We all wish we could save more money, but figuring out where to start can be a real headache.

These 27 brilliant money saving tips will not only help you track your expenses but also transform your budgeting habits into something that feels manageable and even fun.

From small everyday changes to big financial decisions, each tip is designed to empower you to take control of your finances and boost your savings. Get ready to revolutionize your relationship with money!

1. Set Clear Financial Goals

Dreaming of a new car or a vacation? Start with clear financial goals!

Identify what you want to achieve, whether it’s saving for a rainy day or a major purchase. Writing these goals down can make them feel more tangible, making it easier to plan your budget around them.

Break down your goals into smaller, actionable tasks and set deadlines to keep yourself accountable. For instance, if you’re saving for a trip, calculate how much you need to save each month to reach your goal by your target date.

Not only does this clarity help in budgeting, but it also motivates you to stay on track. Plus, watching your savings grow is a great feeling!

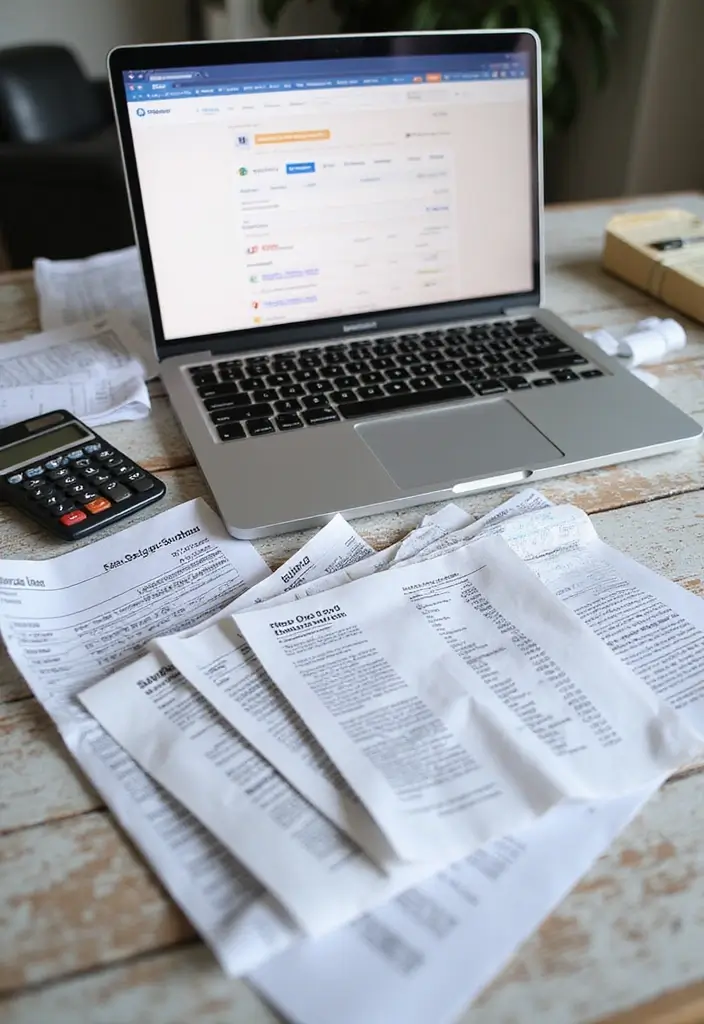

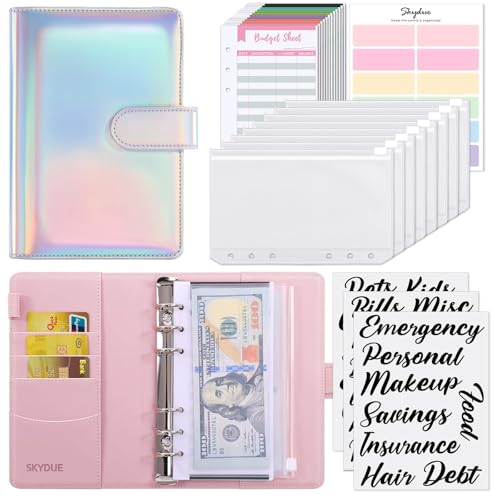

2. Track Your Expenses

Know where your money goes! Tracking your expenses is essential to understanding your spending habits.

Use apps or a simple spreadsheet to categorize your spending—like groceries, dining out, and entertainment. Seeing your spending visually can be a real eye-opener. You might find that those morning lattes really add up!

