Saving money can be both fun and rewarding, especially when you get creative with your strategies! Money saving jars are not just a trend; they can turn mundane saving habits into something exciting.

From colorful jars that brighten up your space to clever themes that make saving a game, these ideas will help you stay motivated and reach your financial goals quicker.

With each jar representing a specific purpose or goal, you’ll feel more connected to your savings journey, seeing your efforts turn into tangible results. Let’s dive into these innovative money-saving jar ideas that will help you grow your savings fast!

1. The ‘Rainy Day’ Jar

Every smart saver knows the importance of having a ‘rainy day’ fund. This jar symbolizes financial security, helping you set aside money for unexpected expenses or emergencies.

Choose a jar that’s sturdy and visually appealing, perhaps with a lid to keep the contents secure. Label it clearly, but don’t include specific amounts. Each time you contribute, think of it as a shield against future financial storms.

for success:

– Start Small: Initially, add whatever you can—every little bit counts.

– Set a Goal: Maybe aim for three months of expenses to begin with.

– Keep it Visible: Display it in a prominent place to remind yourself of your goal.

Establishing a rainy day jar not only helps you save but also fosters a sense of peace knowing you’re prepared for life’s little surprises.

A ‘Rainy Day’ jar isn’t just a savings tool; it’s your financial umbrella! Start small, and watch how each contribution shields you from unexpected storms. Remember, every little bit counts!

The ‘Rainy Day’ Jar

Editor’s Choice

SUPVAN T50M Pro Bluetooth Label Maker Machine with 3 Tapes, Wide Waterpr…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

2. The ‘Vacation Fund’ Jar

Who doesn’t dream of a vacation? This jar is perfect for those wanderlust moments when you need a financial boost to make your travel dreams a reality.

Decorate your jar with travel-themed stickers or drawings, representing places you want to visit. This will keep your goals front and center and motivate you to add to it regularly.

How to maximize your vacation savings:

– Create a travel budget: Determine how much you’ll need for your trip, and aim to fill your jar by that amount.

– Set weekly targets: Contribute a set amount each week to keep your momentum going.

– Use bonuses: Consider funneling any extra cash like tax refunds or work bonuses straight into your vacation fund.

Every time you toss in some cash, imagine the sandy beaches or mountain trails waiting for you!

The ‘Vacation Fund’ Jar

Editor’s Choice

Clever Fox Travel Journal – Vacation & Trip Organizer with Budget Plan…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

200PCS Tropical Summer Stickers for Water Bottle, Vinyl Waterproof Aesth…

3. The ‘New Gadget’ Jar

Got your eye on the latest tech gadget? Instead of letting impulse buys drain your wallet, create a designated jar just for this purpose!

This jar helps you save specifically for that shiny new item you’ve been coveting, like a smartphone or gaming console. By saving systematically, you’ll appreciate your purchase even more.

Saving strategies you can use:

– Research costs: Know how much the gadget costs and set a realistic saving timeline.

– Reward yourself: Each time you reach a milestone, give yourself a small treat, like a coffee or a movie night.

– Stay motivated: Place a picture of the gadget on the jar to remind you of your goal.

Creating a gadget jar turns the wait into anticipation, and when you finally get that device, it feels like twice the reward!

The ‘New Gadget’ Jar

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

hizgo Kids Adults Piggy Bank, Small Clear Piggy Bank for Kids Adults Mus…

4. The ‘Holiday Fund’ Jar

The holiday season can be financially draining, but with a holiday fund jar, you can spread the costs throughout the year. This jar helps you prepare for gifts, decorations, and festive events without breaking the bank.

Choose a festive jar, perhaps with holiday-themed decorations. Make it a family project by letting everyone contribute and take turns deciding how the money will be spent.

for holiday savings:

– Set a timeline: Start as early as possible, ideally right after the holiday season ends to maximize your savings.

– Make it a family affair: Get the whole family involved to make it more enjoyable.

– Plan your spending: Have an idea of what you’ll spend on each person or event to avoid overspending.

With each dollar saved, you’ll be one step closer to a stress-free holiday season.

