing infographics that highlight key statistics about life insurance benefits. These can be easily shared and reposted, expanding your reach. Don’t forget to include a call to action, encouraging followers to seek professional advice.

– Use trending hashtags to increase visibility.

– Collaborate with influencers in the finance niche.

– Host live Q&A sessions to engage directly with your audience.

Social Media Campaigns

Editor’s Choice

SENSYNE 62″ Phone Tripod & Selfie Stick, Extendable Cell Phone Tripod St…

2-Pack LED Video Lighting Kit, Anautin 15W/1700Lux Photography Lighting …

The Seven Figure Agency Roadmap: How to Build a Million Dollar Digital M…

2. Educational Webinars

Webinars are a fantastic way to connect with potential clients while educating them about life insurance. Plan engaging sessions that cover topics such as ‘Understanding Life Insurance Benefits’ or ‘How to Choose the Right Policy.’

Utilize guest speakers, perhaps financial advisors or satisfied clients, to add credibility and variety to your content. Make sure to allow for a Q&A segment, allowing participants to ask questions and voice concerns. This interaction can build trust and establish you as a knowledgeable authority in financial planning services.

– Promote your webinars through email and social media.

– Record sessions for future use and to attract on-demand viewers.

– Incorporate interactive elements like polls to keep your audience engaged.

Educational Webinars

Editor’s Choice

Logitech Brio 101 Full HD 1080p Webcam for Meetings, Streaming, Desktop,…

FIFINE Studio Condenser USB Microphone Computer PC Microphone Kit with A…

Kaiess 10.2″ Selfie Ring Light with 65″ Adjustable Tripod Stand & Phone …

3. Engaging Blog Content

Creating a blog dedicated to personal finance can attract millennials seeking information on life insurance. Your articles should be relatable, using real-life scenarios to convey the importance of insurance in financial planning.

Create topics like ‘5 Reasons Millennials Need Life Insurance’ or ‘How Life Insurance Fits Into Your Financial Goals.’ Incorporate visuals, infographics, and personal anecdotes to make the content more relatable. SEO should be prioritized, so use keywords wisely to ensure your blog gets the traffic it deserves.

– Encourage guest posts from industry experts or influencers to diversify content.

– Use storytelling techniques to make posts more engaging.

– Incorporate frequently asked questions to address common concerns.

Engaging Blog Content

Editor’s Choice

The One Hour Content Plan: The Solopreneur’s Guide to a Year’s Worth…

4. Interactive Quizzes

Quizzes can be a fun way to engage with your audience while educating them about life insurance. Create interactive quizzes like ‘Which Life Insurance Policy is Right for You?’ or ‘Test Your Knowledge on Life Insurance Basics!’

These not only provide valuable information but also encourage users to share their results, expanding your reach. Make sure to include a follow-up email option to provide tailored advice based on their results. This allows for personalized contact and can lead to potential client acquisition.

– Promote the quiz through social media and your website.

– Offer a small incentive, like a free consultation, for participation.

– Share results or popular answers to keep the conversation going.

Interactive Quizzes

Editor’s Choice

U.S. Army Licensed Insignia Division United States Military T-Shirts for…

ibasenice 4pcs Buzzers Portable High Toy for Pranks Easy to Use Noise Ma…

5. Community Workshops

Hosting community workshops is a great way to build local relationships and educate potential clients about life insurance. Partner with local businesses or community centers to reach a wider audience. These workshops can cover various topics, from general life insurance education to specific planning strategies for families.

Make the sessions interactive by including activities or discussion groups. Offering refreshments can also make the event more appealing, creating a friendly and open atmosphere where people feel comfortable asking questions.

– Promote the workshops through social media, local newspapers, and community boards.

– Consider inviting guest speakers to lend credibility.

– Gather feedback post-event for improvements and testimonials.

Connecting with your community isn’t just about selling life insurance; it’s about building trust. Host workshops that educate and engage—because informed clients are empowered clients!

