Getting into real estate can feel like a daunting adventure, but with the right guidance, it can be one of the most rewarding journeys you embark on.

From navigating the ever-changing real estate market trends to mastering investment property strategies, this list is packed with practical tips tailored for first-time homebuyers.

Whether you’re looking to purchase your first home or invest in rental properties, these insights will help you build a solid foundation for your financial future. Grab a cozy seat, and let’s jump into these essential real estate tips!

1. Understand Your Budget

Before you even start looking for properties, sit down and assess your financial situation. Knowing your budget is crucial. It helps you set realistic expectations and prevents you from falling in love with properties that are out of reach.

Break down your finances by considering all income streams, monthly expenses, and potential down payment amounts. Don’t forget to factor in closing costs, property taxes, and ongoing maintenance fees. This way, you’ll have a clear idea of what you can afford without overstretching your finances.

Also, consider getting pre-approved for a mortgage. This not only shows sellers you are serious but can also give you an edge in competitive markets.

– Calculate your total income

– List your monthly expenses

– Check for hidden costs associated with buying a home

Understanding your budget sets a solid foundation for all your real estate ventures!

Understand Your Budget

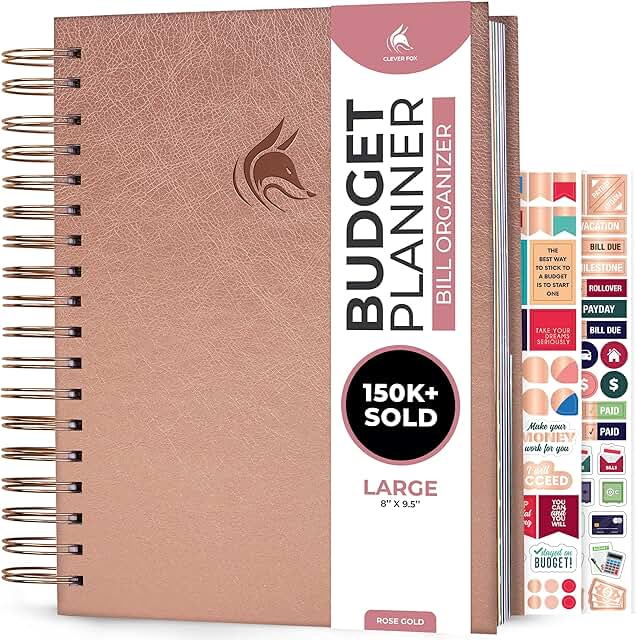

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Calculated Industries 3405 Real Estate Master IIIx Residential Real Esta…

Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. Expense…

2. Research Local Market Trends

The real estate market is constantly changing, so staying informed about local trends is essential.

Dive into recent sales data, neighborhood statistics, and home price trends. Understanding these factors will help you determine if it’s a buyer’s or seller’s market. You can use various online resources or consult a local real estate agent to gather insights.

Pay attention to factors like average days on the market, price fluctuations, and upcoming developments in the area. This knowledge can help you make informed decisions and negotiate better deals.

– Use online resources for market research

– Network with local real estate professionals

– Attend open houses to gauge market conditions

Being well-informed empowers you as a buyer and helps you seize timely opportunities.

Research Local Market Trends

Editor’s Choice

Real Estate Investing QuickStart Guide: The Simplified Beginner’s Guid…

Nicpro 39 PCS Aesthetic School Supplies with Cute Pencil Case, 12 Color …

3. Start with an Affordable Property

As a first-time investor, it’s tempting to go for your dream home, but starting with an affordable property is a smarter strategy.

Look for fixer-uppers or properties in less trendy neighborhoods. This approach not only helps you gain experience but also keeps your initial investment lower. You can always upgrade or move later.

Additionally, consider properties that can generate rental income. Investing in a duplex, for instance, allows you to live in one unit while renting the other. This can significantly offset your mortgage payments and provide valuable experience in managing tenants.

– Focus on properties with growth potential

– Explore less popular neighborhoods

– Look for multi-family homes to maximize income

Starting small lets you learn the ropes without overwhelming yourself financially.