The ‘Holiday Fund’ Jar

Editor’s Choice

SKYDUE Budget Binder, Money Saving Binder with Zipper Envelopes, Cash En…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

5. The ‘Emergency Fund’ Jar

Life can throw unexpected challenges your way, and having an emergency fund can keep you afloat during tough times. Dedicate a jar specifically for emergencies to ensure you’re ready for any curveball.

Use a sturdy, opaque jar to keep your savings secure and out of sight—out of mind! This way, you’re less tempted to dip into it.

Effective saving strategies include:

– Define emergencies: Only use this jar for genuine emergencies, like car repairs or medical expenses.

– Track your progress: Regularly check how much you have saved to encourage yourself.

– Automate savings: If possible, set up a direct transfer to this jar each payday.

Establishing an emergency fund not only offers peace of mind but also fosters financial responsibility.

An emergency fund jar isn’t just about savings; it’s your safety net for life’s surprises. Keep it secure and only dip in for genuine emergencies—you’ll thank yourself later!

6. The ‘Home Improvement’ Jar

Whether it’s a new coat of paint or a complete renovation, a home improvement jar can help finance those projects you’ve been dreaming about.

Start by outlining the changes you’d like to make around your home. Decorate your jar with paint swatches or mini home decor items to get inspired.

Home improvement savings tips:

– Make a plan: Prioritize the most important renovations or improvements so your money is spent wisely.

– Shop smart: Look for sales, discounts, or clearance items to make your money stretch further.

– Explore DIY options: Opt for projects you can do yourself to save even more money.

With consistent saving, your home will not only look refreshed but will also feel like a reflection of your hard work!

Transform your living space, one coin at a time! Your dreams of a beautiful home can start with a simple money saving jar dedicated to home improvements.

7. The ‘Fitness Goals’ Jar

Saving doesn’t always have to be about money; it can motivate you towards your health and fitness expectations too! Designate a jar for fitness-related expenses, like gym memberships or workout gear.

Each time you save up for something that enhances your fitness journey, like a new yoga mat or personal training session, your motivation will increase.

to stay on track:

– Create a fitness plan: Outline what fitness goals you want to achieve and how much you might need to spend.

– Reward yourself: Use milestones, like completing a workout challenge, to treat yourself with some cash into this jar.

– Visualize your goals: Attach a picture of your fitness idols or goals on the jar to inspire you to save.

This jar won’t just grow your savings; it will also help foster a healthier lifestyle!

8. The ‘Kids’ Education’ Jar

Investing in your child’s education is one of the best gifts you can give. A dedicated jar for educational expenses ensures you’re prepared for school supplies, classes, and future tuition.

Decorate the jar with drawings or stickers representing subjects your child is passionate about, making savings feel more personal.

How to build this fund:

– Set a target amount: Determine how much you’ll need each year for educational needs.

– Break it down: Figure out how much you need to save each month to reach that goal.

– Involve your kids: Teach your children about saving by having them contribute their allowances to the jar.

A dedicated education fund will not only empower your child but also encourage a lifelong love of learning!

9. The ‘Pet Care’ Jar

If you have furry friends, an animal care jar is essential for saving up for vet visits, food, and toys. It’s a fun way to show your pets how much you care by ensuring they have everything they need!

Choose a whimsical jar that reflects your pet’s personality and decorate it with pet images or paw prints.

Savvy pet-saving tips:

– Estimate yearly costs: Calculate how much you typically spend on your pets each year, including unexpected expenses like emergency vet visits.

– Set aside monthly contributions: Allocate a certain amount of your budget each month to build the jar.

– Look for deals: Use coupons and sales to reduce regular pet costs and funnel the savings into this jar.

A pet care jar ensures that your beloved companions are always taken care of without financial stress.

10. The ‘Charity’ Jar

Giving back is a beautiful way to make a difference. Create a charity jar to set aside money for causes you’re passionate about.

This jar can be a personal reminder to help those in need while strengthening your financial habits.

Charity jar best practices:

– Choose your causes: Decide which organizations or projects you want to support and set goals for each.

– Involve your community: Encourage friends and family to contribute or match your savings.