Community Workshops

Editor’s Choice

Ice Chilled Condiment 15.3 Containers 5X 20oz(2.5 Cup) Server with Separ…

H-Qprobd 36″x24″ White Board for Wall Double-Sided Magnetic Dry Erase Bo…

CLOKOWE Mini Projector with WiFi and Bluetooth, Built-in Apps, Smart Por…

6. Personalized Email Campaigns

Email marketing continues to be one of the most effective ways to reach millennials. Develop personalized email campaigns that cater to different client segments based on their needs and interests.

Utilize engaging subject lines and content that speaks directly to their financial goals. For instance, share tips on starting a family, relating them to the importance of life insurance. Remember to include actionable insights and easy steps to get started.

– Segment your audience to tailor content effectively.

– Include links to useful resources or blog posts.

– Incentivize sign-ups with exclusive content or free consultations.

Personalized Email Campaigns

Editor’s Choice

The 1-Page Marketing Plan: Get New Customers, Make More Money, And Stand…

The Infographic Guide to Personal Finance: A Visual Reference for Everyt…

The Seven Figure Agency Roadmap: How to Build a Million Dollar Digital M…

7. Video Testimonials

Video testimonials can be an incredibly powerful tool for building trust and credibility. Reach out to satisfied clients who are willing to share their stories on camera. These authentic experiences can showcase how life insurance has positively impacted their lives.

Ensure that the videos are short, engaging, and highlight key benefits that resonate with millennials. Sharing these on social media and your website can help humanize your brand and make the concept of life insurance more relatable.

– Encourage clients to share their personal experiences.

– Optimize videos for different platforms, from Instagram Stories to YouTube.

– Include a strong call to action at the end of each video.

Video Testimonials

Editor’s Choice

SENSYNE 62″ Phone Tripod & Selfie Stick, Extendable Cell Phone Tripod St…

UBeesize 12” Selfie Ring Light with 62’’ Tripod Stand for Video Rec…

MAYBESTA Wireless Mini Microphone for iPhone, Android Phone – Bluetooth …

8. Gamified Learning Experiences

Gamification is an effective way to engage millennials. Consider developing a mobile app or a web platform where users can learn about life insurance through games or interactive challenges.

This could include scenarios where users make decisions about coverage, and see how their choices affect their financial futures. By making learning about life insurance fun and interactive, you can create a more meaningful experience that sticks with them.

– Incorporate rewards for users who complete challenges or share with friends.

– Use engaging visuals and user-friendly interfaces.

– Promote the game on social media to attract participants.

9. Collaborations with Influencers

Partnering with influencers who resonate with the millennial audience can amplify your reach significantly. Look for influencers in the personal finance or lifestyle niche who have a genuine interest in promoting financial literacy.

These collaborations can take various forms, from sponsored content to joint webinars. Make sure the influencer’s values align with your brand to ensure authenticity. Their endorsements can introduce you to a wider audience and build trust through their established relationship with followers.

– Choose influencers with an engaged audience rather than just high follower counts.

– Encourage them to share personal stories related to life insurance.

– Create tailored campaigns that reflect the influencer’s style.

Collaborate with influencers who share your passion for financial literacy. Their authentic voices can connect you with millennials, turning your life insurance marketing ideas into trusted recommendations!

Collaborations with Influencers

Editor’s Choice

HyperX SoloCast – USB Condenser Gaming Microphone, for PC, PS4, PS5 an…

10. Interactive Financial Planning Tools

Offering free interactive tools on your website can attract millennials interested in financial planning. These tools could be calculators for estimating life insurance needs or budget planners that include insurance costs.

Ensure the tools are user-friendly and visually appealing, encouraging visitors to explore further. Collect user data with consent to follow up with tailored advice and marketing subsequent to their interaction. It’s a great way to provide value while simultaneously fostering potential leads.

– Design tools that are mobile-friendly and accessible.

– Promote your tools through blog articles and social media.

– Gather user feedback to improve functionality.

