Saving money doesn’t have to be a dull chore; it can actually be a fun challenge! Biweekly money saving challenges offer a fantastic way to watch your savings grow without feeling overwhelmed.

Whether you’re saving for a vacation, a new gadget, or just building a financial cushion, these challenges can help you achieve those goals while keeping your finances exciting. Imagine setting small, achievable targets every two weeks and seeing your savings account swell with every paycheck!

In this listicle, we’ll explore 25 creative money saving challenges that can make reaching your financial goals a breeze. Let’s get started on this journey toward financial empowerment!

1. The 52-Week Challenge

Kick off your savings journey with the classic 52-week challenge! This challenge involves saving a gradually increasing amount each week, starting with just $1 in the first week and adding a dollar each subsequent week.

By the end of the year, you’ll have saved $1,378! To adapt it for a biweekly schedule, you can save $2 in the first two weeks, then $4 in the next two weeks, and so on. This method not only builds a healthy savings account but also teaches the importance of incremental growth.

– Start small to avoid feeling overwhelmed.

– Keep a visual tracker to celebrate your progress.

– Consider creating an exciting savings goal to motivate you.

You can challenge a friend to do it with you for added motivation!

2. Round-Up Savings

Turn your spare change into savings with the round-up challenge! Every time you make a purchase, round up to the nearest dollar and save that extra change. For biweekly challenges, set aside the total amount of your round-ups every two weeks.

You’ll be surprised at how quickly those small amounts add up! This method allows you to save without even realizing it.

– Use a savings app that automatically rounds up transactions.

– Keep a dedicated jar for physical coins if you prefer a hands-on approach.

– Set clear goals on what you want to save for.

Combine this with your regular purchases to boost savings effortlessly!

3. No-Spend Challenge

Try a no-spend challenge for a biweekly boost to your savings! Designate a time frame, like two weeks, where you only spend on essentials. This means no dining out, no shopping for non-essentials, and no impulse buys.

At the end of the two weeks, see how much you’ve saved from your usual spending habits. It’s a great way to assess your financial habits and identify areas to cut back.

– Plan meals at home to avoid temptations.

– Find free activities to fill your time instead.

– Keep a journal to track your feelings about the challenge.

Challenge friends or family to join you and share your progress for motivation!

4. The $5 Challenge

Every time you receive a $5 bill, save it! This whimsical challenge can yield impressive results without feeling like a burden. Just stash away every $5 bill that comes your way during your biweekly pay periods.

You might be surprised at how quickly those bills pile up.

– Keep a designated savings jar for easy tracking.

– Consider depositing the saved amount every two weeks for a tangible boost in your savings account.

– Get family and friends involved to see who can collect the most!

This is a fun way to enjoy little rewards while saving. It makes saving feel less serious!

Saving money doesn’t have to be a chore! With the $5 Challenge, every little bill adds up to big savings. Start stashing those fives and watch your savings thrive!

5. The 30-Day No-Coffee Challenge

If you’re a coffee lover, this one’s for you! Challenge yourself to avoid coffee for 30 days and save the money you would have spent on your daily brews.

Instead, brew coffee at home or explore other beverages. At the end of the month, tally your savings and treat yourself to something special!

– Find a fun coffee alternative to help with cravings.

– Track your daily savings in a visible spot.

– Share your progress on social media for accountability!

This challenge not only boosts your savings but also encourages healthier habits and potentially new interests!

6. The 1% Challenge

For those new to saving, the 1% challenge is perfect! Each month, save 1% of your income for two weeks. This means if you earn $2,000, you would save $20 every two weeks.

This simple and manageable method allows you to build confidence in your savings habits. Over time, challenge yourself to increase the percentage as you get more comfortable with saving.

– Use direct deposit to your savings account for effortless savings.

– Set up reminders to keep you on track.

– Celebrate milestones to stay motivated!

This method makes saving feel much more attainable, especially for beginners!

7. The Seasonal Savings Challenge

Align your savings with the seasons! Set goals for each season, adjusting your savings plan accordingly. For example, save for a summer vacation or holiday shopping during winter.

Every two weeks, save a predetermined amount that aligns with your seasonal goals. This strategy not only keeps your savings on track but also gives you something exciting to look forward to.