– Share your progress: Regularly report how much you’ve saved and the impact it can make, which can motivate you and others.

Watching this jar grow can not only boost your finances but also your spirit as you contribute to something greater than yourself.

When you give, you grow! Create a charity jar to not only boost your savings but also make a meaningful impact—because every little bit counts towards changing lives.

The ‘Charity’ Jar

Editor’s Choice

100 Days Money Saving Challenge Coin Envelope Budgetstorage Book, Mini 1…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

Wooden Cash Money Saving Box,Piggy Bank for Kids & Adults,10000 Savings …

11. The ‘New Wardrobe’ Jar

Refreshing your wardrobe can be expensive, but with a dedicated jar, you can save without guilt! A ‘new wardrobe’ jar allows you to plan for those must-have pieces without overspending.

Choose a stylish jar and fill it with money intended solely for clothing and accessories. This jar helps you avoid impulse purchases by giving you a clear saving goal.

Wardrobe saving strategies:

– Set a budget: Know how much you’ll need for seasonal clothing and aim for that amount.

– Analyze your closet: Before shopping, review what you currently own to avoid unnecessary duplicates.

– Shop sales: Funnel money into the jar during sales periods to grab those pieces you’ve had your eye on.

A dedicated wardrobe jar helps you make smart fashion choices while keeping your finances on track!

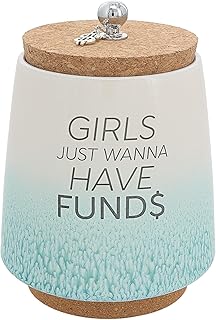

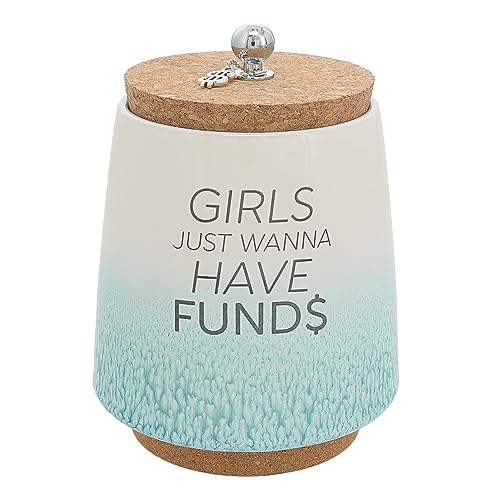

The ‘New Wardrobe’ Jar

Editor’s Choice

Pavilion ‘Girls Just Wanna Have Funds’ 6.5-Inch Ombre Teal Money Ceramic…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

12. The ‘Hobby Fund’ Jar

Whether you’re into painting, photography, or gardening, a ‘hobby fund’ jar can help finance your creative passions. This jar is a fantastic way to support your interests and ensure you have the necessary supplies.

Decorate your jar to reflect your hobbies, maybe with paint splatters or stickers. This adds a personal touch and keeps you motivated!

Hobby saving tips:

– Identify your needs: Know what materials or courses you require and set a savings goal.

– Turn saving into a challenge: Create mini-goals within your hobby, like earning enough for a class or new tools.

– Share progress: Connect with fellow hobbyists and share your savings journey for encouragement.

With a hobby fund jar, you can dive into your passions guilt-free, enjoying your leisure time without financial stress.

The ‘Hobby Fund’ Jar

Editor’s Choice

YAUNGEL Gardening Tools – 10 Pcs Garden Tool Set Heavy Duty Stainless St…

ESRICH 26 PCS Acrylic Paint Set with 12 Colors Acrylic Paints (12ml, 0.4…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

13. The ‘Date Night’ Jar

Nurturing relationships can require investment—financially and emotionally. With a ‘date night’ jar, you can plan for fun-filled evenings without breaking the bank.

Decide on how much you want to save and start contributing towards exciting outings, whether it’s a fancy dinner or movie night.

Date night saving strategies:

– Set a monthly goal: Decide how much you need for your ideal date night and save accordingly.

– Mix it up: Save for both low-cost and extravagant experiences to keep things fresh.

– Include creativity: Use DIY date ideas to save even more!

