Staying on top of your finances can feel like a daunting task, especially as a student with countless expenses. But what if you could turn budgeting into a fun and creative activity? Bullet journaling is the perfect way to inject some personality into your financial planning while helping you save money effectively. From tracking your expenses to jotting down money-saving techniques, your bullet journal can become a powerful tool in your budgeting arsenal.

In this listicle, you’ll find 25 unique bullet journal ideas tailored specifically for students looking to manage their finances better. Each idea is designed to not only keep you organized but to inspire you to adopt money-saving habits that can last a lifetime. Get ready to transform your budgeting game with these creative layouts and tips!

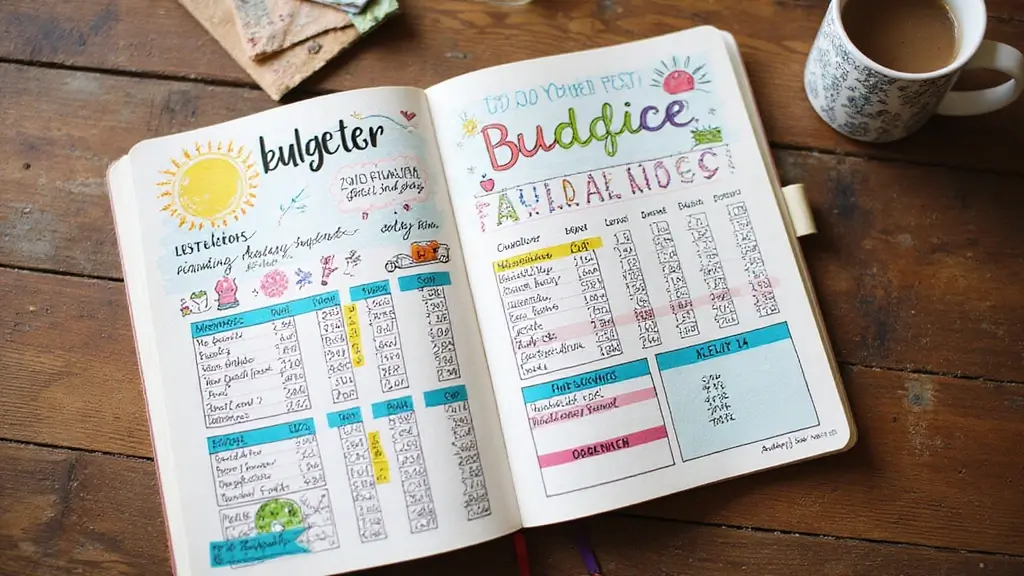

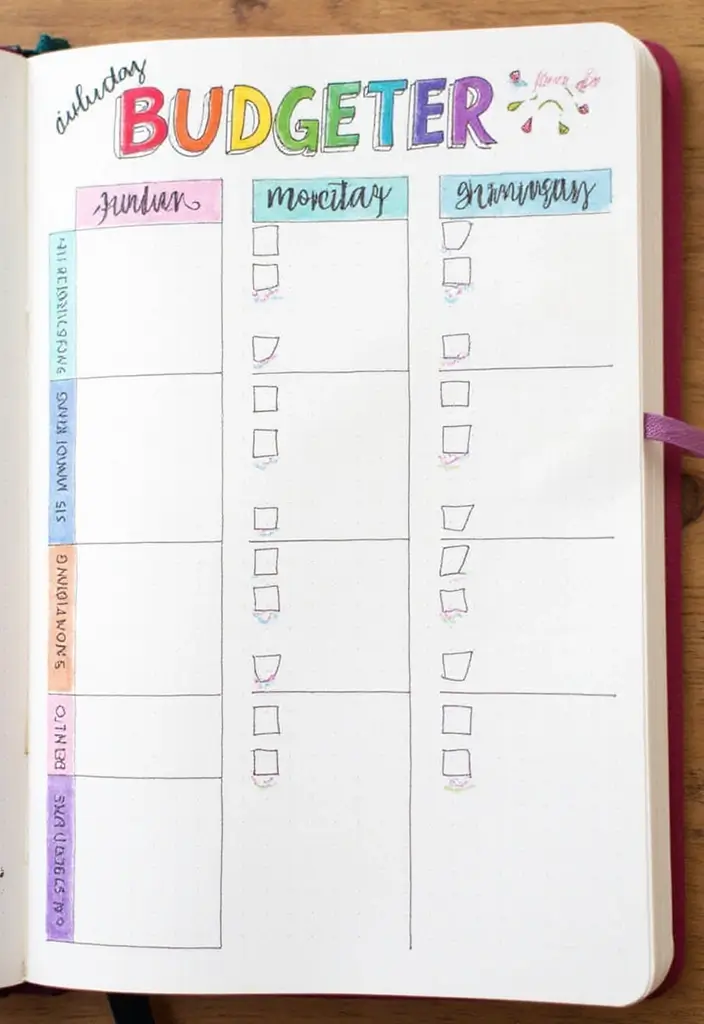

1. Monthly Budget Tracker

Kick off your bullet journal experience with a monthly budget tracker. This layout is your financial base camp, showing income and expenses for the month. Use a simple grid or table format to categorize your spending – think essentials like groceries, rent, and entertainment.

To make it visually appealing, consider coloring in the cells as you track your spending, turning it into a game. You might even add little icons to represent each category. This not only makes it easier to see where your money goes but also adds a touch of creativity to your financial planning. Plus, review it regularly to adjust your budget as necessary!

– Tip: Keep your categories broad in the beginning to minimize complexity.

– Color Coding: Use different colors for different categories to visually separate expenses.

– Reflection: At the end of the month, write a small note on what you learned about your spending habits.

Tracking your budget isn’t just about numbers; it’s about taking control of your financial story. A monthly budget tracker is your first step to mastering money and making every dollar count!

