Money management might seem daunting, but it doesn’t have to be! With these 30+ money life hacks, you can easily boost your financial health while enjoying life to the fullest. Frugal living isn’t just about cutting back; it’s about smart choices that lead to big savings and financial freedom. From budgeting strategies to investment hacks, these tips can transform your family’s financial landscape. Let’s dive into practical ideas that make money management both fun and achievable!

1. Budgeting Basics: The 50/30/20 Rule

Keeping track of finances can feel overwhelming, but breaking it down really helps! The 50/30/20 rule is a fantastic budgeting strategy where you allocate 50% of your income to needs, 30% to wants, and 20% to savings. This simple approach helps families manage their expenses without feeling deprived.

This method promotes a balanced lifestyle, ensuring essentials are covered while still allowing room for some fun. Consider using tools like budgeting apps or spreadsheets to automate your tracking. Here’s how to implement it:

– Analyze your monthly income and categorize expenses.

– Set limits for each category to prevent overspending.

– Make adjustments monthly based on your spending habits.

By sticking to this rule, you can not only control your spending but also increase your savings gradually, leading to better financial health in the long run!

Budgeting Basics: The 50/30/20 Rule

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Texas Instruments BA II Plus Financial Calculator, Black Medium

2. Automate Your Savings

If you want to save money without thinking about it, automation is the way to go. Set up automatic transfers from your checking account to your savings account right after payday. This way, you treat savings as a non-negotiable expense!

Here’s how to get started:

– Choose an amount that feels comfortable based on your budget.

– Set up recurring transfers every month.

– Consider multiple savings accounts for different goals (vacation, emergency fund, etc.).

Over time, you won’t miss that money, but you’ll be thrilled when you check your savings balance!

Automation simplifies the process and can significantly boost your financial health by making saving effortless.

Automate Your Savings

Editor’s Choice

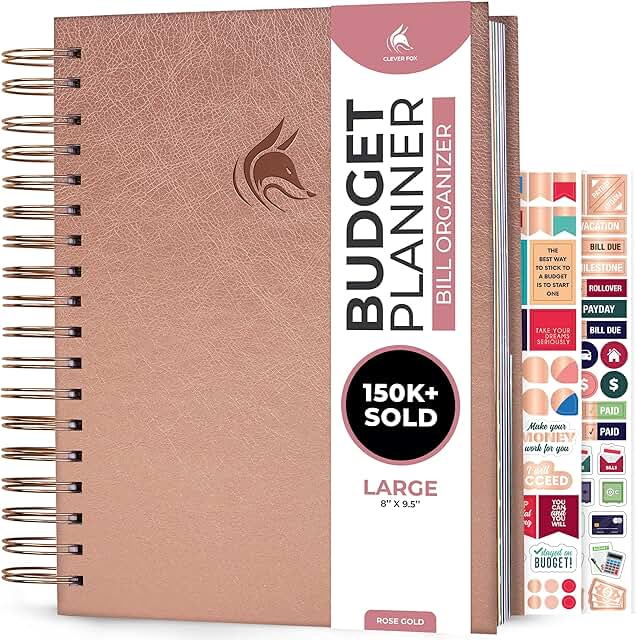

Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. Expense…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

My Bank Account: A Comedy of Savings and Fiscal Fantasy Long Sleeve T-Shirt

3. Meal Planning for Less Waste

Food is one of the biggest expenses for families, but meal planning can dramatically cut costs. By organizing your meals for the week, you can avoid impulsive grocery shopping and reduce food waste.

To get started, follow these simple steps:

– List out meals for the week, focusing on sales and items you already have at home.

– Create a grocery list based on your meal plan to avoid unnecessary purchases.

– Prep meals in advance and store them for quick access.

Not only will this save money, but it’ll also keep your family eating healthier! Plus, knowing what you’re cooking each night saves time and reduces stress.

Meal Planning for Less Waste

Editor’s Choice

Decorably 52 Sheets Pastel Undated Weekly Meal Planner and Grocery List …

Shabbos Pad – Butterfly Print – Memo Pads & Menu Plan – Agenda Planner f…

Bentgo Prep – 20-Piece 1-Compartment Reusable Meal Prep Containers with …

4. Thrifting for Family Essentials

Shopping second-hand is not only eco-friendly but also wallet-friendly! Thrifting can score your family amazing deals on clothes, toys, and even home essentials. Many thrift stores offer high-quality items at a fraction of the retail price.