Each contribution to this jar is an investment in your relationship, turning ordinary dates into cherished memories.

The ‘Date Night’ Jar

Editor’s Choice

32 – Scratch-Off Savings Challenge Cards | 2.5 x 3.5 inch Savings Cards …

Romantic & Fun Scratch Off Date Night Ideas Card Game – Perfect Couples …

Locking Digital Coin Bank Savings Jar – Pennies Nickles Dimes Quarter Ha…

14. The ‘Seasonal Activities’ Jar

With the changing seasons come new adventures! A ‘seasonal activities’ jar allows you to save for fun seasonal events, like pumpkin patches in autumn, summer fairs, or winter skiing trips.

Choose a jar that reflects the season and fill it with money each time you want to enjoy specific activities. This way, you’re always ready for family fun!

for success:

– Plan ahead: List activities you’d love to do each season and budget for them.

– Share with family: Encourage family members to contribute, making it a group effort.

– Look for discounts: Find local deals to stretch your savings even further.

With this jar, you can create lasting memories with family while staying financially savvy!

The ‘Seasonal Activities’ Jar

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

NiHome Acrylic Magnetic to Do List Planning Board with Sliders & Desktop…

Foreside Home & Garden FDAD06116 Adventure Wooden Bank

15. The ‘Learning Fund’ Jar

Learning is a lifelong journey, and a ‘learning fund’ jar encourages personal development through courses, books, or seminars.

Whether you want to upskill or simply explore new interests, this jar can help you invest in yourself.

Learning jar tips:

– Define your learning goals: Identify areas you want to grow in and budget for them.

– Research opportunities: Look for free or discounted courses to maximize your savings.

– Celebrate achievements: When you complete a course or read a book, celebrate by adding a little more to the jar as a reward.

Your learning fund jar will not only boost your knowledge but also inspire continuous growth and self-discovery.

The ‘Learning Fund’ Jar

Editor’s Choice

My First Library: Boxset of 10 Board Books for Kids

16. The ‘Grocery Savings’ Jar

Grocery shopping can take a big chunk out of your budget, but a ‘grocery savings’ jar helps you save specifically for food expenses. This strategy allows you to cut costs while ensuring you always have enough for your meals.

Choose a jar that matches your kitchen decor, and fill it with cash intended for your grocery runs.

Grocery saving tips include:

– Set a monthly budget: Determine how much you need for groceries each month and save toward that goal.

– Use deals and coupons: Funnel any savings from sales back into the jar to help it grow.

– Plan meals: Creating meal plans can help you stick to your grocery budget.

With a grocery savings jar, you’ll be more mindful of your spending and make healthier food choices!

17. The ‘Birthday Fund’ Jar

If you have a busy social calendar, a ‘birthday fund’ jar can help you manage the costs of gifts and celebrations. This jar enables you to partake in your loved ones’ special days without overspending.

Opt for a festive jar adorned with colorful ribbons or balloons, making it visually exciting!

Birthday jar strategies include:

– Track birthdays: Keep a list of important dates to plan well ahead.

– Budget for gifts: Decide how much you want to allocate to each person and adjust your savings accordingly.

– Contribute regularly: Add a bit each month to ensure you’re prepared for the upcoming birthday celebrations.

A birthday fund jar takes the stress out of financial planning, allowing you to focus on making beautiful memories!

The ‘Birthday Fund’ Jar

Editor’s Choice

Larcenciel Gift Wrapping Paper Set, 6 Sheets Metallic Black Gold Foil Wr…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Foreside Home & Garden FDAD06116 Adventure Wooden Bank

18. The ‘Car Maintenance’ Jar

Car repairs can hit hard, but a dedicated ‘car maintenance’ jar can help you stay ahead of any expenses. This jar ensures you’re financially prepared for routine services or unexpected issues.

Choose a robust jar and keep it visible in your car or garage to remind you of your goals.

Maintenance jar tips:

– Estimate costs: Look into your car’s service needs and set a savings goal based on those estimates.

– Track your spending: Keep receipts and track costs to encourage continued saving.

– Prioritize maintenance: Regularly check your car to avoid bigger repairs down the road.

