Living frugally doesn’t mean you have to sacrifice your lifestyle; in fact, it can add a dose of creativity and awareness to your family’s spending habits!

This collection of money-saving hacks is perfect for families looking to enhance their financial literacy while enjoying the little things in life. From simple budgeting tips to clever cost-cutting techniques, each hack is designed to make your finances feel less overwhelming and more manageable. Get ready to transform your spending habits with these savvy strategies that can lead to big savings over time!

Let’s take a fun journey into the world of frugal living, where every little decision counts and financial freedom is within your reach!

1. Create a Family Budget Together

Start strong by involving the entire family in creating a budget. This not only educates everyone about financial responsibility, but also makes them feel invested in the family’s financial goals.

Gather around the kitchen table with paper, pens, and your monthly income and expenses. Use online budgeting tools or apps for a more engaging experience. Make sure to allocate funds for essentials, savings, and even a bit of fun.

This collaborative effort nurtures financial literacy in children, teaching them the importance of budgeting from an early age. Plus, it’s a great way to spark conversations about money and set collective spending goals!

– Tips: Designate a monthly budget review to track your progress and adjust as needed.

– Tricks: Involve kids in deciding the family’s ‘fun fund’ to boost their engagement.

Create a Family Budget Together

Editor’s Choice

Paycheck to Billionaire: Master Financial Freedom – Smart Investing & Co…

Amazon$19.99

Amazon$19.99

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.482. Use Expense Tracking Apps

Tracking your expenses can be a game changer in identifying where your money goes and how you can cut back.

Consider using apps like Mint or YNAB (You Need A Budget) to simplify the process. These tools categorize your spending automatically, so you can easily see where you can cut costs.

Make a habit of checking your app weekly to stay accountable and make informed decisions. You might find subscriptions or impulse purchases that can be eliminated! Remember, the more aware you are of your spending habits, the easier it becomes to save.

– Tips: Set reminders in the app to log your expenses, making it a fun ritual.

– Tricks: Use color coding in your app to visualize your spending categories effectively.

Use Expense Tracking Apps

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.483. Meal Planning and Batch Cooking

Food expenses can take a large chunk out of your budget, but meal planning and batch cooking can help keep those costs down.

Start by planning your meals for the week. Create a shopping list of needed ingredients and stick to it—this helps prevent impulse buys!

Batch cooking allows you to make large portions of meals, which you can freeze and reheat for busy days ahead. Not only does this save money, but it also reduces food waste.

– Tips: Get creative with leftovers to whip up new dishes for the second half of the week.

– Tricks: Use clear containers to store meals in the fridge, making it visually appealing and easy to grab during mealtime.

Meal Planning and Batch Cooking

Editor’s Choice

Qeirudu 10 Pack 8oz Freezer Storage Containers with Screw Lids, Leakproo…

Amazon$9.99

Amazon$9.99

Etekcity Food Kitchen Scale, Digital Grams and Ounces for Weight Loss, B…

Amazon$10.99

Amazon$10.99

Reusable Shopping Bags – Large, Foldable, Eco-Friendly, Water-Resistant,…

Amazon$19.99

Amazon$19.994. Embrace DIY Projects

Why buy when you can DIY? Engaging in do-it-yourself projects not only saves money but also fosters creativity and family bonding.

From home decor to gifts and even clothes, the possibilities are endless. Use common household items to create something new and exciting. For example, upcycling old furniture can add character to your home without breaking the bank.

Plus, it’s a fun way to spend time together as a family. Get the kids involved in crafting or building—this can also teach them valuable life skills.

– Tips: Look for inspiration on platforms like Pinterest for easy DIY ideas.

– Tricks: Create a family crafting day to make it a regular activity!

Why buy when you can DIY? Embrace creativity and save money—upcycling old items not only adds character but also brings families together. Let’s craft memorable moments!

Embrace DIY Projects

Editor’s Choice

ALL-IN-ONE Paint, Durable cabinet and furniture paint. Built in primer a…

Amazon$33.99

Amazon$33.99

Sundaymot Arts and Crafts Supplies for Kids, 2000+Pcs DIY Craft Kits, Ag…

Amazon$22.92

Amazon$22.92

Rolife DIY Miniature Greenhouse Kit, Tiny/Mini House Making Kit with Fur…

Amazon$33.59

Amazon$33.595. Shop Secondhand

Secondhand shopping is not only eco-friendly but a fantastic way to save money, especially for families.