Monthly Budget Tracker

Editor’s Choice

Planner Stickers (24 Page, 1000+ Stickers, Multicolor, Paper, Vintage St…

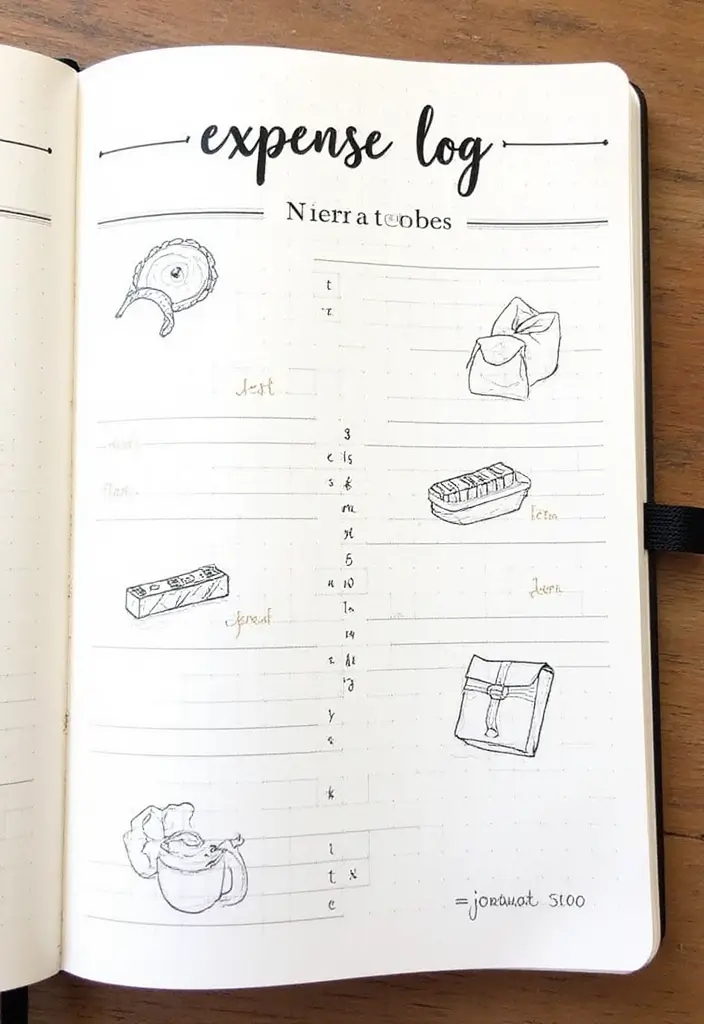

2. Expense Log

An expense log is where the nitty-gritty of your spending gets real. Capture every little expense, from that morning coffee to your weekend movie ticket. This will help highlight patterns in your spending habits, making it easier to cut back on unnecessary costs.

Set this up using a simple log with date, description, and amount spent columns. You can add a section for notes so you can jot down if it was a necessary purchase or an impulse buy. Over time, you’ll start to see areas where you can save or eliminate expenses altogether.

– Keep It Simple: Don’t overcomplicate it. Stick to essentials.

– Daily Check-Ins: Spend a few minutes each day updating your log to make it a habit.

– Monthly Review: Look back on your logs at the end of the month to spot trends.

Tracking every expense brings clarity to your finances. You’ll be amazed at what you discover when you see where your money really goes!

Expense Log

Editor’s Choice

Scrapbook Tape, 4 Pack Double Sided Tape Roller for Crafts, Adhesive Glu…

Gel Pens, 5 Pcs 0.5mm Black Ink Pens Fine Point Smooth Writing Pens, Hig…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

3. Savings Goals Page

Set yourself up for success with a savings goals page. This is where you identify what you want to save for, whether it’s a new laptop, a trip, or an emergency fund. Having a visual representation of your goals can be a strong motivator.

Create a dedicated space in your journal for each savings goal and break it down into manageable chunks. For each goal, draw a progress bar or a thermometer graphic you can fill in as you save. This not only keeps your goals front and center but also adds a fun visual element to your savings journey.

– Visualization: Use a thermometer graphic or a pie chart to depict your progress.

– Motivational Quotes: Include quotes that inspire you to save.

– Short-Term vs. Long-Term: Distinguish between what you want to save in the short and long term.

Savings Goals Page

Editor’s Choice

Lined Journal Notebook for Writing, A5 100 GSM Thick Paper, Leather Hard…

Aesthetic Monthly Planner Stickers – 1100+ Beautiful Design Accessories …

Gel Pens for Adult Coloring Books, 30 Colors Fine Point Gel Marker Pen w…

4. Spending Habit Reflection

Understanding your money habits is crucial for effective budgeting. A spending habit reflection section allows you to analyze your purchases thoroughly. Dedicate a page each month to write down your thoughts on what you spent money on, what you regret, and what was worth it.

This exercise encourages mindful spending and can help you make better financial choices in the future. Use bullet points or mind maps to organize your reflections, which helps in identifying patterns and areas for improvement.

– Key Questions: List questions to guide your reflection, like: “Did I need this?” or “What could I have done instead?”

– Monthly Themes: Consider focusing on a different theme each month to mix it up, like ‘self-care’ or ‘food.’

– Growth Mindset: Emphasize growth over guilt in your reflections, celebrating progress.

Spending Habit Reflection

Editor’s Choice

Paper Mate Colorful Gel Pens – InkJoy Gel Pens Assorted Medium Point (0….