With a car maintenance jar, you’ll drive with peace of mind, knowing you have funds set aside for your vehicle’s needs.

The ‘Car Maintenance’ Jar

Editor’s Choice

NICOOTHBudget Binder Cash Envelopes A6 Money Saving Binder with Zipper e…

19. The ‘Tech Upgrade’ Jar

Tech is constantly evolving, and a ‘tech upgrade’ jar can help you save for those essential updates. Whether it’s a new laptop or upgrading your software, this jar ensures you’re always up-to-date without straining your budget.

Opt for a sleek jar that reflects the tech theme.

Tech savings strategies:

– Research the costs: Know the prices for the tech you want and plan your savings accordingly.

– Timing is everything: Look for sales events or new model releases to get the best deals.

– Regularly contribute: Make it a habit to add to the jar each time you save money on tech purchases.

A tech upgrade jar not only keeps you current but also enhances your productivity and enjoyment.

20. The ‘Self-Care’ Jar

In today’s busy world, it’s easy to neglect self-care, but a dedicated ‘self-care’ jar can help prioritize your well-being. This jar is perfect for funding spa days, massages, or even a relaxing bubble bath at home.

Choose a calming jar, perhaps decorated with soothing colors or scents.

Self-care savings tips include:

– Identify what you need: Know what self-care activities make you feel happy and relaxed.

– Make it a regular activity: Add money each pay period so that you can treat yourself without guilt.

– Try low-cost options: Incorporate free or low-cost self-care practices to maximize your budget.

Your self-care jar is a gentle reminder that taking care of yourself is just as important as saving!

The ‘Self-Care’ Jar

Editor’s Choice

HIQILI Women Fragrance Oil 6x10ml, Essential Oils for Candle Scents Soap…

And Per Se Wellness Journal, 91 Days Self Care Journal For Women & Men, …

Bath and Body Gift Basket Set for Women – Coconut Vanilla Christmas Gift…

21. The ‘Goal Achievement’ Jar

Celebrating your goals is essential, and a ‘goal achievement’ jar adds a fun twist to your financial journey. This jar can be for anything—from saving towards an experience to achieving personal milestones.

Add colorful decorations to your jar that represent your aspirations, making it visually motivating.

Goal-setting tips:

– Define your goals: Set clear and specific goals, whether short-term or long-term.

– Celebrate milestones: Each time you achieve a goal, reward yourself by adding a little extra to the jar.

– Stay inspired: Keep positive affirmations or images related to your goals on the jar for daily motivation.

With a goal achievement jar, every dollar saved feels like a celebration in itself!

The ‘Goal Achievement’ Jar

Editor’s Choice

300PCS Motivational Sticker, Inspirational Words Stickers for Teens Adul…

Goal Planning Notepad – A5 Goal Setting Journal For Project Action Plan,…

22. The ‘Home Decor’ Jar

If you enjoy decorating your space, a ‘home decor’ jar can help fund new furniture, wall art, or other aesthetic additions. This jar allows you to create a beautiful home environment without overspending.

Pick a stylish jar to match your decor style, filling it with cash for your decorating ambitions.

Home decor saving strategies:

– Set a decorating budget: Determine how much you’ll need for your decor projects.

– Prioritize pieces: Identify which items are necessary to achieve your vision.

– Use sales effectively: Look for discounts and sales to maximize your savings.

A home decor jar ensures your space feels inviting and reflects your personality, all while staying within budget!

23. The ‘Subscription Services’ Jar

In a world full of subscriptions, a dedicated ‘subscription services’ jar can help you manage expenses related to streaming services, magazines, and more. This jar makes it easier to be intentional with your subscriptions rather than letting them pile up.

Select a jar that matches your lifestyle and keep it filled to cover your subscriptions.

Subscription-saving tips include:

– Evaluate your needs: Periodically review which subscriptions you use and determine your budget.

– Set aside money monthly: Allocate a certain amount each month to the jar, ensuring you have the funds when it’s time to renew.

– Cancel unused services: Save even more by cancelling subscriptions you don’t use.

With a subscription services jar, you’ll have more control over your spending while enjoying your favorite pastimes!