Start with an Affordable Property

Editor’s Choice

144-Piece Pink Tool Kit Basic Home Repair Tool Set General Household Han…

Pro Grade Paint Roller Kit, Brush & Roller,10 Piece Set, Wall Painting N…

Real Estate Investing QuickStart Guide: The Simplified Beginner’s Guid…

4. Get Professional Help

Navigating the world of real estate can be complex, so don’t hesitate to enlist professional help.

Working with a real estate agent can provide insights into the market and streamline the buying process. Choose someone experienced, trustworthy, and familiar with your target area. A good agent will know the ins and outs of neighborhoods and can help you find properties that fit your criteria.

Additionally, consider hiring a real estate attorney to review any contracts and ensure everything is above board. This is especially important for first-time buyers who may not be familiar with all the legal jargon.

– Research agents and read reviews

– Ask for references from friends or family

– Review contracts thoroughly with a lawyer

Professional guidance can save you time, money, and a lot of headaches down the road.

Don’t navigate the real estate maze alone! A trusted agent can turn a daunting process into a smooth journey, helping you find the perfect home with confidence.

Get Professional Help

Editor’s Choice

The Book on Rental Property Investing: How to Create Wealth With Intelli…

The Little Book of Common Sense Investing: The Only Way to Guarantee You…

When Your Loved One Has Dementia: A Simple Guide for Caregivers

5. Learn About Financing Options

Understanding your financing options is key to successful property investment.

Besides traditional mortgages, there are various loan types to explore, such as FHA loans, VA loans, and USDA loans that offer different benefits depending on your situation. Researching these options can save you money and make home buying more accessible.

Don’t forget to check for first-time homebuyer programs and grants available in your area. These programs often provide down payment assistance or favorable interest rates, making it easier for you to step into homeownership.

– Research various loan types

– Understand government programs that may apply

– Meet with a mortgage advisor for personalized guidance

Knowing your financing options empowers you to make educated decisions and find the best fit for your financial situation.

Learn About Financing Options

Editor’s Choice

The Little Book of Common Sense Investing: The Only Way to Guarantee You…

Calculated Industries 3405 Real Estate Master IIIx Residential Real Esta…

Crypto for Beginners Made Easy: Your Step-by-Step Guide to Understanding…

6. Explore Neighborhoods Thoroughly

The right location can make or break your investment. Before buying, explore different neighborhoods thoroughly.

Visit during various times of day to get a feel for the area. Check out amenities, schools, parks, and public transport options. A neighborhood with good schools or convenient access to public transit tends to hold its value better over time.

Additionally, talk to residents if you can. Get first-hand insights about the community, safety, and lifestyle. This will help you make a more informed decision about where to invest your money.

– Make a checklist of neighborhood features that matter to you

– Observe the community vibe

– Research future development plans

Choosing the right neighborhood lays the groundwork for a successful investment.

Explore Neighborhoods Thoroughly

Editor’s Choice

Real Estate Investing QuickStart Guide: The Simplified Beginner’s Guid…

7. Don’t Skip Home Inspections

Never underestimate the importance of a thorough home inspection!

Even if a property looks perfect at first glance, hidden issues could cost you thousands later on. An inspection can uncover problems like plumbing issues, roof damage, or outdated electrical systems that need immediate attention.

Investing in a professional home inspection gives you peace of mind and can also serve as a negotiation tool. If major repairs are found, you can request the seller to fix them before closing or negotiate a lower price.

– Hire a reputable home inspector

– Attend the inspection to ask questions

– Use findings to strengthen your negotiation

A comprehensive inspection protects your investment and ensures you’re making a sound purchase.

Don’t Skip Home Inspections

Editor’s Choice

Contractors License Study Guide: 300+ Must-Know Questions with Answers a…

Klein Tools 80025 Outlet Tester Kit with GFCI Tester and Non-Contact Vol…

8. Understand Your Responsibilities as a Landlord

If you’re considering rental properties, make sure you fully understand what it means to be a landlord.

You’ll need to manage tenant relationships, handle maintenance requests, and navigate legal obligations, such as fair housing laws. It’s crucial to have a clear understanding of the responsibilities that come with property management.