Here are some tips to make the most of thrifting:

– Visit regularly to catch new arrivals.

– Look for sales or discount days to save even more.

– Check for quality items and be selective.

Thrifting provides a fun treasure hunt experience for the whole family, and you can teach your kids about the value of money while finding unique items.

Why buy new when thrifting can uncover hidden gems for your family? Dive into the world of second-hand shopping and turn every trip into a treasure hunt that saves you money!

Thrifting for Family Essentials

Editor’s Choice

2 Pcs Reusable Shopping Bags Foldable – Lightweight, Waterproof, Reusabl…

COCONIX Fabric & Carpet Repair Kit | Fix Tears, Holes, and Burns on Fabr…

5. Use Cashback and Rewards Programs

Maximize your spending by taking advantage of cashback offers and rewards programs. Many credit cards and apps allow you to earn points or cashback on your everyday purchases.

Here’s how to benefit:

– Research and sign up for a credit card with great rewards tailored to your most frequent purchases (like groceries or gas).

– Use cashback apps when shopping to earn money back on purchases.

– Combine rewards programs with promotions for even better savings.

Just make sure to pay off credit cards each month to avoid interest charges! With a little planning, you can turn your spending into savings.

Use Cashback and Rewards Programs

Editor’s Choice

CN5 Money Counter Machine Mixed Denomination Value Counting UV/MG/IR/DD …

Credit Card Reward Categories for Points or Miles self Adhesive Decals S…

6. Declutter and Sell Unwanted Items

Decluttering your home is an excellent excuse to make some extra cash! Go through closets, toys, and furniture and identify items your family no longer uses. Hosting a garage sale or using online platforms can turn old items into quick cash.

Here’s a step-by-step guide:

– Sort through each room and categorize items into keep, donate, and sell.

– Clean and photograph sellable items for online platforms.

– Set fair prices and promote your sale on social media.

Not only will you earn some money, but you’ll also create a more organized and peaceful living space. It’s a win-win!

Declutter and Sell Unwanted Items

Editor’s Choice

8K Digital Cameras for Photography – Autofocus 88MP WiFi Profession Came…

Amazon Basics Collapsible Fabric Storage Cubes Organizer with Handles, S…

MX-5500 8 Digits Price tag Gun with 5000 Sticker Labels, Pricing Gun Kit…

7. Utilize Public Libraries

Libraries are a treasure trove of resources that many families overlook. Beyond just books, many libraries offer free access to e-books, audiobooks, movies, and even classes!

Here’s why you should utilize your local library:

– Free entertainment: Borrow books and media instead of buying.

– Classes and workshops: Attend free community events to learn new skills.

– Access to technology: Use computers and Wi-Fi for free.

Make it a family outing! You can spend quality time together browsing, reading, and enjoying community events all while saving money.

Utilize Public Libraries

Editor’s Choice

Gritin 9 LED Rechargeable Book Light for Reading in Bed – Eye Caring 3 C…

8. DIY Home Projects

Taking on DIY projects can be a fantastic way to save money on home improvements while spending quality time as a family. Instead of hiring professionals, tackle small projects together, from painting to gardening!

Here’s how to get started:

– Identify projects that need attention and research how to do them.

– Gather materials and tools, opting for thrifted or recycled items to cut costs.

– Set a family day for your project – make it fun!

The pride of creating something together and saving money is immeasurable. Plus, you’ll improve your home’s value without breaking the bank!

DIY Home Projects

Editor’s Choice

Fiskars 3-in-1 Garden Tool Set, Includes Trowel, Transplanter, and Culti…

Hi-Spec Tool Set 25pc Pink Household DIY Tool Kit for Women. Small Mini …

10PCS Palette Knife, Stainless Steel Painting Knife Set, Flexible Spatul…

9. Create a Family Financial Goal Board

Visual reminders can motivate and inspire! Creating a family financial goal board is a fun way for everyone to be on the same page about savings and financial goals.

Here’s how to make one:

– Gather magazines, colorful paper, and markers.

– Discuss dreams and goals—vacations, a new car, or even a new home!