Once you know your spending patterns, you can start making adjustments. Set limits on categories where you overspend and reallocate those funds towards your savings goals. The key is consistency; check in weekly to stay updated on your finances.

3. Use the 50/30/20 Rule

Simplify your budgeting with the 50/30/20 rule!

This method divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings. It’s a straightforward way to manage your money without making it overly complicated.

By sticking to these percentages, you can ensure that you’re covering your essentials while also setting aside money for the future. If you find it challenging to allocate your funds, consider adjusting your want percentage until it feels comfortable. The 20% savings can go into an emergency fund or retirement account, paving your way to financial security.

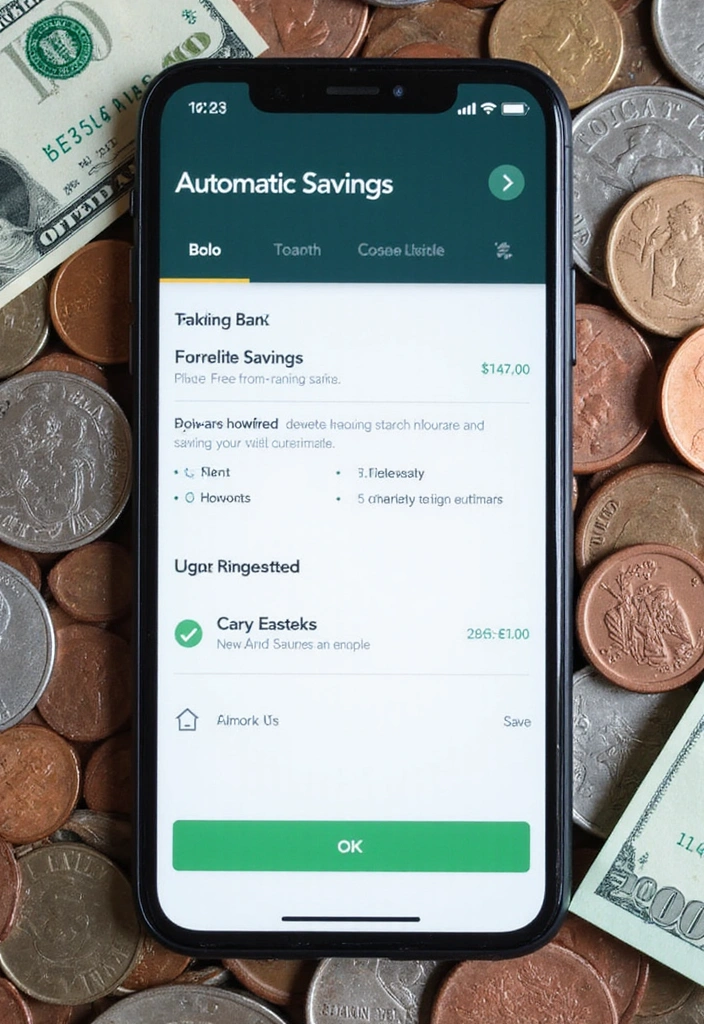

4. Automate Your Savings

Make saving effortless by automating your savings!

Set up an automatic transfer from your checking account to your savings account each month. This way, you save without even thinking about it. Start small—like $50 a month—and increase it as you get comfortable.

Many banks offer tools that allow you to schedule these transfers right after payday, which means you get to enjoy your money with less guilt, knowing that your savings are taken care of. Plus, consider using apps that round up your purchases and save the change, making saving even easier. It’s like free money!