Consider drafting a lease agreement that outlines responsibilities for both you and your tenants. Additionally, being responsive and approachable will not only help keep your tenants happy but can also lead to lower turnover rates.

– Create a comprehensive lease agreement

– Stay organized with property management tools

– Educate yourself on landlord-tenant laws

By being a proactive landlord, you ensure a smoother rental experience and foster positive tenant relationships.

Being a landlord isn’t just about collecting rent; it’s about building relationships and understanding your responsibilities. A clear lease agreement can set the stage for a successful rental experience!

Understand Your Responsibilities as a Landlord

Editor’s Choice

TRUSTS & ASSET PROTECTION STRATEGIES that WORK: How to Protect Your Asse…

Adams Residential Lease, Forms and Instructions [Print and Downloadable]…

9. Factor in Potential Renovations

When looking at properties, consider their potential for renovations.

Homes that need a little TLC can often be purchased at a lower price, which means you might have some equity to play with after making improvements. However, you’ll need to budget for renovations wisely.

Identify which renovations will add the most value. Kitchens and bathrooms typically provide the highest return on investment, so focus on these areas if you plan to remodel. Also, consider cosmetic changes that can make a significant impact, such as fresh paint or new flooring.

– Estimate renovation costs ahead of time

– Prioritize renovations with the highest ROI

– Keep an eye on design trends to attract buyers or renters

By assessing the potential renovations, you can turn a basic property into a valuable asset.

Renovating a fixer-upper can turn a budget buy into a dream home. Focus on kitchens and bathrooms for the best ROI, and watch your equity grow!

Factor in Potential Renovations

Editor’s Choice

Home Planner Sticker Book 2nd Ed | Pack of 15 | 766 Total Stickers | Ass…

Design the Home You Love: Practical Styling Advice to Make the Most of Y…

Multitool Hammer Camping Gear Accessories Survival Kits 14 in 1 Multifun…

10. Stay Educated on Legalities

Real estate comes with a slew of legal considerations that you must be aware of.

From understanding zoning laws to property taxes and tenant rights, staying informed is crucial for new investors. Many states offer resources and courses to help you understand the legal landscape of real estate transactions.

Consider joining a local real estate investing group or forum to stay updated on emerging laws and regulations that could impact your investments. Familiarize yourself with contracts and paperwork involved in real estate transactions to avoid potential pitfalls down the road.

– Attend workshops or seminars on real estate law

– Join real estate investing groups online

– Consult with a real estate attorney for complex matters

Knowledge of legalities protects you and your investment from unexpected challenges.

Stay Educated on Legalities

Editor’s Choice

11. Build a Network of Professionals

Networking can be a game-changer in real estate.

Building relationships with other investors, real estate agents, contractors, and financial advisors can provide you with valuable resources, referrals, and insights. Attend local real estate investor meet-ups and industry conferences to expand your network.

Having a solid network means you can get recommendations for reputable service providers, learn about off-market deals, and share experiences with others in similar situations.

– Attend networking events and workshops

– Join online forums or social media groups focused on real estate

– Stay connected with professionals for ongoing support

A strong network not only supports your current endeavors but can also foster future investment opportunities.

Build a Network of Professionals

Editor’s Choice

Custom Metal Business Cards 20-800pcs Bulk, 0.45mm Engraved Aluminum, Pr…

12. Keep an Eye on Interest Rates

Interest rates can have a big impact on your purchasing power, so it’s important to keep a close watch on them.

Even a slight increase can affect your monthly payments and overall budget. Consider working with a mortgage broker who can help you find the best rates available.

If rates are low, it might be a good time to make your move, but if they’re rising, you may want to speed up your buying process or consider locking in a rate.

– Use online tools to track interest rate trends

– Stay informed about national economic factors affecting rates

– Review your mortgage options frequently

Understanding how interest rates affect your investment decisions can save you money and open up opportunities.

Keep an Eye on Interest Rates

Editor’s Choice

The Book on Investing In Real Estate with No (and Low) Money Down: Creat…

ZURURU Fitness Tracker with Blood Pressure Heart Rate Sleep Health Monit…

HP 10bII+ Financial Calculator – 100+ Functions for Business, Finance,…

13. Know When to Walk Away

In real estate, it’s easy to get emotionally attached to properties, but you must know when to walk away.