– Design the board together, placing it somewhere visible.

Every time you see the board, it’ll serve as a reminder of what you’re working towards. Celebrate small milestones along the way, making your financial journey a shared adventure!

Create a Family Financial Goal Board

Editor’s Choice

Sundaymot Arts and Crafts Supplies for Kids, 2000+Pcs DIY Craft Kits, Ag…

10. Shop during Sales and Off-Season

Timing your purchases can dramatically lower your costs. Shopping during sales events or off-season can save you a ton of money, especially for clothes, holiday items, and big-ticket purchases.

Here’s the best approach:

– Keep an eye on sales calendars and plan your shopping around major holidays.

– Purchase seasonal items like winter clothes during summer sales.

– Utilize coupons or cash-back offers during these times for additional savings.

Planning ahead means you can snag what you need at a fraction of the regular price, making it a smart strategy for family budgeting!

Shop during Sales and Off-Season

Editor’s Choice

Cash Envelope Wallet, Reusable Envelope Wallet, Men’s and Women’s Genuin…

11. Learn About Local Discounts and Programs

Many communities offer discounts that families can take advantage of, like local attractions, museums, or restaurants. By doing a little research, you can find plenty of opportunities to save!

Here’s how to find and utilize local discounts:

– Check community websites, local newspapers, or social media pages.

– Sign up for newsletters from local attractions for special offers.

– Ask about family deals or community days that offer reduced rates.

By taking advantage of these local perks, you can enjoy outings without stretching your budget!

Learn About Local Discounts and Programs

Editor’s Choice

The Only Law of Attraction Book You’ll Ever Need: The Complete Guide to …

Passport Holder Men Full Grain Leather, Passport Cover, Passport Case, P…

12. Energy Efficiency at Home

Reducing your utility bills can significantly improve your financial health. Making your home more energy-efficient not only saves money but also helps the environment!

Here are quick tips for achieving this:

– Switch to LED light bulbs to save on energy consumption.

– Unplug electronics when not in use to avoid phantom energy drain.

– Consider adding insulation or weather stripping to keep heating and cooling costs down.

Even small changes can lead to big savings over time, helping your family budget stretch further. Plus, being energy-efficient often means a more comfortable home!

13. Set Up a Family Emergency Fund

Having an emergency fund is crucial for any family’s financial health. This fund acts as a safety net for unexpected expenses, helping to avoid debt during emergencies.

Here’s how to build your fund:

– Aim for at least three to six months’ worth of expenses.

– Start small by saving a percentage of each paycheck.

– Keep the money in a separate savings account to avoid temptation.

The peace of mind that comes with having an emergency fund is priceless. It protects your family’s finances and allows you to focus on what truly matters.

Set Up a Family Emergency Fund

Editor’s Choice

Money Maze Puzzle Box (2 Pack) for Kids and Teens, Makes Cash Gift Givin…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Small Clear Plastic Coin Bank Jars 4-Pack, 16oz with Silver Slotted Lids…

14. Combine Errands to Save Gas

Are you tired of making multiple trips for errands? Combining errands into one trip can save you time and money on gas! Planning your route and being strategic about your stops can improve efficiency.

Here’s how to plan your errand day:

– Make a list of everything you need to do.

– Arrange the stops in a logical order to minimize driving distance.

– Consider carpooling with friends or family for shared trips.

By being smart about your errands, you’ll not only save on fuel but also make your day smoother and less hectic!

Combine Errands to Save Gas

Editor’s Choice

Miracase Phone Holders for Your Car with Metal Hook Clip, Air Vent Cell …

Reusable Grocery Bags (3 Pack) – Heavy Duty Reusable Shopping Bags wit…

15. Engage in Free Community Activities

You don’t have to spend a lot of money to have fun! Many local communities offer free events like concerts, festivals, and workshops. Engaging in these activities allows for quality family time and exploration without the financial commitment.

Discovering local events:

– Check local community boards or online calendars for upcoming events.

– Join local social media groups to stay updated on free happenings.

– Plan family outings around these events for a budget-friendly day out.

Making memories as a family doesn’t have to come at a cost. Free community events can be a wonderful way to connect and enjoy your local area together!

Fun doesn’t have to cost a thing! Explore your community’s free events for laughter, joy, and unforgettable family memories. Discover local gems and make your budget-friendly outings a treasure hunt!