Whether it’s clothing, toys, or furniture, thrift stores and online marketplaces often hold hidden gems at a fraction of retail prices. Before you head to the store, make a list of what you need to avoid unnecessary purchases.

Take your time to browse—sometimes the best finds come when you least expect them! Plus, it can be an adventure for the kids, allowing them to pick out special treasures.

– Tips: Inspect items carefully for wear and tear before purchasing.

– Tricks: Set a budget for thrift shopping trips to stay on track.

Shop Secondhand

Editor’s Choice

COCONIX Fabric & Carpet Repair Kit | Fix Tears, Holes, and Burns on Fabr…

Amazon$19.95

Amazon$19.95

VeraMia Canvas Grocery Bag 3pc XL Set with Real Pockets, Long Shoulder S…

Amazon$22.38

Amazon$22.38

NETANY Plastic Storage Baskets – 8 Pack, Gray, Durable, Easy to Use, Fle…

Amazon$21.99

Amazon$21.996. Use Coupons and Cashback Offers

Coupons and cashback offers can significantly reduce your grocery and shopping expenses.

Start by clipping coupons from newspapers, online resources, or apps. Many stores have loyalty programs that reward you for shopping with them, offering points or discounts on future purchases.

Combining coupons with sales can maximize your savings even further. Don’t forget about cashback apps like Ibotta, which give you money back for specific purchases.

– Tips: Organize your coupons in a binder for easy access while shopping.

– Tricks: Plan your shopping trips around sales when possible to maximize savings.

Use Coupons and Cashback Offers

Editor’s Choice

![30 Money Saving Hacks You’ll Want to Start Using 31 WISELIFE Reusable Grocery Bags [3 Pack],Large Grocery Tote Bag Water Res...](https://m.media-amazon.com/images/I/81lgubcsfnL._AC_UL320_.jpg)

WISELIFE Reusable Grocery Bags [3 Pack],Large Grocery Tote Bag Water Res…

Amazon$16.12

Amazon$16.127. Energy Efficiency at Home

Reducing your utility bills is a crucial yet often overlooked aspect of frugal living.

Simple changes like switching off lights when not in use, unplugging devices, or using LED bulbs can lead to noticeable savings. Conducting an energy audit can identify areas where energy is wasted.

Consider investing in energy-efficient appliances or insulating your home to save on heating and cooling costs in the long run. Every little change adds up to significant savings!

– Tips: Set a monthly challenge to reduce energy consumption and track your savings.

– Tricks: Use a smart thermostat to optimize your energy usage effortlessly.

Energy Efficiency at Home

Editor’s Choice

Amazon Basics Non-Dimmable LED Light Bulbs, Long Lasting, 9W, E26 Base, …

Amazon$15.79

Amazon$15.798. Focus on Free Family Activities

There are countless joys to be found in free activities that entertain everyone in the family.

Check your local community calendar for free events, including concerts, festivals, or movie nights in the park. Nature hikes and picnics can be both fun and refreshing, costing little to nothing.

Libraries often host free workshops or reading programs to keep kids engaged. Embracing these options can lead to wonderful family memories without the hefty price tag.

– Tips: Create a ‘fun calendar’ where family members can add free activities they come across.

– Tricks: Turn a simple outing into an adventure by making scavenger hunts or challenges while exploring.

Focus on Free Family Activities

Editor’s Choice

ZAZE Extra Large Picnic Outdoor Blanket, 80”x80” Waterproof Foldable B…

Amazon$28.49

Amazon$28.49

Battleship Classic Board Game, Strategy Game for Kids Ages 7 and Up, Fun…

Amazon$9.99

Amazon$9.99

Ello Cooper 22oz Stainless Steel Water Bottle with Straw and Carry Handl…

Amazon$11.91

Amazon$11.919. Set Savings Goals

Setting specific savings goals can motivate your family to save.

Whether it’s for a family vacation, a new car, or a fun activity, having a target helps everyone stay focused. Discuss your goals together and create a visual tracker, like a savings jar or chart, to mark progress.

Celebrate milestones along the way to keep the momentum going! This shared commitment creates a sense of unity in achieving the family’s financial aspirations.

– Tips: Involve children in setting smaller goals that lead up to the bigger ones.

– Tricks: Use different colored jars for each goal to make saving more exciting.