If negotiations aren’t going as planned or if the property requires more repairs than it’s worth, don’t hesitate to back out. Have a clear idea of your maximum budget and stick to it.

There are always other properties out there. Having the courage to walk away from a bad deal can save you from major financial headaches down the road.

– Set a budget and stick to it

– Trust your instincts about a deal

– Continuously remind yourself there will be other opportunities

Practicing patience and discipline can prove to be one of your best strategies in real estate investing.

14. Don’t Rush into Decisions

Real estate decisions require thoughtful consideration.

Avoid the urge to rush into a purchase just because you feel pressured by the market. It’s essential to take your time, research, and weigh your options, especially as a first-time buyer.

Rushed decisions could lead to buyer’s remorse or financial strain. Consider consulting with your network or professionals to get their insights before making a final call.

– Take time to analyze the pros and cons of each property

– Seek input from trusted friends or family

– Sleep on major decisions before committing

Taking a measured approach can lead to better investment outcomes.

Don’t Rush into Decisions

Editor’s Choice

Texas Instruments BA II Plus Financial Calculator, Black Medium

15. Set Realistic Goals

Establishing clear, realistic goals is vital for your journey as a new investor.

Whether you’re aiming to buy your first home, generate rental income, or flip properties, having defined objectives will help keep you focused. Break your larger goals into smaller, actionable steps to track your progress more easily.

Consider setting timelines for each goal, like when you want to purchase your first property or how much profit you want to make from a flip.

– Write down specific, measurable goals

– Create a timeline for your objectives

– Regularly review and adjust your goals as needed

By setting achievable goals, you can remain motivated and on track throughout your real estate journey.

Set Realistic Goals

Editor’s Choice

Undated Weekly Planner, Weekly To Do List Notebook with Goal & Habit Tra…

Calendar Whiteboard for Wall, TANKEE 17×13 Inches Whiteboard Calendar Co…

16. Utilize Online Resources

The internet is a treasure trove of resources for aspiring real estate investors.

From blogs and podcasts to webinars and online courses, there’s no shortage of information available to help you learn the ropes. Utilize these resources to build your knowledge base and stay updated on market trends.

Websites like Zillow and Realtor.com can help you keep track of property listings in your area. Moreover, forums like BiggerPockets offer a community of investors sharing tips, experiences, and advice.

– Subscribe to real estate newsletters

– Listen to podcasts focused on property investment

– Join online communities for support and networking

Online resources can accelerate your learning curve and connect you with the right people and information.

Utilize Online Resources

Editor’s Choice

Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Prim…

The Little Book of Common Sense Investing: The Only Way to Guarantee You…

The Book on Rental Property Investing: How to Create Wealth With Intelli…

17. Understand the Buy-and-Hold Strategy

The buy-and-hold strategy is a popular approach for long-term real estate investors.

This method involves purchasing a property and holding onto it for an extended period while it appreciates in value. This strategy requires patience, but it often yields significant returns in the long run.

Consider factors like location, market trends, and the demand for rental properties in your area when utilizing this strategy. Additionally, make sure to maintain the property well to retain its value over time.

– Select properties in high-demand areas

– Allow time for appreciation

– Keep the property in good condition to attract tenants

A buy-and-hold strategy can provide a steady income stream and build wealth over time.

18. Know the Importance of Curb Appeal

First impressions matter, especially in real estate!

Curb appeal is crucial for attracting potential buyers or renters. Invest in landscaping, paint, or minor renovations that enhance the exterior appearance of your property. Simple changes like keeping the lawn tidy or adding potted plants can make a substantial difference.

Not only does curb appeal attract interest, but it can also positively impact your property’s value. When people are drawn to a well-maintained exterior, they’re more likely to view the interior favorably as well.

– Maintain landscaping regularly

– Repaint or clean the exterior as needed

– Add decorative elements to enhance visual appeal

Prioritizing curb appeal can set the tone for a successful sale or rental experience.