Engage in Free Community Activities

Editor’s Choice

Eddie Bauer – Throw Blanket, Reversible Sherpa Fleece Bedding, Buffalo P…

GoSports Slammo Game Set (Includes 3 Balls, Carrying Case and Rules) – O…

Copco Hydra 16.9 oz Water Bottle with Leak-Proof Lid – Tritan Reusable w…

16. Negotiate Bills and Payments

Don’t be afraid to negotiate your bills! Many service providers (like cable and internet companies) are often willing to lower your rates just by asking.

Here’s how to effectively negotiate:

– Review your current bills and research competitor rates.

– Call your provider and politely ask if they have any promotions available.

– Be prepared to switch services if they can’t meet your request.

A little negotiation can lead to significant savings, freeing up more money for your family budget!

Don’t let your bills drain your budget! A simple phone call can open the door to savings. Negotiate like a pro and watch your financial health flourish!

Negotiate Bills and Payments

Editor’s Choice

The Infographic Guide to Personal Finance: A Visual Reference for Everyt…

2026 Budget Planner – Monthly Budget Book from JAN 2026 – DEC 2026 with …

Logitech Zone 301 Wireless Bluetooth Headset with Noise-Canceling Microp…

17. Refinance Loans When Possible

Have you looked at your loans lately? Refinancing existing loans can lower your monthly payments and save you money in the long run! This is especially true for student loans, mortgages, or car loans.

Here’s how to approach refinancing:

– Shop around for lower rates and better terms.

– Check your credit score to ensure you qualify for better rates.

– Calculate potential savings to ensure it’s worth the fees that may be involved.

Refinancing can provide breathing room in your budget and help your family achieve financial goals more quickly!

Refinance Loans When Possible

Editor’s Choice

Mr. Pen Mechanical Switch Calculator – 12 Digit Large LCD Display, Pink …

Credit Card Multitool – 11 in 1 Wallet Tool with Can Opener, Knife, Bott…

The Infographic Guide to Personal Finance: A Visual Reference for Everyt…

18. Use Generic Brands

When shopping, don’t overlook generic brands! Many store-brand products offer the same quality as name brands but at a lower cost.

Here’s why to give them a try:

– Compare prices and ingredients to see if there’s a clear difference.

– Start with items you frequently buy, like groceries or toiletries.

– Your family may prefer the taste or quality without even realizing it!

Switching to generic can significantly cut grocery bills, allowing you to allocate funds toward other family needs or savings!

Use Generic Brands

Editor’s Choice

Generic Multi-Purpose Cleaning Paste, 7 Ounce (Pack of 3)

Moda West 24 Hygiene Kits – Bulk Case of Wholesale Basic Toiletry Kits f…

Vlasic Pickle Balls, Dill Pickle Flavored Corn Puffs, Stocking Stuffer, …

19. Take Advantage of Tax Deductions and Credits

Tax season doesn’t have to be stressful! Familiarizing yourself with available deductions and credits can save your family a substantial amount of money.

Here’s how to maximize your tax benefits:

– Keep detailed records of expenses throughout the year.

– Research available tax credits you may qualify for based on income or family size.

– Consider consulting a tax professional to ensure you get the most out of your return.

Understanding taxes can feel overwhelming, but it’s worth the time to explore what you might be missing!

Take Advantage of Tax Deductions and Credits

Editor’s Choice

Mechanical Switch Calculator with Big Buttons, Calculators Desktop, 12 D…

TaxAct Online 2018 Deluxe+ Federal Edition [PC Online code]

Letter Size Yearly Tax Organizer Book with 12 Separate Pockets Spiral Bo…

20. Invest in High-Interest Savings Accounts

Not all savings accounts are created equal! Investing in a high-interest savings account can make your money work harder for you.

Here’s the lowdown:

– Research online banks that offer higher interest rates compared to traditional banks.

– Look for accounts with no monthly fees to maximize your savings.

– Make a habit of depositing a portion of your income into this account regularly.

Over time, the interest earned can add up, giving your family more financial freedom to tackle future goals!

Don’t let your savings sit idly! A high-interest savings account can turn your hard-earned cash into a powerful tool for your family’s financial freedom. Invest wisely, save smart!