Why Didn’t They Teach Me This in School?: 99 Personal Money Management P…

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

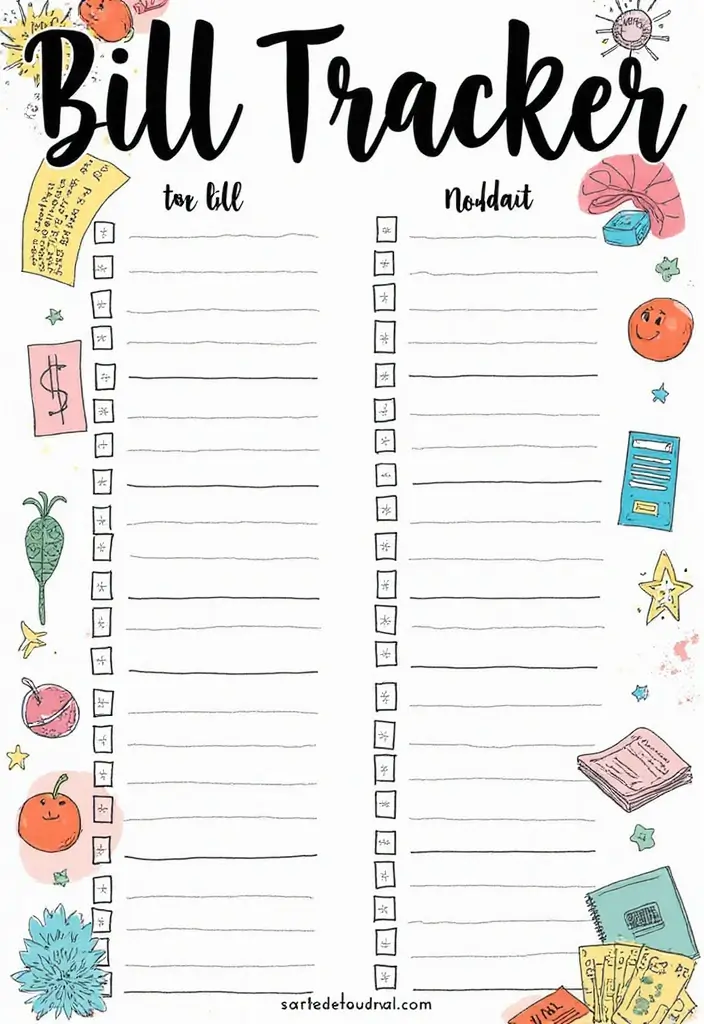

5. Bill Tracker

Bills can feel never-ending, especially for students managing multiple payments. A bill tracker in your bullet journal can help you stay organized and ensure you never miss a payment. Create a simple checklist with each bill listed alongside its due date.

Color code each bill to indicate whether it’s paid or unpaid, creating a visual sense of accomplishment as you check them off. This will ultimately help prevent late fees and support better financial management! You might also add a section for any notes related to each bill, like changes in rates or planned adjustments.

– Deadline Alerts: Use symbols or stickers to mark important deadlines.

– Monthly Review: At the end of the month, review your bills to spot any patterns in your spending.

– Adjustments: Keep track of any fluctuations in your bills to budget accordingly.

Bill Tracker

Editor’s Choice

Stocking Stuffers for Women: 7 Pcs Gel Pens 0.5mm Quick Dry Black Ink Fi…

3 Pcs Know Your Worth Then Add Tax Sticker – Motivational Boss Babe Qu…

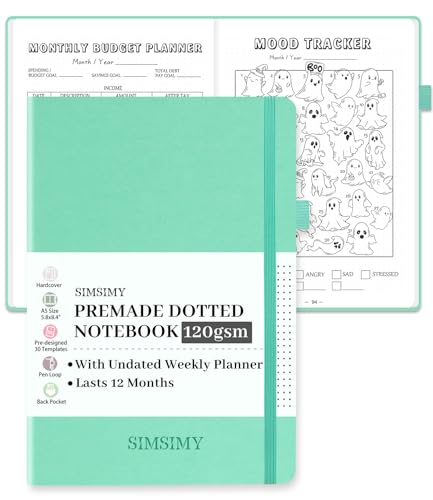

Premade Bullet Dotted Journal with Undated Weekly Monthly Planner, Pre-m…

6. Side Hustle Tracker

If you’re looking to boost your income, a side hustle tracker is essential. Document your various ways of making extra cash, whether it’s freelancing, tutoring, or selling crafts online. Create a section in your bullet journal that outlines your different side hustles and tracks your earnings from each.

Include columns for tasks you need to complete, earnings to date, and even goals for how much you want to earn. This layout turns your side hustles into a fun challenge, motivating you to achieve your financial targets.

– Goal Setting: Write realistic targets for each side hustle to aim for.

– Weekly Check-Ins: Dedicate a time each week to review your progress and adjust your efforts as necessary.

– Celebrate Success: Write notes on achievements to keep your motivation high.