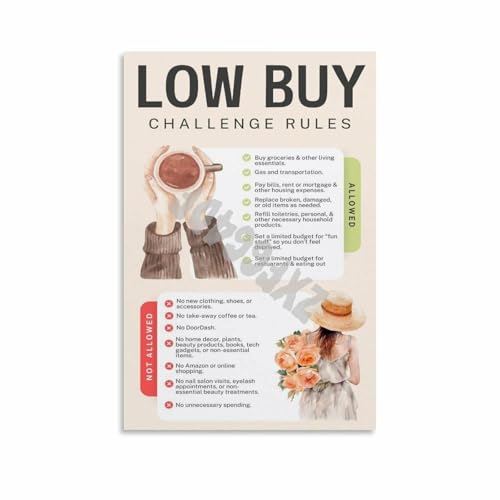

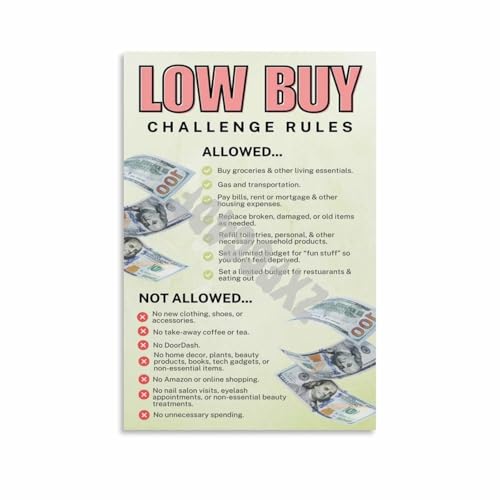

5. Create a No-Spend Challenge

Challenge yourself with a no-spend month!

This is a great way to reset your spending habits and refocus on your goals. Decide on a period—be it a week, a month, or even a few days—where you only spend on essentials.

Use this time to get creative and explore free activities like hiking or visiting a museum on free admission days. You may be surprised by how much you save when you eliminate non-essential purchases. After the challenge, reflect on what you learned. Did you discover new hobbies or realize you don’t need to spend as much as you thought?

6. Use Coupons and Cash Back Offers

Who doesn’t love a discount? Start using coupons to save on your everyday purchases.

Check out apps and websites that offer cash back on groceries and other essentials. Even small savings can add up over time! Plan your shopping trips around sales and combine coupons to maximize your savings.

Consider using loyalty programs at your favorite stores to gain rewards and discounts. Every cent counts, and with these strategies, you’ll be surprised at how much you can save each month!

7. Meal Plan and Prep

Cut down on food expenses by meal planning!

Planning your meals for the week helps minimize last-minute takeout and food waste. Start by making a list of the meals you want to prepare, focusing on seasonal ingredients and sales.

Create a shopping list based on your meal plan, and stick to it when you shop. Prepping meals on a Sunday can save you time during the week and ensure you have healthy options available. With some creativity, you can whip up delicious meals that save you money and keep you energized!

8. Make Your Coffee at Home

Save tons of cash by swapping your daily coffee shop visit with homemade brews!

Invest in a good coffee maker and some quality beans. Experiment with different brewing methods to find what you love most.

By making coffee at home, you’re not just saving money; you’re also gaining control over the quality and flavor. Get creative with flavors and try out fun recipes for lattes or cold brews. Plus, you can sip your drink while lounging in your cozy pajamas—who wouldn’t love that?

Brew your own coffee and watch your savings grow! Enjoy the perfect cup in your cozy pajamas while knowing you’re keeping your wallet happy.

9. Buy Used Instead of New

Don’t shy away from second-hand shopping!

Thrift stores, online marketplaces, and garage sales are treasure troves for gently used items at a fraction of the original price. From clothes to furniture and electronics, you can find great deals while being eco-friendly.

Before making a big purchase, check if you can find what you need used. This not only saves money but also promotes sustainability. Plus, who knows the stories that come with these items? It adds a unique charm to your home and wardrobe.

Second-hand shopping isn’t just wallet-friendly; it’s a treasure hunt! Discover unique items, save money, and embrace sustainability – all while adding a story to your home.

10. Cancel Unused Subscriptions

Take a look at your subscriptions—are you really using them?

From streaming services to gym memberships, these monthly fees can pile up quickly. Go through your statements and identify what you can cut back on. If you find you’re not using a service enough to justify the cost, don’t hesitate to cancel.

Consider using free trials judiciously for services you might want to try. This way, you can enjoy premium offerings without spending a dime, at least for a little while!

11. Utilize Public Transport

Public transport can be a money-saver!

Whether you’re commuting to work or running errands, consider swapping your car for a bus, train, or bike. You’ll save on gas, parking fees, and maintenance costs. Plus, it’s a great way to reduce your carbon footprint!

If public transport isn’t an option, consider carpooling with coworkers or friends. This can halve your costs while also making commuting more enjoyable. Get creative with your transportation method; you might discover new routes and hidden gems along the way!

12. Take Advantage of Free Events

Don’t let your social life suffer while saving money! Look for free events in your community.

Many places offer free concerts, festivals, art shows, and museum days. These activities are not only budget-friendly but also a great way to explore your area and meet new people. Check community boards or social media for listings.