21. Teach Kids about Money Early

Teaching your children about money management at a young age can set them up for success in the future. Involve them in budgeting and saving in fun ways!

Here’s how:

– Set up a savings jar for them to watch their money grow.

– Play money management games to make learning fun.

– Discuss financial decisions openly to encourage questions and engagement.

Building a financial foundation early on will help them understand the value of money and make informed decisions as they grow!

Teach Kids about Money Early

Editor’s Choice

Rich Dad CASHFLOW Board Game, Educational Business & Finance Literacy Ga…

Financial Literacy: How to Gain Financial Intelligence, Financial Peace …

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

22. Utilize Free Financial Education Resources

Knowledge is power, especially when it comes to finances! Many free resources are available online, including courses, webinars, and eBooks designed to improve financial literacy.

Here’s how to make the most of these resources:

– Look for reputable websites or organizations offering free courses.

– Join community workshops that focus on budgeting and saving.

– Encourage family discussions about what you learn together.

Improving your financial knowledge as a family can lead to better choices and empowerment!

Utilize Free Financial Education Resources

Editor’s Choice

Easy to Use Accounting Ledger Book – The Perfect Expense Tracker Noteboo…

23. Plan Family Vacations Off-Peak

Traveling during off-peak times can save your family a lot of money! Flights and accommodations often drop in price when demand is lower.

Here’s how to save:

– Research your destination for off-peak seasons to visit.

– Book in advance for the best deals on flights and hotels.

– Look for vacation packages that offer bundled savings.

Off-peak travel can also mean fewer crowds, allowing your family to enjoy your destination more fully without the financial strain!

Plan Family Vacations Off-Peak

Editor’s Choice

50 States, 5,000 Ideas: Where to Go, When to Go, What to See, What to Do

BAGAIL 8 Set Packing Cubes Luggage Packing Organizers for Travel Accesso…

24. Consider Side Hustles for Extra Income

Looking for ways to bring in extra cash? Starting a side hustle can be an entertaining way to earn money while pursuing your interests!

Here’s how to get started:

– Identify skills or hobbies that could translate into income (like baking, crafting, or freelancing).

– Use platforms like Etsy or Fiverr to market your services.

– Set realistic goals for how much time you can dedicate to your side hustle.

Every little bit helps, and you may find your passion turning into a profitable venture. Plus, it can be a fun family project if you get everyone involved!

Consider Side Hustles for Extra Income

Editor’s Choice

Sundaymot Arts and Crafts Supplies for Kids, 2000+Pcs DIY Craft Kits, Ag…

PRODUCTIVITY STORE Pro – Undated, 2026 Planner, 5.8” x 8.3” – The #1…

Kitchen Conversion Chart Magnet – Measurements Conversion Chart – Baking…

25. Use a Spending Journal

Keeping a spending journal can help you identify where your money goes! By writing down every purchase for a month, you can spot patterns and areas to cut back.

Here’s how to start:

– Use a notebook or budgeting app to track daily expenses.

– Review weekly to notice trends or guilty spending habits.

– Set goals for areas you want to improve on.

After a month, you’ll have a clearer picture of your spending habits, allowing your family to make informed financial decisions!

Use a Spending Journal

Editor’s Choice

Budget Planner – Budget Book with Bill Organizer and Expense Tracker, 6….

Why Didn’t They Teach Me This in School?: 99 Personal Money Management P…

100 Days Money Saving Challenge Coin Envelope Budgetstorage Book, Mini 1…

26. Leverage Student Discounts

If your family includes students, make sure to take advantage of student discounts! Many restaurants, stores, and services offer special rates for students.

Here’s how to find and use these discounts:

– Research online to discover which places offer student pricing.

– Always carry student ID for verification.

– Encourage your kids to ask about discounts when dining out or shopping.

These small savings can add up quickly, easing the financial stress on your family!

27. Participate in Community Swap Events

Community swap events are a fun way to exchange items your family no longer needs for things they want, all for free! Clothes, toys, and household goods can be traded without spending a dime.

Here’s how to participate:

– Check local community boards for upcoming swap events.

– Bring items in good condition that you won’t use anymore.

– Enjoy browsing and trading with neighbors!

It’s a sustainable way to refresh your family’s belongings while saving money and connecting with the community!