Side Hustle Tracker

Editor’s Choice

200 PCS World Travel Stickers for Luggage Suitcases, Vinyl Country Trave…

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

Gel Pens, 6 Pcs 0.7mm Quick Dry Black Ink Pen, Cute Ergonomic Fine Point…

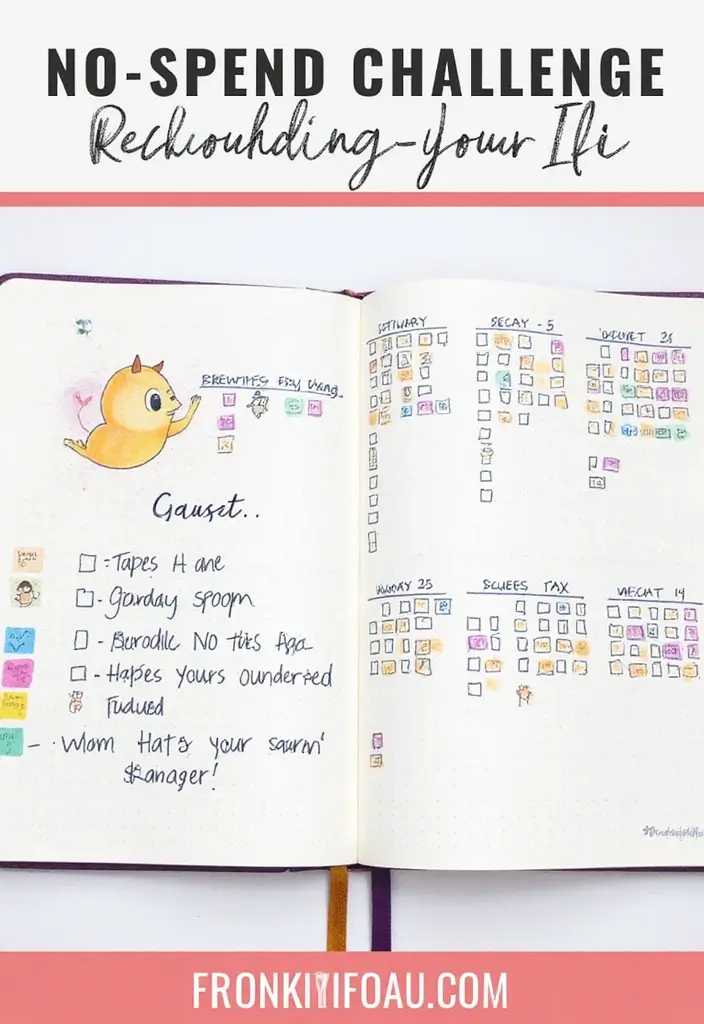

7. No Spend Challenge

Want to save some serious cash? Try a no spend challenge! This layout encourages you to track days where you don’t spend money at all. Challenge yourself for a week or even a month and see how much you can save.

Setting up this challenge in your bullet journal can be a fun way to gamify saving. Use a calendar-style layout where you can check off each day you succeed, and motivate yourself with small rewards or treats on completion of each milestone.

– Celebratory Rewards: Plan small rewards for every week you complete without spending.

– Community: Share your progress with friends or online communities to gain support.

– Reflection: Write down what you learned from the challenge to inform future spending habits.

No Spend Challenge

Editor’s Choice

Undated Weekly Planner, Weekly To Do List Notebook with Goal & Habit Tra…

Paper Mate Colorful Gel Pens – InkJoy Gel Pens Assorted Medium Point (0….

100Pcs Merry Christmas Stickers Christmas Decorations Reindeer Santa Cla…

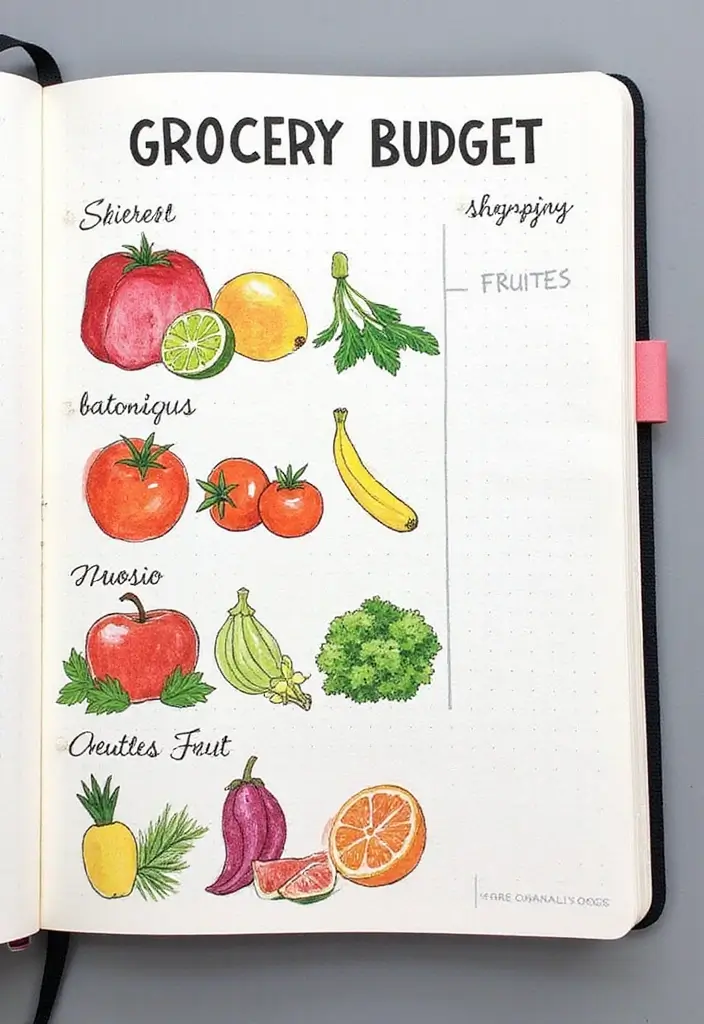

8. Grocery Budget Planner

Grocery shopping can take a large chunk of your budget if you’re not careful. A grocery budget planner allows you to plan meals based on your weekly budget, ensuring you stay within limits. Start by listing your essential items and then add meals for the week.

Consider creating a shopping list section tied to your meal plan, so you only buy what you need! Take it a step further by keeping track of sales or discounts at your local grocery stores, helping you stretch your dollars even further.

– Meal Prepping: Incorporate meal prepping tips to minimize food waste.

– Store Specials: Leave space to note down any ongoing sales or coupons you can utilize.

– Recipe Ideas: Include sections for quick, budget-friendly recipe ideas to make meal planning easier.

Grocery Budget Planner

Editor’s Choice

Cloth Tote Bags, Reusable, Foldable, Recycle for Shopping, Fits in Pocke…

Rubbermaid Brilliance Food Storage Containers BPA Free Airtight Lids Ide…

Decorably 52 Sheets Pastel Undated Weekly Meal Planner and Grocery List …

9. Financial Vision Board

Bring your financial dreams to life with a financial vision board! This creative section allows you to visually express your aspirations, whether it’s student loan repayment, travel, or saving for a new gadget. Use magazine cutouts, stickers, and drawings to make it a fun and exciting project.

This page serves as a reminder of what you’re working towards, keeping you motivated on your budgeting journey. Make sure to update it as your goals evolve and you achieve milestones!