Know the Importance of Curb Appeal

Editor’s Choice

Outdoor String LED Patio Lights – 100Ft 30M Outside Waterproof Light wit…

2 Pcs 35” Kids Rakes for Leaves – Plastic Rake Head with 2 Pairs Kids G…

Small Fake Potted Plants: 7 Inches Artificial Plants with Seagrass Handw…

19. Be Prepared for Market Fluctuations

The real estate market can be unpredictable, with changes happening due to economic factors, interest rates, or local trends.

It’s essential to be prepared for market fluctuations. Develop a strategy that includes diversifying your investments and planning for downturns. This means not putting all your money into one property and understanding that markets can shift.

During downturns, opportunities may also arise, like lower property prices or motivated sellers. Stay educated on economic trends and be flexible in your investment approach.

– Diversify your property portfolio

– Stay informed about market news and trends

– Prepare for potential downturns with a solid financial plan

By preparing for market fluctuations, you can navigate challenges and seize opportunities when they arise.

20. Create a Property Management Plan

Establishing a property management plan is vital if you own or plan to invest in rental properties.

This plan should outline your responsibilities, tenant communication protocols, maintenance schedules, and financial tracking. A well-organized management plan will save you time and headaches down the road.

Consider using property management software to streamline the process and keep everything organized. If you’re not keen on managing properties yourself, you might want to hire a property management company to handle the details for you.

– Create a checklist for tenant interactions

– Plan regular maintenance inspections

– Track expenses and income meticulously

Having a solid property management plan lays the groundwork for successful rental operations.

A solid property management plan is your best friend in real estate. It saves you time, keeps tenants happy, and ensures your investment thrives!

Create a Property Management Plan

Editor’s Choice

21. Be Mindful of Emotional Investments

Investing in real estate can stir up a lot of emotions.

It’s easy to fall in love with properties, but be cautious not to let emotions cloud your judgment. Always return to your budget and investment goals when considering a property.

Emotional decisions can lead to overpaying or buying properties that don’t fit your investment strategy. Remind yourself that real estate is ultimately a financial investment, and making sound decisions is essential for long-term success.

– Keep your emotions in check during negotiations

– Stick to your budget and investment criteria

– Seek advice from trusted advisors when feeling overwhelmed

By staying emotionally grounded, you can make wiser decisions and avoid common pitfalls.

Be Mindful of Emotional Investments

Editor’s Choice

Real Estate Investing QuickStart Guide: The Simplified Beginner’s Guid…

Intelligent Change The Five Minute Journal – Original Daily Gratitude Jo…

Dave Ramsey’s Personal Finance Software Version 5.3

22. Utilize Technology to Your Advantage

Technology has transformed the way we invest in real estate.

Leverage online platforms like MLS, real estate apps, and virtual tours to streamline your search and research processes. These tools can provide you with immediate access to listings and valuable market data that was not easily available in the past.

Additionally, consider using digital tools for property management, financial tracking, and data analysis to keep your operations organized and efficient. Embracing technology can save you time and help you make smarter investment decisions.

– Explore real estate apps for listings

– Utilize software for property management

– Stay updated on tech trends in real estate

Using technology can significantly enhance your investment strategy and keep you ahead of the competition.

Utilize Technology to Your Advantage

Editor’s Choice

Tablet, 2025 Android 15 Tablet with Gemini AI, 10.1 Inch FHD Display, 30…

23. Understand the Importance of Insurance

Insurance plays a critical role in protecting your investment.

Make sure to have adequate coverage for your property. Homeowner’s insurance, landlord insurance, and even umbrella policies can help shield you from financial pitfalls in case of unforeseen events like damage, liability claims, or natural disasters.

Evaluate your policies regularly to ensure they meet your current needs. Understanding what your insurance covers and what it doesn’t can save you from costly surprises later on.

– Consult with an insurance professional to determine coverage needs

– Regularly review your policies

– Consider additional coverage options if necessary

Ensuring proper insurance coverage is a crucial step in safeguarding your property investments.

24. Familiarize Yourself with Tax Implications

Real estate investing comes with various tax implications that can affect your bottom line.