24. The ‘Outdoor Adventure’ Jar

For those who love the great outdoors, an ‘outdoor adventure’ jar can help you save for camping trips, hiking gear, or other activities in nature. This jar enables you to connect with nature while managing expenses.

Choose a jar that resonates with your adventurous spirit and fill it with the funds you need for your next outdoor escapade.

Adventure saving strategies:

– Plan your outings: Determine the outdoor activities you want to pursue and budget accordingly.

– Seek group discounts: Organize trips with friends to save on costs through group rates.

– DIY experiences: Opt for free or low-cost outdoor activities to maximize experiences.

An outdoor adventure jar means more time exploring nature and less time worrying about finances!

25. The ‘Seasonal Clothing’ Jar

Every season brings the need for new clothing, and a ‘seasonal clothing’ jar lets you prepare without the last-minute shopping frenzy. A dedicated jar for seasonal apparel ensures you have funds ready for your wardrobe updates.

Select a jar that reflects seasonal themes and fill it with cash for your clothing needs.

Clothing jar tips include:

– Set seasonal budgets: Plan how much you need for each season to avoid surprises.

– Shop sales: Funnel savings from sales into your jar and maximize your wardrobe budget.

– Keep it fun: Make seasonal shopping enjoyable by treating yourself with new additions!

With a seasonal clothing jar, you’ll always be ready for transitions in style while managing costs!

26. The ‘Fitness Equipment’ Jar

If you’re into fitness, a ‘fitness equipment’ jar can help fund your workout tools, from weights to yoga mats. This jar empowers you to invest in your health without financial strain.

Opt for a fitness-themed jar and fill it with cash for purchasing equipment.

Fitness saving strategies:

– Research costs: Know what fitness items you want and how much they cost.

– Set goals: Aim for a specific equipment purchase each quarter to keep you motivated.

– Explore second-hand options: Look for gently used equipment to save even more money.

With a fitness equipment jar, you’ll enhance your workouts and embrace a healthier lifestyle!

The ‘Fitness Equipment’ Jar

Editor’s Choice

Fit Simplify Resistance Loop Exercise Bands with Instruction Guide and C…

Yoga Mat Non Slip, Eco Friendly Fitness Exercise Mat with Carrying Strap…

Adjustable Dumbbells Set of 2,Free Weights Dumbbells Set,Adjustable …

27. The ‘Celebration’ Jar

Life is full of milestones worth celebrating, from anniversaries to promotions. A ‘celebration’ jar is perfect for saving up funds dedicated to these joyous events.

Choose a jar that feels festive, filling it with cash to fund your celebrations.

Celebration jar tips:

– Define your celebrations: List out any special dates you want to celebrate and how much you’ll need.

– Invite friends: Encourage friends to contribute for group celebrations, making it more fun!

– Track progress: Keep track of savings to stay motivated.

Celebrating life’s milestones becomes more meaningful with a dedicated jar!

The ‘Celebration’ Jar

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

NICOOTHBudget Binder Cash Envelopes A6 Money Saving Binder with Zipper e…

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

28. The ‘Creative Projects’ Jar

If you love arts and crafts, a ‘creative projects’ jar can help finance your next big ideas. This dedicated jar keeps your creative side alive without overwhelming your budget.

Pick a jar that sparks joy and fill it with cash specifically for arts and crafts supplies.

Creative project-saving strategies include:

– Outline projects: Write down fun projects you want to tackle and estimate costs.

– Plan for sales: Look for discounts on craft supplies to maximize your savings.

– Get friends involved: Collaborate with friends on projects to share costs and ideas.

With a creative projects jar, you can let your imagination run wild while staying within your financial means!

The ‘Creative Projects’ Jar

Editor’s Choice

Pink Tool Box for Women – Sewing, Art & Craft Organizer Small & Large Pl…

iLAND Crafts For Adults Women Teen Girls Ocean Beach UV Resin Kit for be…

Prinz Explore Dream Discover Money Savings Piggy Bank for Adults, Kids S…

29. The ‘Social Events’ Jar

Whether it’s concerts, theater, or community events, a ‘social events’ jar ensures you can enjoy activities without straining your finances. This jar allows you to plan your entertainment while keeping a budget.