You might just stumble upon a new hobby or interest, and it’s a fantastic opportunity to have fun without breaking the bank!

13. DIY Home Repairs

Save big by tackling some home repairs yourself!

There are countless YouTube tutorials and resources available to guide you through simple tasks, from fixing leaky faucets to painting walls. Invest in a basic toolkit and get hands-on!

Not only does this save money, but it also gives you a sense of accomplishment. If you’re unsure about a project, gather tips online or consult with friends who are handy. Just remember, for major repairs, it’s often best to call a professional to avoid costly mistakes.

14. Limit Dining Out

Dining out can be a fun treat, but it can also drain your wallet.

Try to limit eating out to once a week or on special occasions. Instead, make it a fun event to cook at home with family or friends. Challenge yourself to recreate your favorite restaurant dishes!

You can also explore “meal kits” which offer variety and may be more budget-friendly than frequent dining out. With some creativity, you can discover the joys of home-cooked meals without the stress of overspending.

15. Use a Savings Jar

Turn saving into a fun game with a savings jar!

Grab a jar and toss in all your spare change at the end of each day. You’ll be amazed at how quickly it adds up. Set a goal for the jar, like saving for a special treat or trip.

Consider using separate jars for different goals to keep things organized and exciting. Seeing the jar fill up is encouraging and motivates you to continue saving. Plus, when it’s time to cash in, you’ll feel a great sense of achievement!

Saving money doesn’t have to be dull! Turn it into a game with a savings jar. Toss in your change daily, and watch your goals come to life—one coin at a time!

16. Shop Off-Season for Clothes

Get the best deals by shopping off-season!

Buy winter clothes at the end of winter or summer attire at the end of summer when retailers are eager to clear out inventory. You can snag incredible discounts while building a wardrobe for next season.

Also, consider outlet stores and clearance sections for additional savings. By planning ahead with your clothing purchases, you’ll not only save money but also find unique pieces that stand out.

17. Start a Side Hustle

Why not make some extra cash with a side hustle?

Consider your hobbies or skills; maybe you can freelance, sell crafts online, or offer tutoring in a subject you excel at. Side hustles can be a flexible way to boost your savings without a full-time commitment.

Not only does this help you save, but it also allows you to explore your passions and meet new people. Plus, the additional income can go directly into your savings account, helping you reach your financial goals even faster.

18. Avoid Impulse Purchases

Impulse buys can wreck your budget!

Before making a purchase, implement a rule—wait 24 hours before buying non-essential items. This gives you time to think about whether you really need it. Often, you’ll realize you can live without it.

Also, create a shopping list before heading out and stick to it. If you find yourself wandering, set a budget for how much you’re willing to overspend. Keeping your focus on your goals can steer you away from unnecessary expenses.

19. Use Energy Wisely

Cut down on your utility bills by using energy wisely!

Simple changes like turning off lights when you leave a room or unplugging devices that aren’t in use can lead to significant savings. Consider investing in energy-efficient appliances and LED bulbs, which may have a higher upfront cost but save you money in the long run.

You could also explore local utility programs that offer rebates for energy-saving upgrades. It’s a fantastic way to save money and contribute to a healthier planet!

20. Revise Your Insurance Policies

Review your insurance policies annually to ensure you’re getting the best rates.

Shop around for better deals—sometimes, switching providers can lead to substantial savings. Look for discounts for bundling multiple policies, like home and auto insurance.

Don’t be afraid to negotiate with your current provider; they might offer you a better rate to keep your business. Regularly reassessing your policies ensures you’re not overpaying while still receiving the coverage you need.

21. Learn to Say No

Practicing the power of no can be incredibly liberating!

It’s easy to say yes to every invite or request, but learning to say no to social events or extra expenses you can’t afford is essential for your financial health.

Stick to your budget and goals; remember, it’s okay to decline if it jeopardizes your financial stability. Choosing when to splurge can also make those moments more enjoyable. It’s all about balance and prioritizing your financial priorities.

22. Get Financially Educated

Knowledge is power! Equip yourself with financial education.

Read books, listen to podcasts, or attend workshops on personal finance to expand your understanding. The more you know, the better decisions you can make regarding budgeting and saving.

Consider following finance bloggers or influencers who share tips and advice. Investing time in learning can yield tremendous returns in your financial journey, making it easier to stick to your money-saving goals.

23. Use a Rewards Credit Card Wisely

If you use credit cards responsibly, they can benefit you!