Interactive Financial Planning Tools

Editor’s Choice

2026 Budget Planner – Monthly Budget Book from JAN 2026 – DEC 2026 with …

Casio SL-300SV Standard Function Desktop Calculator | General Purpose | …

11. Monthly Newsletter

A monthly newsletter can be an excellent way to keep clients informed and engaged. Share tips, updates on life insurance, and relevant industry news in a digestible format. This can help maintain a connection with clients and remind them of their insurance needs.

Include sections like client spotlights, where you share success stories, or highlight new services you’re offering. Adding a personal touch, like a message from you or your team, can enhance the connection. Make sure it is visually appealing and easy to read.

– Use a visually pleasing layout with eye-catching images.

– Incorporate links to blog posts or resources.

– Encourage feedback or suggestions for future content.

Monthly Newsletter

Editor’s Choice

Lined Journal Notebook for Writing, A5 100 GSM Thick Paper, Leather Hard…

12. Client Referral Programs

Implementing a referral program can incentivize your current clients to recommend you to their family and friends. Offer rewards, such as discounts or gift cards, for successful referrals that lead to new clients.

Make sure the program is easy to understand and promote it through your website and social media. This can create a community feel, as clients become advocates for your services. Share success stories from other referrals to motivate participation.

– Clearly outline how clients can participate and what they can earn.

– Regularly remind clients about the referral program through emails and newsletters.

– Thank clients personally for their referrals to foster loyalty.

Client Referral Programs

Editor’s Choice

Hairstylist Referral Cards for Salon| 50 pk | for Client Loyalty Discoun…

13. Tailored Policy Reviews

Offering tailored policy reviews can be a great way to engage clients and showcase your expertise. Schedule individual consultations to review their current policies and financial situation.

During the review, highlight any gaps in their coverage or changes in their circumstances that may require updates. This personal touch shows clients that you care about their specific needs. Follow up with a comprehensive report summarizing your recommendations, reinforcing the value of your expertise.

– Use technology to streamline the review process and record insights.

– Ensure your recommendations are clearly articulated and easy to understand.

– Provide follow-up support to address any questions after the review.

14. Showcase Real-Life Scenarios

Using real-life scenarios can effectively communicate the value of life insurance. Create case studies or stories that highlight how life insurance has helped families in difficult situations. These narratives can resonate well with millennials who want to understand the practical impact of financial products.

Share these stories on your blog, social media, or during workshops. Make sure they are relatable and connect emotionally with your audience. Additionally, consider using video format for greater impact.

– Incorporate visuals to accompany stories, making them more engaging.

– Encourage clients to share their stories with you for authenticity.

– Use storytelling in your marketing materials to reinforce key messages.

Showcase Real-Life Scenarios

Editor’s Choice

Trading Journal for Men: Professional Notebook for Traders – 120 Pages f…

Video Camera Camcorder Digital Camera Recorder Full HD 1080P 15FPS 24MP …

15. Host Charity Events

Organizing charity events can create a positive reputation while connecting with your community. Host events that focus on financial literacy, such as workshops or seminars that educate attendees on the importance of life insurance.

These events can also include a fundraising component for local causes, which fosters connections and goodwill. Share the outcomes and successes of these events on your platforms to highlight your involvement and commitment to the community.

– Partner with local charities to enhance outreach.

– Use social media to promote the event and share behind-the-scenes moments.

– Collect testimonials from participants to highlight the benefits of attending.

Host Charity Events

Editor’s Choice

Janlaugh 100 Pcs Bulk Journal Inspirational Notebooks for Women Men Moti…

Wenqik 100 Pcs Inspirational Mini Compact Mirror for Purse Women Small G…

Native 1080P Projector with WiFi and Two-Way Bluetooth, Full HD Movie Pr…

16. Offer Free Resources

Providing free resources related to life insurance can build trust and establish your expertise. Create downloadable guides or e-books that cover essential topics like ‘Life Insurance Basics’ or ‘How to Choose the Right Coverage.’

Ensure these resources are easy to find on your website and promote them through social media and email campaigns. This adds value to your audience and encourages them to return for more information, positioning you as their go-to expert.

– Use visually appealing designs to make resources attractive.

– Encourage sharing by offering them for free in exchange for contact information.