– Use a seasonal calendar to plan your goals.

– Set reminders for when to increase your savings amounts.

– Make it a family affair by involving loved ones in joint seasonal goals.

You can create a vision board with images representing your seasonal goals to keep you motivated!

8. The Reverse Challenge

This challenge flips the traditional saving approach on its head! Instead of saving more each week, start at a larger amount and decrease it over time. For biweekly savings, begin with a high sum, like $50, and reduce it by $5 every two weeks.

By the end of the year, you’ll have saved significant cash while teaching yourself to manage fluctuating savings.

– Keep a colorful chart to visualize your decreasing savings.

– Challenge friends to see who can stick to it the longest!

– Use the saved amounts to treat yourself to something special after completion.

This method can feel counterintuitive, but it can actually work well for those who are disciplined with their finances!

9. The Penny Challenge

Embrace the humble penny with the penny challenge! Each day, save the number of pennies that corresponds to the day of the month—for example, save 1 penny on the 1st, 2 pennies on the 2nd, and so on.

At the end of the month, it will add up to a surprising amount of savings! This is a super simple and engaging way to build your savings over time.

– Use a jar to track your daily savings easily.

– Use this method with your kids to teach them about saving.

– Personalize your savings goal—think of a fun way to spend what you save!

This can be a fun family challenge that turns into a game where everyone can participate!

10. The Travel Fund Challenge

Dreaming of a getaway? Start a travel fund challenge! Designate a specific amount to save every two weeks, focusing solely on funding your travel dreams.

Budget ahead for trips, experiences, or accommodations. Track your progress meticulously and celebrate each milestone with a small treat.

– Be realistic about your travel goals to set achievable savings targets.

– Use a travel app that helps you visualize your dream destinations!

– Plan mini-trips along the way to keep the excitement alive.

A travel vision board can help you stay motivated and inspired as you save!

Your travel dreams are just a savings plan away! Start a travel fund challenge and watch your adventures unfold, one deposit at a time.

11. The Utility Bill Challenge

This challenge is all about cutting down on utility bills and saving the difference! Set a goal to reduce your bills each month, whether it’s by conserving water, turning off lights, or using less electricity.

The money saved from the bills can be added to your savings every two weeks. Focus on small tasks that can help reduce your utility costs.

– Monitor your bills to identify patterns in usage.

– Involve your family to create a collective effort in reducing costs.

– Treat your savings as a reward for your efforts!

Each small change contributes to a bigger impact on your savings and the environment!

12. The 10-Percent Challenge

This challenge is straightforward yet effective. Save 10% of your income every two weeks. This percentage can help build a healthy savings habit while also preparing for any emergencies.

When you consistently set aside this amount, you will gradually learn to live within the remaining 90%.

– Set up an automatic transfer to your savings account for simplicity.

– Reassess your spending habits to find areas to reduce extra costs.

– Celebrate reaching milestones along the way!

This strategy helps build financial discipline while ensuring you always have a safety net!

Save 10% of your income every two weeks! This simple challenge not only builds your savings but teaches you to thrive on less. Celebrate your milestones and watch your financial confidence grow!

13. The ‘Save for a Cause’ Challenge

Use your saving skills to make a difference! Choose a charity or cause that resonates with you and set a goal to save a certain amount every two weeks.

Not only will you be contributing to something meaningful, but you’ll also instill a sense of purpose in your saving journey.

– Research various charities to find one that aligns with your values.

– Share your goal with friends and family to encourage donations!

– Celebrate your progress and impact on the cause!

Connecting your financial goals with social responsibility can create a fulfilling experience!

14. The Monthly Goal Challenge

Set specific financial goals for each month! For biweekly savings, divide the total amount you need into two equal parts and save each biweekly paycheck.

This challenge keeps you focused on your goals and allows you to celebrate achievements monthly, whether it’s a new gadget, a special event, or a savings milestone.

– Write down your goals and keep them visible.

– Keep a savings tracker to visualize your progress.

– Share your goals with friends for accountability!

The excitement of monthly targets can keep your motivation high and create a fun challenge atmosphere!