Set Savings Goals

Editor’s Choice

HOMiDEK Magnetic Whiteboard for Fridge – Reusable Dry Erase Chore Chart,…

Amazon$8.48

Amazon$8.48

100 Envelopes Money Saving Challenge, 100 Envelope Challenge Binder, Eas…

Amazon$7.99

Amazon$7.9910. Cancel Unused Subscriptions

Many of us forget about unused subscriptions that keep draining our accounts monthly.

Take a moment to review your bank statements and identify any subscriptions you no longer use or need. Often, streaming services, magazines, or gym memberships can be easily canceled.

This small action can free up funds for more meaningful expenses or savings. Don’t hesitate to ask the family if they still find value in shared subscriptions; it’s an excellent way to get everyone involved in your financial decisions.

– Tips: Create a subscription calendar to remind you of renewal dates.

– Tricks: Negotiate with service providers for better rates if you choose to stay with a service.

Cancel Unused Subscriptions

Editor’s Choice

NordVPN Basic, 10 Devices, 1-Year, Premium VPN Software, Digital Code

Amazon$24.99

Amazon$24.9911. Use Public Transportation

Switching from driving everywhere to utilizing public transportation can lead to massive savings on gas, parking, and maintenance.

Explore local bus or train routes; they often have monthly passes that can significantly discount travel costs. Not only does using public transport save you money, but it also helps reduce your carbon footprint!

Encourage family members to take turns using public transportation for errands or outings. It can be a unique and fun experience to explore the city together.

– Tips: Research available routes and schedules in advance to make your trips easy and enjoyable.

– Tricks: Introduce a family challenge to see who can save the most money using public transportation for a month.

[affiai keyword="30 Money Saving Hacks You’ll Want to Start Using 11. use public transportation" count="3" template="grid" price="20-10000"]12. Shop Seasonal Produce

Shopping for seasonal produce can significantly reduce grocery bills while providing the freshest and most flavorful options.

Visit local farmers’ markets or grocery stores to find fruits and vegetables that are in season. These options are often cheaper and taste better since they’re harvested at their peak.

Consider planning meals around seasonal produce to maximize value and minimize waste. Plus, it’s a great opportunity to teach children about the benefits of eating healthy, fresh foods!

– Tips: Join local community-supported agriculture (CSA) for fresh produce at better prices.

– Tricks: Create a seasonal meal calendar to make meal planning easier and more fun.

Shop Seasonal Produce

Editor’s Choice

Decorably 52 Sheets Pastel Undated Weekly Meal Planner and Grocery List …

Amazon$6.99

Amazon$6.99

12+1 Reusable Produce Bags Grocery Washable, Organic Cotton Mesh Produce…

Amazon$22.49

Amazon$22.4913. Reevaluate Insurance Policies

Insurance can be a significant monthly expenditure, so it’s worth taking the time to reevaluate your policies.

Shop around for better rates or consider bundling policies for discounts. Ensure you’re not over-insured or paying for unnecessary coverage.

Regularly reviewing your policies allows you to find potential savings without sacrificing security. Make it a family project to compare and discuss different options—this will enhance everyone’s understanding of financial products.

– Tips: Set reminders every six months to review your insurance policies.

– Tricks: Use online comparison tools to easily find the best deals.

[affiai keyword="30 Money Saving Hacks You’ll Want to Start Using 13. reevaluate insurance policies" count="3" template="grid" price="20-10000"]14. Plan Holiday Purchases Ahead

Holiday cheer shouldn’t break the bank! Planning holiday purchases well in advance can help you budget effectively and take advantage of sales.

Start setting aside a small amount each month specifically for holiday spending. Use the off-season to shop sales and take advantage of discounts before the holiday rush begins.

Also, consider handmade gifts, which can have a personal touch that family and friends will cherish. This thoughtful approach keeps holiday stress at bay while preserving your budget!

– Tips: Create a holiday gift list in advance and stick to it.

– Tricks: Use a designated holiday savings account to keep track of your budget.

[affiai keyword="30 Money Saving Hacks You’ll Want to Start Using 14. plan holiday purchases ahead" count="3" template="grid" price="20-10000"]15. Initiate a No-Spend Challenge

A no-spend challenge can be an exciting way for the family to engage in frugal living and discover creative solutions.

Choose a set period—whether it’s a week or a month—where you only spend on essentials like food and bills. During this time, focus on free activities, DIY projects, and exploring local resources.

This challenge encourages everyone to think critically about their spending habits and find joy in low-cost or no-cost options. You might be surprised at how much you can save during this time!