– Regularly update resources to keep content fresh and relevant.

Providing free resources isn’t just helpful; it’s your ticket to trust! Make life insurance simple and accessible, and watch your clients return for more expert insights.

Offer Free Resources

Editor’s Choice

Understanding Digital Marketing: Marketing Strategies for Engaging the D…

Designing Data-Intensive Applications: The Big Ideas Behind Reliable, Sc…

The AI Engineering Bible for Developers: Essential Programming Languages…

17. Networking Events

Participating in or hosting networking events can provide valuable connections. These events can be themed around financial literacy, bringing together professionals and potential clients interested in life insurance.

Encourage discussions and provide presentations showcasing your expertise. Follow up with participants after the event to nurture those connections. Networking can also lead to collaborative opportunities with other professionals in the finance sector.

– Use social media to promote the event and highlight key speakers.

– Create a friendly and welcoming atmosphere to encourage engagement.

– Gather feedback post-event to improve future networking opportunities.

Networking Events

Editor’s Choice

Mini Portable Projector 4K WiFi 6 BT 5.2 Upgraded Portable Projector Ful…

Network Tool Kit, ZOERAX 11 in 1 Professional RJ45 Crimp Tool Kit – Pass…

18. Co-Branding Initiatives

Consider partnering with businesses that share your values for co-branding initiatives. This can expand your reach and introduce you to a new audience. For example, collaborating with local fitness studios to offer wellness workshops could combine the concepts of health and life insurance.

These partnerships can also include cross-promotions via social media or shared events that focus on financial well-being. Ensure that both brands align in their messaging to create a seamless experience for participants.

– Choose partners that resonate with your target audience.

– Promote the co-branded events actively on all platforms.

– Share insights and success stories from the collaboration to highlight the benefits.

Co-Branding Initiatives

Editor’s Choice

Custom Electric Branding Iron For Wood, Black Temperature-Controlled Woo…

2nd Birthday Guest Book: Dusky Pink Black Themed – Second Party Baby Ann…

The Seven Figure Agency Roadmap: How to Build a Million Dollar Digital M…

19. Utilize Local SEO

Optimizing for local SEO can help attract clients in your geographical area. Ensure your website is optimized for local searches, including keywords relevant to your location and services.

Create content that highlights local events, partnerships, or community involvement. Listing your business on local directories and optimizing your Google My Business profile can also enhance visibility. Engaging with local clients through relevant content can position you as a trusted community resource.

– Encourage satisfied clients to leave reviews on Google.

– Use location-based keywords in your blog posts and website copy.

– Regularly update your online presence to reflect current information.

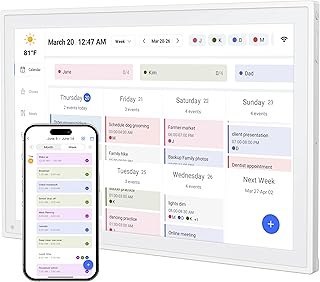

20. Create a Strong Brand Identity

A strong brand identity can help you stand out in a crowded market. Develop a consistent visual and narrative identity that resonates with millennials. This includes everything from your logo to your website design and social media presence.

Tell your story on your website, emphasizing what makes you unique. Engage with your audience through a consistent tone and messaging, making sure it aligns with their values and lifestyle. When your branding feels relatable, potential clients are more likely to connect and trust your services.

– Regularly evaluate your branding for consistency.

– Gather feedback from clients to ensure your branding resonates.

– Adjust your branding strategy as necessary to fit evolving market trends.

Create a Strong Brand Identity

Editor’s Choice

Digital Calendar, 10.1inch Smart WiFi Electronic Calendar&Chore Chart, I…

Jecery 2 Pieces Skeleton Artist Glove with 2 Finger for Drawing Tablet D…

21. Utilize Analytics for Improvement

Using analytics can provide insights into what strategies are working and where improvements are necessary. Track your website traffic, social media engagement, and email open rates to assess the effectiveness of your campaigns.