Select a jar that fits your personality, filling it with cash for social outings.

Social event-saving tips:

– Research events: Keep an eye on local listings for fun activities and estimate how much you’ll need for tickets.

– Group outings: Coordinate with friends to save money by buying tickets in bulk.

– Limit spending: Challenge yourself to save a certain percentage of your income specifically for social events.

A social events jar turns entertainment into a regular part of your budget, ensuring you stay connected while saving money!

The ‘Social Events’ Jar

Editor’s Choice

Hicocool Clear Piggy Bank, Acrylic Piggy Bank for Adults Must Break to O…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

30. The ‘Mindfulness’ Jar

In today’s fast-paced world, a ‘mindfulness’ jar can help you focus on self-care and personal growth. This jar is perfect for funding yoga classes, meditation retreats, or relaxation tools.

Choose a calming jar and fill it with cash for mindfulness activities.

Mindfulness jar strategies include:

– Identify practices: Know what mindfulness activities you want to pursue and budget for them.

– Prioritize self-care: Allocate money towards activities that benefit your mental well-being.

– Engage with the community: Join group classes or workshops to share costs and experiences.

A mindfulness jar fosters personal growth while ensuring that you invest in your mental health!

The ‘Mindfulness’ Jar

Editor’s Choice

Hihealer Meditation Cushion, Traditional Tibetan Meditation Pillow Velve…

Gaiam Essentials 2/5″ Thick (10mm) Yoga & Pilates, Fitness & Exercise Ma…

ASAKUKI Essential Oil Diffuser 500ml, Ultrasonic Aromatherapy Humidifier…

Conclusion

Money saving jars are not just a practical way to save; they’re also a creative outlet that can make your saving journey enjoyable. By choosing jars for specific goals, you can keep track of different savings while making it a fun family activity.

Now that you have over 30 unique ideas, it’s time to take action! Consider setting up your jars and watch your savings grow in delightful ways.

What goals will you start saving for today?

Frequently Asked Questions

What Are Money Saving Jars and How Do They Work?

Money saving jars are a fun and creative way to manage your savings by designating specific jars for different financial goals. Each jar represents a unique purpose, like a ‘Vacation Fund’ or ‘Emergency Fund.’

By physically separating your savings into these jars, you can visually track your progress and stay motivated to reach your financial goals!

How Can I Stay Motivated to Use Money Saving Jars?

Staying motivated with money saving jars can be as simple as decorating them to reflect their purpose! For example, use travel-themed stickers for your ‘Vacation Fund’ jar. Additionally, set small milestones for each jar and celebrate when you reach them. This makes saving feel rewarding and keeps you engaged in your financial journey.

Remember, every penny saved brings you closer to your dream!

What Types of Goals Can I Set with Money Saving Jars?

You can set a variety of goals with money saving jars, such as saving for a vacation, holiday expenses, or even home improvements. Each jar can be dedicated to a specific purpose, like a ‘Fitness Goals’ jar for workout gear or a ‘Pet Care’ jar for your furry friend’s needs.

This tailored approach helps you focus your savings efforts and make progress towards multiple objectives simultaneously!

Can Money Saving Jars Help Me Budget Better?

Absolutely! Money saving jars can be an excellent budgeting tool. By allocating specific amounts to each jar based on your financial goals, you can manage your spending more effectively. This strategy encourages you to prioritize your expenses and helps you avoid overspending in one area while neglecting savings in another.

Think of it as a visual reminder of your financial priorities!

What If I Don’t Have Physical Jars—Can I Still Use This Concept?

Definitely! If you don’t have physical jars, you can replicate the concept digitally or with envelopes. Use apps or spreadsheets to track your savings, or assign different envelopes for cash savings. The key is to maintain that clear separation of funds for each goal, which will keep you organized and motivated, no matter the medium you choose to use!

Related Topics

money saving jars

financial tips

savings strategies

budgeting methods

creative savings

rainy day fund

vacation savings

emergency fund

goal achievement

hobby funding

beginner friendly

seasonal savings