– Tips: Keep a journal to document your experiences and insights during the challenge.

– Tricks: Create a family reward for completing the challenge to celebrate your efforts.

Initiate a No-Spend Challenge

Editor’s Choice

Herd Mentality: Udderly Funny Family Board Game | Easy & Fun for Big Gro…

Amazon$19.98

Amazon$19.9816. Learn DIY Home Repairs

Home repairs can cause a significant dent in the family budget, but many tasks can be tackled with some basic knowledge and tools.

Try learning simple repairs through online tutorials, like fixing leaks or patching drywall. Not only does this save money, but it empowers family members to take charge of home maintenance.

Make a family project out of each repair task, allowing everyone to participate and learn new skills together. This can lead to increased confidence and a sense of accomplishment for everyone involved!

– Tips: Keep a checklist of common repairs around the house to use as a guide.

– Tricks: Create a family “handyman” day to tackle all small repairs in one go.

Empower your family with DIY home repairs! Not only do you save money, but you also build confidence and create lasting memories. Let every project be a lesson in skill and teamwork!

Learn DIY Home Repairs

Editor’s Choice

KingTool 325 Piece Home Repair Tool Kit, General Home/Auto Repair Tool S…

Amazon$85.48

Amazon$85.4817. Utilize Free Online Learning Resources

With technology at our fingertips, there’s a vast array of free resources available to learn about personal finance and frugal living.

Websites like Coursera, Khan Academy, or YouTube offer online courses and tutorials that can boost financial literacy for the whole family.

Create a weekly family learning night where you can explore new topics together. Not only does this help with budgeting and money management skills, but it also sparks important conversations around financial values.

– Tips: Choose relevant topics that will benefit your family’s financial goals.

– Tricks: Set goals for what you want to learn together and track progress to encourage commitment.

Utilize Free Online Learning Resources

Editor’s Choice

Mark Twain Financial Literacy WorkbooK, Personal Finance Book for Grades…

Amazon$10.99

Amazon$10.99

SKYDUE Budget Binder, Money Saving Binder with Zipper Envelopes, Cash En…

Amazon$7.18

Amazon$7.1818. Learn to Negotiate

Negotiation skills can lead to significant savings, whether you’re haggling for a better price at a flea market or discussing bills with service providers.

Practice negotiation techniques as a family, discussing examples of where you could apply them. This could be for internet packages, medical bills, or even your rent!

The more comfortable everyone gets with negotiating, the more empowered they will feel about their financial decisions. Teaching children this skill can also prepare them for future financial negotiations in adulthood.

– Tips: Role-play negotiation scenarios to make it fun and educational.

– Tricks: Research the average prices of services before attempting to negotiate.

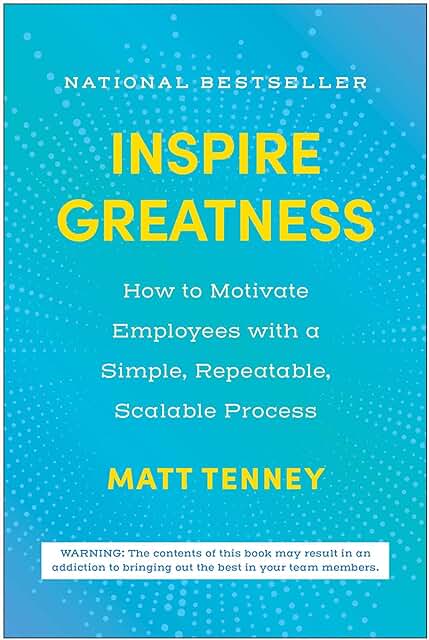

Learn to Negotiate

Editor’s Choice

MBM 60 Negotiation Coaching Cards – Sales Strategies, Persuasion Techn…

Amazon$25.19

Amazon$25.19

Inspire Greatness: How to Motivate Employees with a Simple, Repeatable, …

Amazon$25.63

Amazon$25.6319. Cutting the Cable Cord

Cable bills can add up quickly, but cutting the cord can lead to significant savings.

Explore alternatives like streaming services that often provide a wider range of content at a lower cost. Discuss which channels or shows are must-haves for the family and seek out subscription options that cater to those interests.

By switching to more affordable entertainment options, you can enjoy family movie nights without the hefty price tag. Empower your family to choose what they truly value in entertainment.

– Tips: Create a list of must-watch shows and compare streaming services to find the best fit.