15. The Holiday Savings Challenge

Holidays can be expensive, so why not prepare ahead? Start a holiday savings challenge! Each paycheck, put away a predetermined amount towards holiday expenses.

This approach allows you to enjoy the holidays stress-free, knowing you have funds set aside.

– Calculate an estimated budget for gifts and festivities to establish savings amounts.

– Start saving early—consider a year-round approach for extra cushion.

– Encourage family members to join in and save together for shared experiences!

By saving ahead of time, you can enjoy a guilt-free holiday season without the post-holiday financial hangover!

16. The Meal Prep Challenge

Eating out can drain your wallet, so why not save by meal prepping? Dedicate a few hours each week to prepare and pack your meals. For the biweekly challenge, set aside what you’d normally spend on takeout.

At the end of the two weeks, see how much you saved by avoiding restaurant meals.

– Plan your meals around sales and seasonal ingredients for savings.

– Keep it fun by trying new recipes and involving family members.

– Track your spending to see the difference!

Cooking at home not only saves money but can also improve your cooking skills and health!

17. The Entertainment Savings Challenge

Cut back on entertainment costs by finding free or low-cost activities in your area! Challenge yourself to spend no more than a certain amount on entertainment each biweekly period.

Use that saved money for something special, like a bigger outing or experience!

– Research community events and free activities that align with your interests.

– Explore nature or local parks for low-cost fun.

– Keep a log of what you save each time you skip a paid activity!

This challenge can lead to discovering unique local gems while bonding with friends and family!

18. The DIY Challenge

If you love crafting or home improvement, the DIY challenge is perfect for you! Instead of purchasing new items or hiring services, commit to making or fixing things yourself.

Every two weeks, calculate the money saved by avoiding store-bought items and stashing it away.

– Share your DIY projects on social media for inspiration!

– Keep a list of projects you want to tackle.

– Celebrate completion with a little treat for all your hard work.

This challenge encourages creativity while also boosting your savings!

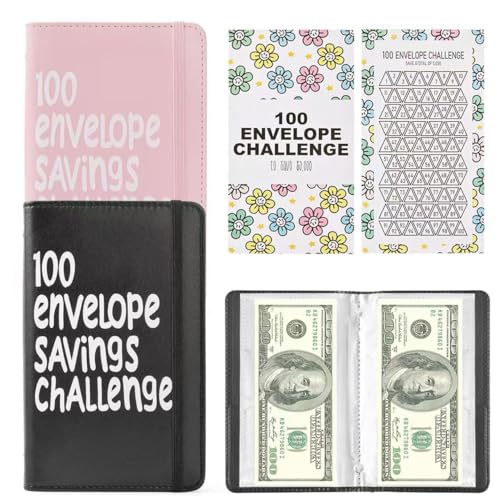

19. The ‘Envelope’ Challenge

The envelope system is a tangible way to manage your finances! Label envelopes for different spending categories and allocate your cash accordingly.

At the end of two weeks, whatever is leftover in each envelope goes straight to savings! This method teaches you budgeting while making savings fun.

– Start with basic categories like groceries, entertainment, and savings.

– Set spending limits for each envelope.

– Be creative with how you use the leftover cash!

You can personalize envelopes for special savings, like travel or emergencies, to make it even more engaging!

The ‘Envelope’ Challenge makes budgeting fun! Let your leftover cash boost your savings and watch your financial goals soar. Who knew saving could be this rewarding?

20. The ‘Pledge’ Challenge

Make a pledge to save a specific amount every two weeks. It can be a set amount or based on your income, but stay committed! Celebrate each time you reach your pledge amount to keep the excitement alive.

This not only helps your savings but also builds discipline in your financial habits.

– Track your progress visually to stay motivated.

– Share your goals with friends for accountability!

– Use a savings app to monitor your growth.

This challenge can be shared as a group effort with family or friends for extra motivation!

21. The Holiday Gift Challenge

Get a head start on holiday shopping by saving for gifts year-round! Each month, set aside a specific amount for gifts, so you’re prepared when the season arrives. For a biweekly approach, save half that amount every two weeks.

This way, you avoid financial stress when the holidays come around!

– Research gift ideas early to set a budget.

– Adjust gift amounts based on your needs.