28. Avoid Impulse Purchases

Impulse buying can wreak havoc on your budget! To avoid falling into this trap, it helps to have a strategy in place.

Here are some practical tips:

– Create a 24-hour rule: If you want something, wait a day before buying.

– Limit your shopping trips to once a week to reduce temptation.

– Stick to a shopping list to avoid unnecessary purchases.

Being mindful of your spending habits can help you stick to your budget and boost your overall financial health!

Avoid Impulse Purchases

Editor’s Choice

8 Magnetic Notepads – Notepads for Grocery List, Shopping List, To-Do …

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

29. Use a Bill Organizer

Staying on top of bills can be overwhelming for families. A bill organizer can help manage payments and deadlines effectively.

Here’s how to create one:

– Gather all your bills and establish a filing system.

– Use labels for easy identification (like utilities, credit cards, etc.).

– Set reminders for payment dates to avoid late fees.

This organized approach not only saves money in late fees but also reduces stress around bill payments!

Use a Bill Organizer

Editor’s Choice

DYMO LabelManager 160 Portable Label Maker Bundle, Easy-to-Use, One-Touc…

Sooez Accordion File Organizer, 13 Pockets Expanding File Folder, Portab…

EVGATSAUTO Smart Counter Rechargeable Finger Counter Long Battery Life 9…

30. Focus on Long-Term Financial Goals

While managing day-to-day expenses is vital, don’t lose sight of your long-term financial goals! Setting goals for savings, retirement, or buying a home can guide your financial choices.

Here’s how to align daily actions with long-term goals:

– Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

– Discuss these goals regularly with your family to stay motivated.

– Track progress together, celebrating milestones.

Keeping the big picture in mind will help your family make smarter financial decisions that lead to a secure future!

Focus on Long-Term Financial Goals

Editor’s Choice

Goal Setting: How to Create an Action Plan and Achieve Your Goals (Works…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Conclusion: Your Journey to Financial Freedom Starts Today!

Implementing these money life hacks can transform your family’s financial health, one step at a time. From budgeting to investing and everything in between, every little change can lead to big savings. Embrace frugal living as a lifestyle, not a restriction, and instill these habits in your children for a financially savvy future.

Start today, and watch as your efforts pave the way for financial freedom, making life just a little easier and a lot more enjoyable!

Frequently Asked Questions

What are some effective budgeting strategies for families?

Budgeting can feel daunting, but it doesn’t have to be! One of the most popular strategies is the 50/30/20 rule. This method divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. It’s a straightforward way to ensure you’re living within your means while also planning for your future!

How can I automate my savings effectively?

Automating your savings is a game changer! By setting up automatic transfers from your checking account to your savings account right after payday, you can save without even thinking about it. This way, you treat your savings like a recurring expense, making it easier to build your nest egg over time. Remember, even small amounts can add up significantly!

What are some practical saving money ideas for families?

There are countless saving money ideas that can benefit families! Meal planning is a fantastic way to cut food costs and reduce waste. Additionally, consider engaging in community swap events to trade items you no longer need for things you want. And don’t forget about thrifting for high-quality second-hand items, which can save you a bundle on clothes and household essentials!

How can I reduce my family’s debt effectively?

Reducing debt can feel overwhelming, but there are effective debt reduction techniques to make it manageable. Start by assessing your debts and prioritizing them. The snowball method, where you focus on paying off the smallest debts first, can provide quick wins and motivate you to tackle larger debts. Additionally, consider negotiating lower interest rates with your creditors to save on payments!

What investment hacks can help families grow their savings?

Investing doesn’t have to be intimidating! One simple investment hack is to open a high-interest savings account, which can help your money grow faster. You can also consider contributing to a Roth IRA for long-term savings, as it allows your investments to grow tax-free. Start small and gradually increase your contributions as you become more comfortable with investing!

Related Topics

money life hacks

frugal living

budgeting strategies

saving money tips

debt reduction

family finance

automated savings

DIY projects

financial education

long-term goals

cashback rewards

community resources

![30+ Money Life Hacks to Boost Your Financial Health 104 TaxAct Online 2018 Deluxe+ Federal Edition [PC Online code]](https://m.media-amazon.com/images/I/41KOgF1NbtL._AC_UY218_.jpg)