– Tricks: Try a free trial of different services to see which ones your family enjoys the most.

Cutting the Cable Cord

Editor’s Choice

Amazon Fire TV Stick 4K Max streaming device, with AI-powered Fire TV Se…

Amazon$34.99

Amazon$34.99

Roku Ultra – Ultimate Streaming Player – 4K Streaming Device for TV with…

Amazon$68.99

Amazon$68.9920. Buy in Bulk Wisely

Buying in bulk can lead to great savings if done wisely.

Items with a long shelf life, like canned goods, grains, or cleaning supplies, can be much cheaper when purchased in larger quantities. Just make sure you have the storage space and that you will realistically use the items before they expire.

Involve the family in bulk buying trips and discuss which items would benefit your household the most. It’s a great way to encourage teamwork while saving money!

– Tips: Keep a running list of bulk-worthy items as you notice them.

– Tricks: Split bulk purchases with friends or family to save even more!

Buy in Bulk Wisely

Editor’s Choice

Lerine 10 Pack Dishwasher Safe Reusable Bags, Leakproof Reusable Freezer…

Amazon$9.37

Amazon$9.37

Flour Sugar Storage Containers (5.3L/4pk) Great Rice Canisters Sets For …

Amazon$20.85

Amazon$20.85

Lysol All Purpose Cleaner Spray, Multi-Purpose Disinfecting Spray, Kitch…

Amazon$3.97

Amazon$3.9721. Use a Flexible Spending Account (FSA)

If your employer offers a Flexible Spending Account (FSA), take advantage of it!

An FSA allows you to use pre-tax dollars for eligible health expenses, which can save your family money in the long run. Carefully plan your contributions based on anticipated healthcare expenses for the year.

Discuss with family members what expenses might qualify and keep track of those costs throughout the year. Utilizing an FSA can lead to significant savings and reduce the financial burden of healthcare costs!

– Tips: Review eligible expenses regularly to maximize your benefits.

– Tricks: Create reminders to use FSA funds before they expire.

Maximize your savings by using a Flexible Spending Account! By planning ahead, you can turn pre-tax dollars into healthcare savings, easing the financial burden for your family. It’s a smart way to save while staying healthy!

Use a Flexible Spending Account (FSA)

Editor’s Choice

Medical Expense Tracker: A Record Logbook for Keeping Track Your Medical…

Amazon$8.99

Amazon$8.99

Texas Instruments BA II Plus Financial Calculator, Black Medium

Amazon$37.49

Amazon$37.49

22. Attend Free Workshops and Classes

Many communities offer free workshops and classes on various topics, including finance and parenting.

Research local organizations or libraries that host events to learn new skills or enhance your financial literacy. Attend these sessions as a family, allowing everyone to take part in the learning experience. It’s a fantastic way to bond while saving money.

– Tips: Follow local community calendars online to stay updated on upcoming events.

– Tricks: Set a goal to attend a certain number of workshops each month to keep the learning momentum going.

Attend Free Workshops and Classes

Editor’s Choice

Paycheck to Billionaire: Master Financial Freedom – Smart Investing & Co…

Amazon$19.99

Amazon$19.99

Easy to Use Accounting Ledger Book – The Perfect Expense Tracker Noteboo…

Amazon$6.71

Amazon$6.7123. Create an Emergency Fund

Having an emergency fund is crucial for financial stability and can prevent the need to rely on credit when unexpected expenses arise.

Start small by setting aside a little money each month, gradually building a cushion that can cover 3-6 months of expenses. Involve the whole family in this goal to make it even more rewarding!

Teach children about the importance of saving for emergencies and celebrate milestones as your fund grows. This practice promotes financial literacy and prepares everyone for unexpected situations.

– Tips: Use a high-interest savings account for your emergency fund to maximize growth.

– Tricks: Automate transfers to your emergency fund to make saving easier.

Create an Emergency Fund

Editor’s Choice

100 Days Money Saving Challenge Coin Envelope Budgetstorage Book, Money …

Amazon$10.99

Amazon$10.99

Money Maze Puzzle Box (2 Pack) for Kids and Teens, Makes Cash Gift Givin…

Amazon$9.98

Amazon$9.98

Why Didn’t They Teach Me This in School?: 99 Personal Money Management P…

Amazon$14.80

Amazon$14.8024. Look for Free Entertainment Options

Entertainment doesn’t have to come with a price tag. Explore local parks, community events, or public libraries that offer free entertainment options.