– Personal Touches: Incorporate personal drawings or photographs for a unique touch.

– Daily Inspiration: Place this page where you’ll see it regularly for ongoing motivation.

– Goal Checkpoints: Include mini-goals that lead up to your larger aspirations.

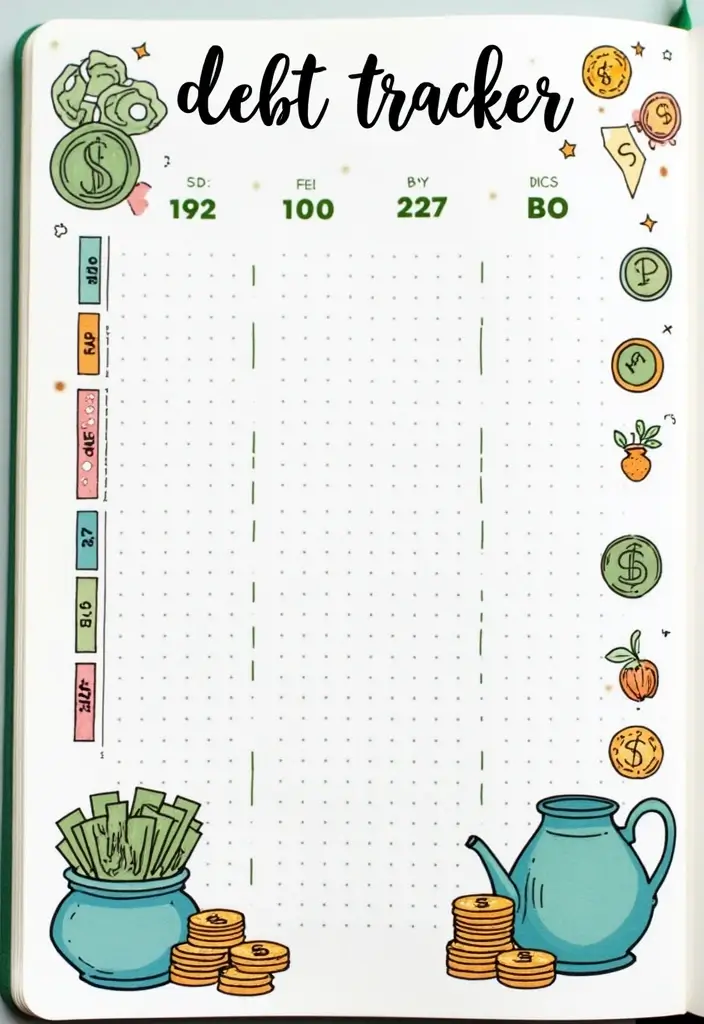

10. Debt Tracker

Managing debt can be overwhelming, but a debt tracker helps you see your progress and stay motivated to pay it off. Create a page for each debt showing the total amount owed, minimum payments, and due dates. You can also create a progress bar to fill in as you make payments, making it visually satisfying!

This layout helps you remain accountable and focused on your goal of becoming debt-free, serving as a constant reminder of what you’re working towards.

– Celebrate Milestones: Reward yourself when you pay off a debt or reach a significant milestone.

– Reflect on Your Progress: At the end of each month, write about your feelings toward your debt repayment journey.

– Adjust Your Strategy: Use insights from your tracker to adjust your payment strategies as necessary.

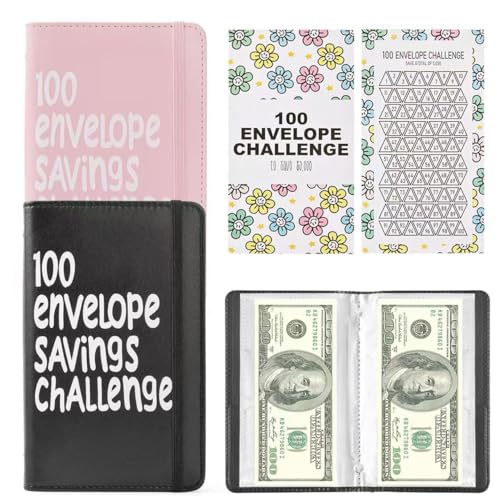

11. Savings Challenges

Engage in some fun with savings challenges that can help you build your savings effortlessly! There are plenty of creative ideas, like the 52-week challenge where you save a specific amount each week, or the ‘round-up’ method where you save the spare change from your purchases.

Dedicate sections in your bullet journal to outline different challenges you want to tackle, and track your progress visually! Whether you choose a challenge that requires minimal daily effort or one that pushes you a little, they can significantly boost your savings over time.

– Gamify Your Savings: By turning it into a game, you’ll find it easier to stick to your goals.

– Collaborate: Team up with friends or family to create a friendly competition.

– Track Progress: Create visual trackers to celebrate milestones, making it more fun.

Savings Challenges

Editor’s Choice

Color More 175 Piece Deluxe Art Set with 2 Drawing Pads, Acrylic Paints,…

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

12. Investment Tracker

If you’re starting to dabble in investments, a tracker is essential for keeping tabs on your portfolio. Create a dedicated page to list all your investments, their values, and performance over time. This will help you stay informed about your financial growth and adjust your strategies as necessary.

Include sections for notes on investment goals, market trends, and other relevant information you may want to track or remember.

– Visual Representation: Use graphs or charts to depict your growth visually.

– Research Notes: Add space for insights or learnings from your investment journey.

– Monthly Check-Ins: Regularly review your investments to assess performance.