Regularly reviewing analytics helps tailor future strategies, ensuring they align with your audience’s preferences. Consider A/B testing different campaigns to discover which resonates best with potential clients. This data-driven approach can lead to more successful marketing efforts.

– Set clear objectives for what you want to achieve with your analytics.

– Use data visualization to simplify insights for your team.

– Adjust your strategies based on analytics to maximize ROI.

Utilize Analytics for Improvement

Editor’s Choice

The 1-Page Marketing Plan: Get New Customers, Make More Money, And Stand…

22. Leverage Podcasting

Podcasting can be an engaging way to connect with millennials while providing valuable information. Consider launching a podcast that discusses financial topics, including life insurance, in a relatable way. Invite guests, such as financial experts and satisfied clients, to share their insights and experiences.

Ensure your podcast is conversational and approachable to build a loyal audience. Promote episodes on social media and encourage listeners to engage with content. Podcasting can also establish you as an authority in the financial services space, fostering a dedicated following.

– Keep episodes concise and engaging for busy listeners.

– Use storytelling techniques to make discussions relatable.

– Promote listener feedback to enhance community involvement.

23. Highlight Unique Selling Points

Clearly communicating your unique selling points can help distinguish your services in a competitive market. Identify what sets your insurance products apart, whether it’s customer service, personalized plans, or unique coverage options.

Use your website, social media, and marketing materials to emphasize these points. Make sure potential clients understand the benefits of choosing your services over competitors. Tailor your messaging to address millennials’ specific concerns around life insurance.

– Focus on relatable language that resonates with your audience.

– Use visuals to support your selling points effectively.

– Incorporate case studies that highlight your unique offerings in real-life applications.

Stand out in the crowded world of life insurance! Highlight what makes your services unique, and watch millennials connect with your brand like never before. It’s all about making your message resonate!

Highlight Unique Selling Points

Editor’s Choice

Virtual Architect Ultimate Home Design with Landscaping and Decks

The Seven Figure Agency Roadmap: How to Build a Million Dollar Digital M…

The 1-Page Marketing Plan: Get New Customers, Make More Money, And Stand…

24. Focus on Storytelling

Storytelling can be a potent tool in marketing life insurance. Create narratives that humanize the product and make it relatable to your audience. Share stories about families who benefited from life insurance in times of need or how it helped individuals achieve their financial goals.

These stories can be shared through blog posts, social media, and even video formats. By connecting emotionally with potential clients, you’re more likely to develop rapport and trust, making them more inclined to consider your services.

– Utilize visuals to enhance storytelling through videos or infographics.

– Encourage clients to share their experiences for authenticity.

– Adapt stories to align with current events or themes that resonate with your audience.

25. Invest in Paid Advertising

Investing in paid advertising can provide a boost in visibility, especially if you’re targeting a specific demographic like millennials. Platforms like Facebook and Google Ads allow for precise targeting, ensuring your message reaches the right audience.

Design visually appealing ads focusing on the unique benefits of your life insurance products. Use engaging images and concise messaging to capture attention quickly. Test different ad formats and monitor their performance, adjusting your strategy based on what resonates best.

– Set clear budgets for your advertising efforts.

– Utilize retargeting ads to reach individuals who have shown interest.

– Track ad performance to ensure effective allocation of resources.

Invest in Paid Advertising

Editor’s Choice

Data in Digital Advertising: Understand the Data Landscape and Design a …

Etlegor A Frame Sign Holder, Stainless Steel Poster Stand Floor Display …

26. Build a Community Online

Creating an online community around personal finance and life insurance can foster engagement and loyalty. Consider starting a Facebook group or forum where individuals can ask questions, share experiences, and learn from each other.

Moderate discussions to provide valuable insights and reinforce your expertise. Regularly engage with members by sharing content, hosting live discussions, or providing timely updates about insurance matters. Building this community can help position you as a trusted resource in their financial journey.

– Encourage members to share their experiences and tips.

– Promote discussions that align with current events or trends in the insurance industry.

– Create a welcoming environment that fosters open dialogue.