Consider hosting a game night at home or organizing potluck dinners with friends instead of going out to eat. This not only saves money but also strengthens community ties!

Encourage your kids to bring their friends over for movie nights or outdoor activities, showcasing that fun can happen anywhere without spending money.

– Tips: Keep a list of free activities in your region to reference when planning family outings.

– Tricks: Create a family challenge to find the most creative free events happening each month.

Look for Free Entertainment Options

Editor’s Choice

GoSports Ladder Toss Indoor & Outdoor Game Set with 6 Soft Rubber Bolo B…

Amazon$34.49

Amazon$34.49

Do You Really Know Your Family? A Fun Family Game Filled with Conversati…

Amazon$15.85

Amazon$15.85

Wind Tour Family Outdoor Waterproof Durable Picnic Blankets with Carry S…

Amazon$9.99

Amazon$9.9925. Limit Dining Out

Dining out can quickly derail your budget, so it’s important to keep it in check.

Set a limit on how often you eat out each month, and make it a special occasion rather than a habit. You can still enjoy your favorite meals by recreating them at home! Involve the family in cooking together, turning meal prep into a fun bonding activity.

Help the kids learn about budgeting for meals by allocating a certain amount for each dining outing. Keeping a record of how much you spend on eating out can reinforce the value of home-cooked meals.

– Tips: Plan a monthly family night where everyone helps cook their favorite restaurant meal at home.

– Tricks: Create a dining-out budget by setting aside a certain amount from your monthly budget.

Limit Dining Out

Editor’s Choice

Rubbermaid Brilliance Food Storage Containers BPA Free Airtight Lids Ide…

Amazon$27.99

Amazon$27.99

Half Baked Harvest Super Simple: More Than 125 Recipes for Instant, Over…

Amazon$11.31

Amazon$11.31

Astercook Kitchen Utensils Set, 39 PCS Silicone Cooking Utensils Set wit…

Amazon$18.98

Amazon$18.9826. Reuse and Repurpose Items

Before throwing things away, think about how items can be reused or repurposed.

Old containers, fabric scraps, or even furniture can be transformed into something new with a bit of creativity. Encourage your kids to brainstorm ways to give old items a new life—this not only saves money but also promotes sustainability.

Organize a family craft day where everyone can work on their own repurposing projects! Not only does this save money, but it’s a fun way to spend time together.

– Tips: Keep a “reuse jar” for inspiration and ideas when you’re feeling crafty.

– Tricks: Research online for creative ways to repurpose common household items.

Reuse and Repurpose Items

Editor’s Choice

Sundaymot Arts and Crafts Supplies for Kids, 2000+Pcs DIY Craft Kits, Ag…

Amazon$22.92

Amazon$22.92

Bentgo Prep – 20-Piece 1-Compartment Reusable Meal Prep Containers with …

Amazon$12.53

Amazon$12.53

150Pcs 4″ x 4″ (10cm x 10cm) Cotton Craft Fabric Bundle Squares,Squares …

Amazon$9.99

Amazon$9.9927. Teach Kids About Money Early

Financial literacy starts at home, and teaching your kids about money from a young age can set them up for success.

Involve them in budgeting discussions, saving for their own goals, and even choosing how to spend their allowance. Use playful tools like games or apps designed to teach kids about money management.

Engaging in these practices together fosters open conversations about finances and encourages responsible money habits early on.

– Tips: Create a money jar system for saving, spending, and donating to teach real-life applications.

– Tricks: Share stories from your own financial journey to create relatable learning moments.

[affiai keyword="30 Money Saving Hacks You’ll Want to Start Using 27. teach kids about money early" count="3" template="grid" price="20-10000"]28. Use a Shopping List

Creating a shopping list before heading out can save you time and money at the store.

Plan your meals and write down what you need before going grocery shopping. This helps prevent impulse buys and ensures you only purchase what’s essential.

Involve the whole family in making the list—this can be a fun way to check what everyone wants for the week! Stick to the list as much as possible to keep spending under control.

– Tips: Use a mobile app to keep your shopping list organized and easily accessible.

– Tricks: Set a small budget for spontaneous treats to balance out the strict shopping list.

A well-planned shopping list can help you save up to 20% on your grocery bill. Involve the family to make it fun and ensure you buy only what you really need!