Investment Tracker

Editor’s Choice

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

Gel Pens, 5 Pcs 0.5mm Black Ink Pens Fine Point Smooth Writing Pens, Hig…

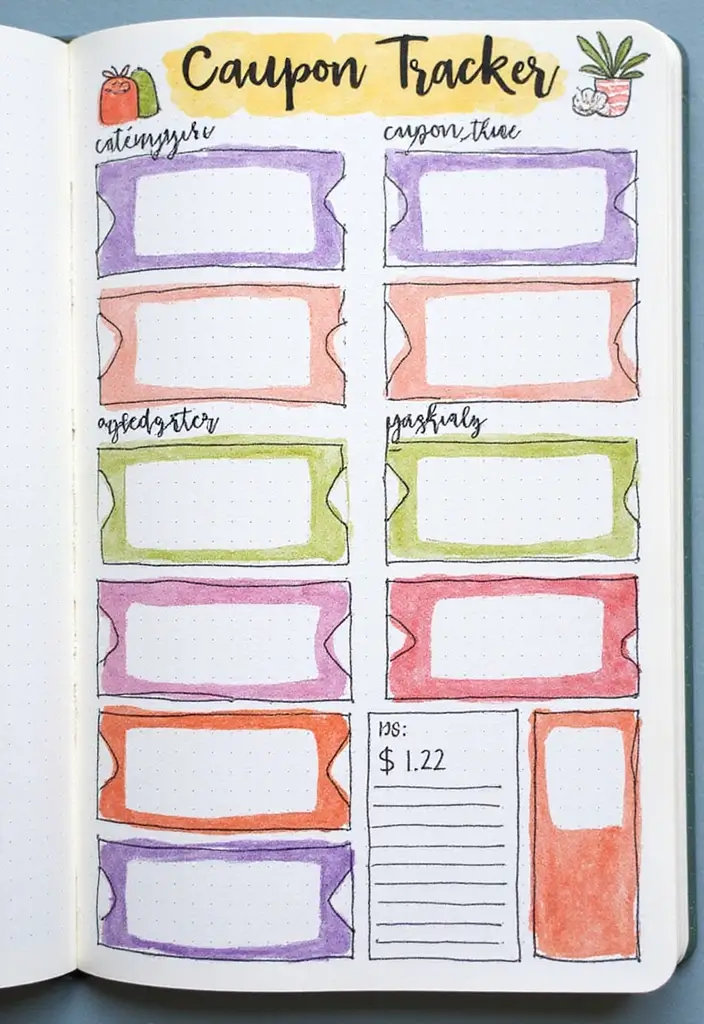

13. Coupon Tracker

Saving money with coupons can be fun, especially when you keep track of them in your bullet journal! A coupon tracker helps you organize and monitor any discounts or savings you have available, ensuring you maximize your savings potential.

Create a dedicated page for noting down coupons, their expiration dates, and the stores they apply to. You can even categorize them by type for easier navigation! Keeping this organized can save you time and money during shopping trips.

– Visual Layout: Use colorful boxes or dividers to organize your coupons.

– Check-Off System: Create tick boxes to indicate when you’ve used a coupon.

– Highlight Deals: Add notes for the best deals when you find them.

Coupon Tracker

Editor’s Choice

Bullet Dotted Journal Notebook for Women & Men, Hardcover Leather Journa…

Receipt Coupon Organizer 104-Pocket Small Accordion Binder 6.7X4.8, Idea…

Stocking Stuffers for Women: 7 Pcs Gel Pens 0.5mm Quick Dry Black Ink Fi…

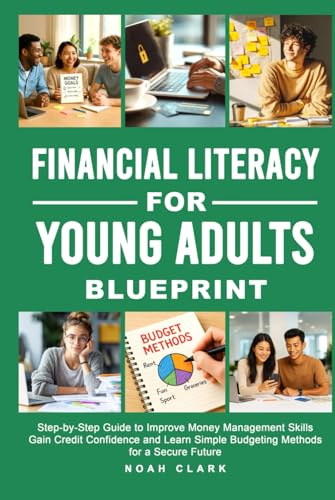

14. Financial Literacy Progress

Improving your financial knowledge can play a vital role in effective budgeting. A financial literacy progress page allows you to track books you’ve read, courses you’ve taken, or podcasts you’ve listened to regarding personal finance.

Documenting your learning activities encourages you to continuously expand your knowledge and stay informed. You might even add summaries or key takeaways from each resource to help solidify your understanding over time.

– Goal Setting: Establish goals for what financial topics you want to learn.

– Reflection Notes: Write reflections on how the knowledge applies to your situation.

– Fun Illustrations: Add doodles or stickers to represent each resource for visual appeal.

15. Monthly Reflection

End each month on a high note with a monthly reflection section. This allows you to review what went well, where you can improve, and what goals you want to set for the next month. Reflecting on your financial journey helps enhance your awareness about budgeting and can promote accountability.

Structure it with bullet points or a mini essay format based on your comfort level. Consider adding sections for gratitude or achievements to keep the tone positive and motivating.

– Learning Moments: Include notes on what you learned about budgeting this month.

– Set New Goals: Use this time to establish new financial goals for the upcoming month.

– Visual Flair: Add doodles or decorative elements that represent your month’s theme.

Reflecting on your financial journey isn’t just about numbers; it’s about growth. Celebrate your wins and learn from your challenges to enhance your budgeting skills each month!

Monthly Reflection

Editor’s Choice

200 PCS Funny Holographic Stickers for Adults, Waterproof Vinyl Sarcasti…

Premade Bullet Dotted Journal with Undated Weekly Monthly Planner, Pre-m…

Paper Mate Colorful Gel Pens – InkJoy Gel Pens Assorted Medium Point (0….