Seek out cards that offer cash back or reward points for purchases you already make. However, be sure to pay off the balance each month to avoid interest fees.

This way, you can reap rewards without falling into debt. Keep track of your spending to make sure you’re not overspending just to earn points. Responsible use of rewards cards can help you save money and enjoy perks!

24. Set Up an Emergency Fund

An emergency fund is your financial safety net. Aim to save three to six months’ worth of living expenses.

Set this money aside in a high-yield savings account to keep it separate from your regular spending. Start small, like saving $20 a week, and gradually increase as you can. This fund will give you peace of mind during unexpected emergencies, preventing you from going into debt when life throws you a curveball.

25. Utilize Flexible Spending Accounts

If your employer offers Flexible Spending Accounts (FSA), take advantage of them!

These accounts allow you to use pre-tax dollars for healthcare expenses, which can save you money on your tax bill. Just keep in mind that most FSAs require you to use the funds within the plan year, so be strategic about your contributions. Understanding these accounts can help you manage medical expenses more effectively and save big.

26. Find a Financial Accountability Partner

Having a financial buddy can make saving more fun!

Find a friend or family member who shares similar financial goals, and hold each other accountable. Schedule monthly check-ins to discuss progress, setbacks, and strategies. Not only can this encourage you to stick to your budget, but you can also share tips and resources. It’s much easier to stay motivated when someone else is cheering you on!

Team up with a financial buddy! Accountability makes saving fun and keeps you on track. Cheering each other on transforms budgeting from a chore into a shared adventure!

27. Celebrate Your Savings Milestones

Celebrate every victory along your savings journey!

Set milestones for your savings goals, and treat yourself when you reach them—within reason, of course! This can be as simple as a movie night at home or a small meal out. Acknowledging your progress keeps you motivated and reinforces good habits. Saving money is a marathon, not a sprint, so enjoy it!

Conclusion

Saving money doesn’t have to be complicated or dull. With these 27 savvy tips, you can take charge of your financial future in a fun and engaging way.

Each small change can lead to big savings over time, so start incorporating them today and see the difference it makes! Remember, the journey to financial stability is unique, and every step counts.

Frequently Asked Questions

What are the best ways to start tracking my expenses effectively?

Starting to track your expenses can be a game-changer for your finances! Begin by choosing a method that suits you—whether it’s a budgeting app, a spreadsheet, or good old-fashioned pen and paper. Make it a habit to record every expense daily to see where your money is going. This practice will help you identify spending patterns and areas where you can cut back. Remember, the key is consistency, so pick a method that you find enjoyable and stick with it!

How can I create a realistic budget using the 50/30/20 rule?

The 50/30/20 rule is a fantastic way to simplify your budgeting! Start by determining your monthly income after taxes. Allocate 50% for needs (like housing and groceries), 30% for wants (like entertainment and dining out), and 20% for savings. This straightforward approach makes it easier to manage your finances and ensure you’re saving for your future. Don’t forget to adjust these percentages based on your personal financial situation—flexibility is key!

What are some fun ways to save money while still enjoying life?

Saving money doesn’t have to mean sacrificing fun! Consider initiating a no-spend challenge with friends to make it a fun activity. You can also explore free community events, plan potluck dinners instead of dining out, or even try DIY home projects. By getting creative, you can find enjoyable ways to cut costs while still having a great time. Remember, saving money is about making smarter choices without missing out on life’s pleasures!

How do I effectively automate my savings?

Automating your savings is a smart strategy that makes saving feel effortless! Set up an automatic transfer from your checking account to your savings account right after payday. Decide on the amount you want to save and ensure that your savings account is separate from your spending account. This way, you won’t be tempted to dip into your savings for everyday expenses. Over time, you’ll be amazed at how quickly your savings grow without you even noticing!

What should I consider when canceling unused subscriptions?

Canceling unused subscriptions can lead to significant savings! Start by reviewing your bank statements to identify recurring charges. Make a list of subscriptions you don’t use regularly—be it streaming services, magazines, or gym memberships. Before canceling, consider if you might use them in the future; if not, go ahead and cut them out! Just remember to check if there are any cancellation fees or policies. Taking this step can clear out your budget and help you save money for things you truly value!

![QLD Wallet for Men - RFID Blocking [Functional & Practical]](https://m.media-amazon.com/images/I/415DVXy0ygL._SL500_.jpg)