Use a Shopping List

Editor’s Choice

Decorably 52 Sheets Pastel Undated Weekly Meal Planner and Grocery List …

Amazon$6.99

Amazon$6.99

Foldable Shopping Bag, Waterproof Reusable Grocery Bag Holder,Tote Bags …

Amazon$3.99

Amazon$3.99

29. Automate Savings

Automating your savings can make it easier to build your savings without even thinking about it.

Set up automatic transfers from your checking account to your savings account each month. This ‘pay yourself first’ strategy ensures you’re saving consistently, without the temptation to spend that money.

Involve the whole family by discussing what you’re saving for and tracking progress together. This keeps everyone motivated while reinforcing good financial habits.

– Tips: Start with small amounts and gradually increase as your budget allows.

– Tricks: Use separate savings accounts for different goals to visualize your progress.

Automate Savings

Editor’s Choice

100 Days Money Saving Challenge Coin Envelope Budgetstorage Book, Money …

Amazon$10.99

Amazon$10.99

Goal Setting Fundrasing Thermometer – 48″x12″ Dry Erase Self-Adhesive Go…

Amazon$19.49

Amazon$19.4930. Assess and Adjust Regularly

Saving money isn’t a one-time task; it requires ongoing assessment and adjustment.

Set regular family meetings to review your budget, savings goals, and spending habits. Encourage open dialogue about financial challenges and successes to keep everyone engaged. This practice not only keeps your finances in check but also helps build financial literacy and confidence among family members.

Making adjustments as life changes helps ensure you stay on track with your financial goals, leading to long-term success.

– Tips: Use a whiteboard or chart to visualize your progress and keep everyone motivated.

– Tricks: Celebrate financial milestones together to reinforce the importance of good money management.

Assess and Adjust Regularly

Editor’s Choice

Busy Family Wall Calendar 2026, Monthly January–December 12″ x 14″

Amazon$16.99

Amazon$16.99

The Infographic Guide to Personal Finance: A Visual Reference for Everyt…

Amazon$9.99

Amazon$9.99

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48Conclusion

Implementing these money-saving hacks can significantly change your family’s financial outlook, paving the way for a more secure future.

From simple budgeting tips to fun DIY projects, each strategy encourages a thoughtful approach to spending and saving. Start small and celebrate your victories together—every little bit counts towards achieving financial freedom. Let’s prioritize our financial journeys and set a positive example for future generations!

Frequently Asked Questions

What are some easy money saving hacks for families to implement right away?

Starting small can lead to big savings! Begin by creating a family budget together to ensure everyone is on board with your financial goals. Using expense tracking apps like Mint or YNAB can help identify where your money goes each month. Also, consider meal planning and batch cooking to cut down on food costs—planning your meals for the week can make grocery shopping more efficient and economical!

How can I teach my kids about financial literacy using money saving hacks?

Teaching kids about money doesn’t have to be boring! Involve them in budgeting discussions and set up fun savings goals, like saving for a family outing or a new toy. You can also engage them in DIY projects or teach them to cook, which not only fosters creativity but also helps them understand the value of money and how to make cost-effective choices. Starting early can set them up for a financially savvy future!

Are there any specific budgeting tips that can help families save more money?

Absolutely! One effective budgeting tip is to set specific savings goals as a family. This can motivate everyone to participate in saving. Additionally, regularly reassess your budget and spending habits—hold family meetings to discuss any adjustments needed. Don’t forget to take advantage of coupons and cashback offers to reduce expenses on everyday purchases. These little efforts can create significant savings over time!

What are some cost-cutting techniques that can help reduce monthly expenses?

There are plenty of smart cost-cutting techniques to explore! Start by canceling unused subscriptions that drain your wallet each month. Consider switching to public transportation to save on gas and parking. You can also shop for seasonal produce to lower grocery bills. Lastly, initiating a No-Spend Challenge can be a fun family activity that encourages everyone to find creative ways to enjoy life without spending money!

How can I create an emergency fund while living on a tight budget?

Building an emergency fund is crucial, even on a tight budget. Start small—set aside a little money each month, even if it’s just $10. Automate your savings by setting up a transfer from your checking account to your savings account each month. This way, you’re paying yourself first! Having an emergency fund will give you peace of mind and help avoid reliance on credit during unexpected situations.

Related Topics

money saving hacks

frugal living

budgeting tips

expense tracking

family activities

DIY projects

cost-cutting techniques

financial literacy

seasonal shopping

meal planning

no-spend challenge

savings goals