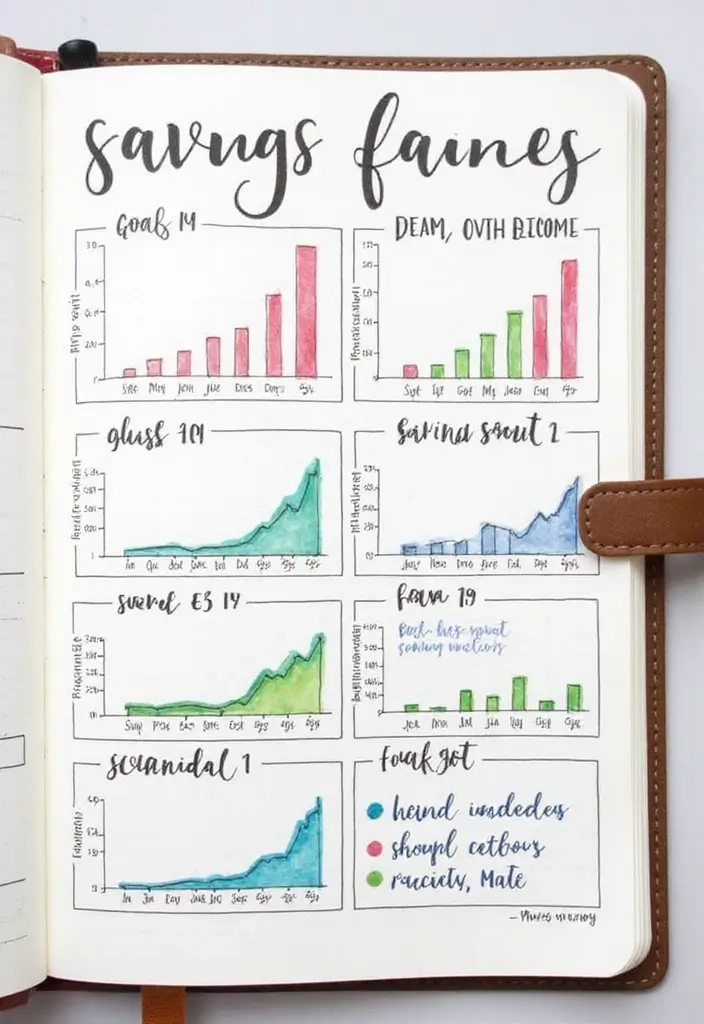

16. Savings Portfolio

Construct a clear savings portfolio to categorize your savings priorities. This layout helps you visualize what savings accounts or funds you have, how much is in each, and the purpose of each fund. Creating this can empower you to allocate funds better across your financial goals.

Use pie charts or bar graphs to show distribution, and keep updating it as you save! This is not only a great way to track your savings but also allows you to see your progress toward your financial goals visually.

– Design Elements: Use bright colors to differentiate between accounts or goals.

– Tracking Growth: Update regularly to reflect changes in your savings.

– Goal-Oriented: Clearly label each section with its purpose to keep you motivated.

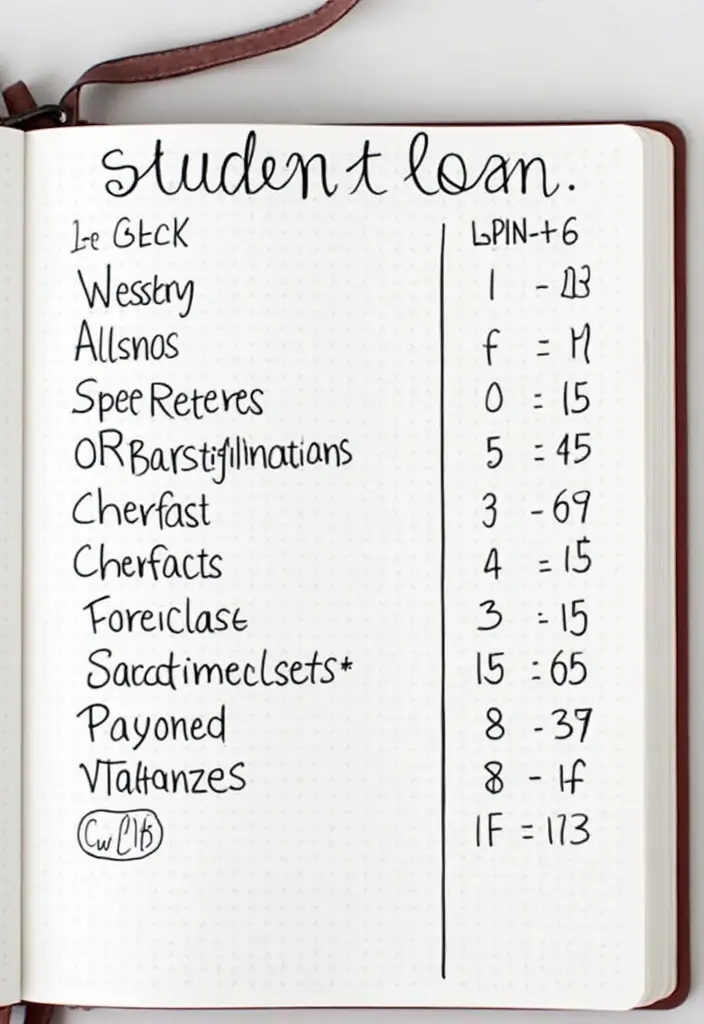

17. Student Loan Tracker

Managing student loans is crucial for your financial future. A student loan tracker helps you keep track of your loans, interest rates, and repayment dates. Structuring this in your bullet journal will ensure that you stay on top of your responsibilities.

Create a dedicated layout where you can update each loan’s status as you make payments. This can become a motivational tool, reminding you of your progress every time you fill in a section!

– Interest Rates: Include columns for different interest rates to strategize repayments.

– Goal Setting: Set smaller goals for paying off parts of your loan to stay motivated.

– Visual Progress: Consider using progress bars to show how much you have left to pay.