– Consider handmade gifts to save money while adding a personal touch!

This proactive strategy means you can spend more time enjoying the holidays instead of stressing about finances!

22. The ‘Pay Yourself First’ Challenge

This challenge emphasizes making savings a priority. When you receive your paycheck, set aside a specific amount for savings before paying bills or spending. This habit ensures that you consistently contribute to your savings.

For biweekly savings, decide on an amount that feels comfortable and sustainable.

– Automate transfers to savings whenever possible.

– Track your spending to see how well you’re managing your budget.

– Celebrate increases in your savings over time!

This method builds a strong savings habit that supports long-term financial health!

23. The 30-day Savings Challenge

Similar to the no-spend challenge, commit to saving a specific amount every day for 30 days. Choose a manageable figure that grows over time, like $1 on the first day, $2 on the second, and so on.

This will encourage consistency and allow you to evaluate your spending habits.

– Track your savings visually to see your progress.

– Celebrate halfway points to stay motivated!

– Involve friends for accountability.

This method fosters instant gratification as you see your savings grow daily!

24. The Savings Jar Challenge

Create a savings jar specifically for goals! Determine a target amount for a specific purpose, like a vacation or a special purchase. Each biweekly period, contribute a set amount into your savings jar until you reach your goal.

This method allows you to visually see your progress and stay motivated.

– Personalize your jar with decorations!

– Set realistic goals so you don’t feel overwhelmed.

– Share what you’re saving for with friends for support!

The more personalized your savings jar, the more motivation you’ll feel to fill it up!

25. The ‘Change’ Challenge

Whenever you make a purchase, round up your spending and save the change. For example, if you buy coffee for $3.50, put 50 cents in your savings jar. This approach encourages you to save without drastic lifestyle changes.

At the end of the month, count the change to see how much you’ve accumulated.

– Use a clear jar so you can see your progress.

– Challenge family members to save their change as well!

– Consider using the total change saved for a fun treat at the end of each month!

This challenge not only saves money but also teaches you the value of small savings!

Conclusion

There you have it! 25 biweekly money saving challenges to spark your savings journey this year. Embrace these creative and engaging strategies to meet your financial goals while having fun!

No matter which challenge you choose, the important thing is to stay committed and track your progress. With consistency and determination, you can achieve remarkable savings and build a more secure financial future.

Frequently Asked Questions

What is a biweekly money saving challenge and how does it work?

A biweekly money saving challenge is a fun and engaging way to save money by setting aside a specific amount every two weeks. It allows you to make consistent progress toward your financial goals without feeling overwhelmed.

For instance, you can start with a simple challenge like saving $1 in the first week, and gradually increase the amount over time. The idea is to create a habit of saving regularly while also making it enjoyable!

How do I choose the right money saving challenge for me?

Choosing the right money saving challenge depends on your financial goals and lifestyle. Consider what motivates you!

If you enjoy gamifying your savings, try challenges like the Round-Up Savings or the $5 Challenge. If you prefer a structured approach, the 10-Percent Challenge might be ideal. Assess your spending habits, and pick a challenge that feels achievable and exciting for you!

Can I combine different money saving challenges?

Absolutely! Combining different money saving challenges can be a great way to maximize your savings potential.

For example, you can participate in the 52-Week Challenge while also tackling a No-Spend Challenge for a specific two-week period. This combination can help you boost your savings while also curbing unnecessary expenses. Just make sure to set realistic goals so you don’t feel overwhelmed!

What are some tips for staying motivated during a biweekly money saving challenge?

Staying motivated during a money saving challenge can be a game-changer for your financial journey. Start by setting clear and achievable goals, and celebrate small milestones along the way!

Visual tracking methods, like using a savings jar or a chart, can provide a tangible reminder of your progress. You can also involve friends or family for support and accountability, making the challenge a fun group activity!

How can I effectively track my savings during a biweekly challenge?

Tracking your savings is key to the success of any biweekly money saving challenge. You can use a simple spreadsheet, a budgeting app, or even a dedicated savings journal to log your progress.

Make it a habit to review your savings every two weeks. This will not only keep you accountable but also allow you to adjust your plans as necessary. Plus, seeing your savings grow can be incredibly motivating!