Understanding these can help you make more informed decisions and maximize your profits. For instance, certain expenses can be tax-deductible, such as mortgage interest, property management fees, and repairs.

Investing in real estate can also lead to capital gains tax when you sell a property for a profit. Consult with a tax professional to ensure you are taking advantage of any deductions and credits available to property investors.

– Keep detailed records of all property-related expenses

– Research tax benefits for real estate investors

– Consult with a tax advisor for personalized advice

Being tax-savvy can significantly impact your overall investment strategy and financial health.

Familiarize Yourself with Tax Implications

Editor’s Choice

TaxAct Online 2018 Deluxe+ Federal Edition [PC Online code]

J. K. Lasser’s Your Income Tax 2022: For Preparing Your 2021 Tax Return

Casio MS-80B Calculator – Desktop Calculator with Tax & Currency Tools…

25. Be Open to Learning from Mistakes

Mistakes are inevitable in real estate, especially as a newbie.

What’s important is how you handle them. Instead of letting failures discourage you, use them as learning experiences. Analyzing what went wrong can provide valuable insights and guide your future investment decisions.

Join forums or networks where investors share their experiences and lessons learned. Understanding common pitfalls can prepare you for similar challenges in the future.

– Reflect on your experiences and document lessons

– Seek advice from seasoned investors

– Stay adaptable and open to new strategies

By embracing mistakes as opportunities for growth, you can become a more knowledgeable and effective investor.

Be Open to Learning from Mistakes

Editor’s Choice

Shift: How Top Real Estate Agents Tackle Tough Times

The Missing Billionaires: A Guide to Better Financial Decisions

The Only Investment Guide You’ll Ever Need: Revised Edition: The Essenti…

26. Keep Your Emotions in Check

When it comes to real estate, emotions can run high, especially when making a purchase.

It’s important to stay level-headed and focus on the facts rather than letting feelings dictate your decisions. Keep a checklist of your priorities and requirements to help ground your choices.

If you find yourself becoming overly attached to a property, step back and consider the financial implications. Is this the right investment for you?

– Stick to your budget without exception

– Reassess your motivations for buying

– Consult trusted friends for an outside perspective

Managing your emotions effectively can lead to sound, rational investments and prevent costly mistakes.

Keep Your Emotions in Check

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

27. Use Professional Photography for Listings

If you’re selling a property, high-quality photography can make a world of difference.

Investing in professional photography can attract more potential buyers and make your listing stand out online. Good images capture the essence of a home, highlighting its best features and creating an emotional connection.

Remember, first impressions are everything in real estate; beautiful images can significantly increase interest and showings. Discuss staging options with your photographer to maximize the appeal.

– Hire a professional photographer with real estate experience

– Consider virtual staging if needed

– Optimize images for online listings

Professional photography can elevate your property’s visibility and increase your chances of a successful sale.

Use Professional Photography for Listings

Editor’s Choice

Torjim Softbox Photography Lighting Kit, 16” x 16” Professional Softbo…

8K Digital Cameras for Photography – Autofocus 88MP WiFi Profession Came…

K&F CONCEPT 64 inch/163 cm Camera Tripod,Lightweight Travel Outdoor DSLR…

28. Plan for Long-Term Success

Real estate investing isn’t just about immediate gains; it’s a long-term strategy.

Develop a plan that aligns with your financial goals over the next 5, 10, or even 20 years. Consider aspects like property appreciation, rental income growth, and market trends.

A solid long-term plan can guide your investment decisions and help you remain composed during market fluctuations. Regularly review and adjust your strategy as your financial situation changes or as market conditions evolve.

– Set long-term financial goals

– Review and update your investment strategy periodically

– Stay informed about market changes

By focusing on long-term success, you can build a sustainable investment portfolio that grows over time.

29. Explore Additional Investment Opportunities

Real estate investing doesn’t have to stop at traditional homes.

Consider diversifying your portfolio with alternative options such as commercial properties, vacation rentals, or even real estate investment trusts (REITs). These opportunities can offer different income streams and potentially higher returns.