27. Use Visual Content

Visual content is crucial for engaging millennials who often prefer quick and digestible information. Incorporate eye-catching infographics, videos, and images in your marketing strategy to convey complex information simply.

Visual storytelling can enhance your messaging and keep your audience interested. Use visuals to break down insurance statistics, policy comparisons, and benefits in a way that’s easy to understand. Share this content across social media, blogs, and emails to maximize reach.

– Ensure visuals align with your branding for consistency.

– Use tools like Canva or Adobe Spark to create stunning graphics.

– Monitor engagement rates to understand what visual types resonate most.

Use Visual Content

Editor’s Choice

Corel VideoStudio Ultimate 2023 | Video Editing Software with Premium Ef…

Infographic Design: Visual Storytelling with Information and Data

Virtual Architect Ultimate Home Design with Landscaping and Decks

28. Post Consistently

Consistency is key in building a recognizable brand and maintaining audience engagement. Develop a content calendar that outlines when and where you’ll post different types of content. Regular posting can increase the visibility of your brand and reinforce your messaging.

Make sure to include a mix of content types—educational posts, client testimonials, and promotional materials—to keep your audience engaged. Being consistent helps establish you as a reliable source in the life insurance space.

– Analyze engagement to determine the best posting times.

– Use scheduling tools to manage your content calendar efficiently.

– Adjust your strategy based on audience feedback and interactions.

Post Consistently

Editor’s Choice

Happy Planner Disc-Bound Planner Jan.–Dec. 2026, Includes 3 Extra Mont…

The 1-Page Marketing Plan: Get New Customers, Make More Money, And Stand…

InstaBrain: The New Rules for Marketing to Generation Z

Conclusion: Bringing It All Together

The landscape of life insurance marketing is evolving, especially as millennials become a more prominent audience. By utilizing these innovative marketing ideas, you can craft strategies that resonate with this demographic, making the concept of life insurance more relatable and appealing. From storytelling and social media campaigns to community engagement and visual content, there are countless ways to connect with potential clients.

Remember, the goal is to build trust and provide value, ensuring your marketing strategies align with the financial aspirations of your clients. Keep experimenting with these ideas and adjust your approach based on what works best for your audience. Here’s to building a thriving life insurance business and making a meaningful impact on your clients’ financial futures!

Frequently Asked Questions

What are some effective life insurance marketing ideas specifically for millennials?

To connect with millennials, consider utilizing social media campaigns and educational webinars. Create relatable content on platforms like Instagram and TikTok, and host webinars that simplify life insurance concepts. Engaging blog content and interactive quizzes can also attract this audience by making learning about life insurance fun and accessible.

How can I use social media to market life insurance to millennials?

Harness the power of storytelling on social media to resonate with millennials. Share personal stories, testimonials, and real-life scenarios that highlight the importance of life insurance. Use eye-catching visuals and engaging videos to capture attention. Don’t forget to interact with your audience through comments and messages to build a community around your brand!

What are client acquisition tactics that work for life insurance agents targeting younger clients?

Implementing personalized email campaigns can be a game-changer. Tailor your messages based on the interests and needs of different client segments. Additionally, consider offering free resources like downloadable guides or interactive tools that help millennials understand their life insurance needs better. A referral program can also incentivize existing clients to bring in new business.

How important is educational content in life insurance marketing?

Educational content is crucial, especially for millennials who seek to understand their financial options. Hosting webinars or creating engaging blog posts can demystify life insurance and build trust. By providing valuable information, you position yourself as an expert, making potential clients more likely to choose your services for their financial planning needs.

What role does community engagement play in marketing life insurance?

Community engagement is vital in building relationships and trust. Hosting community workshops or charity events allows you to connect with potential clients in a meaningful way. These events not only educate attendees about life insurance but also demonstrate your commitment to the community, enhancing your brand’s reputation and fostering long-term client relationships.

Related Topics

life insurance marketing

millennial strategies

client acquisition

social media campaigns

educational webinars

financial literacy

personalized marketing

interactive tools

community engagement

influencer partnerships

visual storytelling

SEO optimization