Research each option thoroughly to understand the associated risks and rewards. Joining investment clubs or online forums can provide insights into which opportunities might be the best fit for you.

– Explore various property types for investment

– Assess risk versus reward for diverse investments

– Network with seasoned investors for advice

By broadening your investment horizons, you can create a more robust and resilient investment portfolio.

Explore Additional Investment Opportunities

Editor’s Choice

The Book on Rental Property Investing: How to Create Wealth With Intelli…

The Little Book of Common Sense Investing: The Only Way to Guarantee You…

The Little Book of Common Sense Investing: The Only Way to Guarantee You…

30. Stay Persistent and Patient

Real estate investing is a marathon, not a sprint.

Success often takes time, patience, and perseverance. Don’t get discouraged by setbacks or slow progress; keep your eyes on your long-term goals. Regularly review your plan and adjust as necessary, but maintain a consistent effort to learn and grow in your investment journey.

Celebrating small victories along the way can help maintain motivation. Remember, the best investors are those who don’t give up, even when the going gets tough.

– Set realistic timelines for your goals

– Track and celebrate your progress

– Surround yourself with supportive individuals

Staying persistent and patient is the key to achieving your real estate dreams.

Stay Persistent and Patient

Editor’s Choice

6pcs Children’s Bible Verse Wall Art Christian Education Posters Prints …

To Do List Notepad – Daily Planner Notepad Undated 52 Sheets Tear Off, 6…

Undated Weekly Planner, Weekly To Do List Notebook with Goal & Habit Tra…

Conclusion

Stepping into the world of real estate investing can be both thrilling and intimidating.

However, with these 30 tips under your belt, you’re well on your way to making informed decisions and building a successful investment portfolio. Remember that learning and adapting is part of the journey.

Continue to seek knowledge, network with others, and stay focused on your goals as you navigate the exciting world of real estate investing.

Frequently Asked Questions

What are the first steps I should take as a new real estate investor?

Starting your journey in real estate can be exciting! Begin by assessing your budget to understand what you can afford. It’s essential to set realistic expectations and prevent overspending. Next, dive into local market trends to familiarize yourself with the areas you’re interested in. This knowledge will help you make informed decisions when selecting your first property.

How can I effectively research local real estate market trends?

Researching local market trends involves looking at recent sales data, neighborhood statistics, and home price movements. You can access this information through online real estate platforms, local government websites, or by connecting with a real estate agent who understands the area. Regularly checking these trends ensures you stay informed and can make strategic investment decisions.

What financing options should I consider for my first investment property?

When it comes to financing your first investment property, you have several options. Besides traditional mortgages, consider exploring FHA loans, VA loans, and USDA loans if you qualify. Each type has its benefits and requirements, so research thoroughly or consult a financial advisor to find the best fit for your financial situation.

What should I know about being a landlord if I’m investing in rental properties?

Becoming a landlord comes with responsibilities that you need to be prepared for. Understanding tenant rights, maintenance requests, and how to manage tenant relationships is crucial. It’s also wise to create a property management plan that outlines your responsibilities and communication protocols. This preparation helps ensure a smooth rental experience and can protect your investment.

How can I ensure I’m making a sound investment in real estate?

To make a sound investment in real estate, start by setting realistic goals and sticking to your budget. Don’t rush into decisions; take your time to research and weigh your options. Consider potential renovations that could add value to a property, and always get a thorough home inspection to uncover hidden issues. Lastly, stay educated on legalities and market fluctuations to adapt your strategies effectively.

Related Topics

real estate tips

first-time homebuyer

property investment

financial planning

market trends

investment strategies

rental properties

home inspections

budgeting for investors

networking in real estate

long-term investing

beginner friendly

![30 Real Estate Tips Every New Investor Should Know 49 Adams Residential Lease, Forms and Instructions [Print and Downloadable]...](https://m.media-amazon.com/images/I/81uP3OCk9qL._AC_UY218_.jpg)

![30 Real Estate Tips Every New Investor Should Know 111 TaxAct Online 2018 Deluxe+ Federal Edition [PC Online code]](https://m.media-amazon.com/images/I/41KOgF1NbtL._AC_UY218_.jpg)