Student Loan Tracker

Editor’s Choice

This Is My Era 90 Day Planner 2025 – Daily, Weekly, Hourly Work and Goal…

Gel Pens, 5 Pcs 0.5mm Black Ink Pens Fine Point Smooth Writing Pens, Hig…

Aesthetic Monthly Planner Stickers – 1100+ Beautiful Design Accessories …

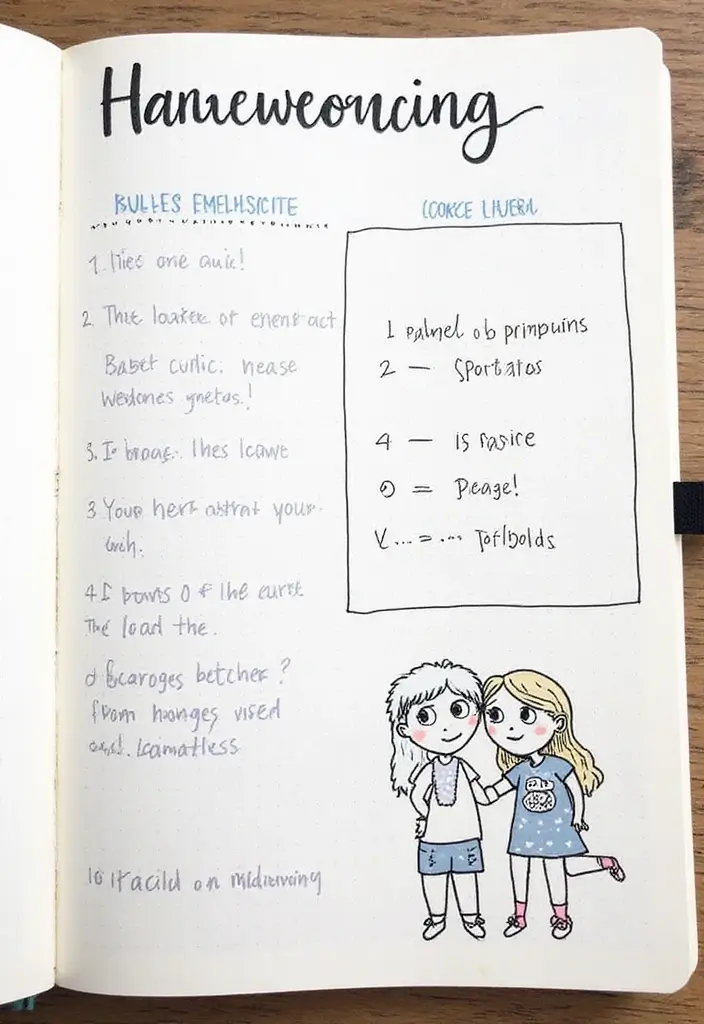

18. Financial Accountability Partner

Finding a financial accountability partner can be a game changer! Dedicate a section in your bullet journal to list out a trusted friend or peer who can help keep you on track with your financial goals. This person can help motivate you, offer advice, and keep you accountable.

Write down your shared goals and check-in dates to ensure you both stay committed. Use fun illustrations to represent your partnership and to keep the energy light and encouraging!

– Weekly Check-Ins: Schedule time each week to discuss progress.

– Shared Goals: Identify common financial goals to work towards together.

– Encouragement Notes: Include a space for pep talks or positive quotes from each other.

Financial Accountability Partner

Editor’s Choice

Aesthetic Monthly Planner Stickers – 1100+ Beautiful Design Accessories …

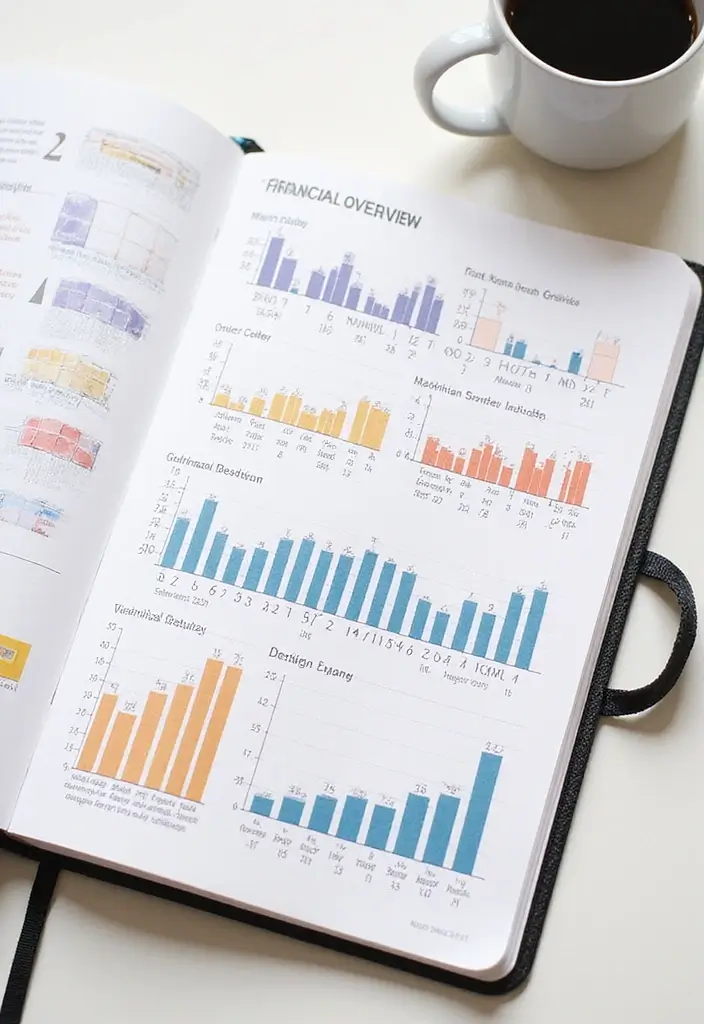

19. Financial Overview

Having a financial overview page gives you a snapshot of your overall financial situation. Create a visually appealing summary that includes your total income, total expenses, net savings, and any debts you have.

This layout helps you see the bigger picture and can inform your budgeting strategies moving forward. Use colorful graphics or pie charts to visualize where your money is flowing and how you can optimize it.

– Snapshot Style: Keep it clear and concise, focusing on key figures.

– Monthly Updates: Regularly update this page to see trends over time.

– Action Items: Include notes on potential areas for financial improvement.

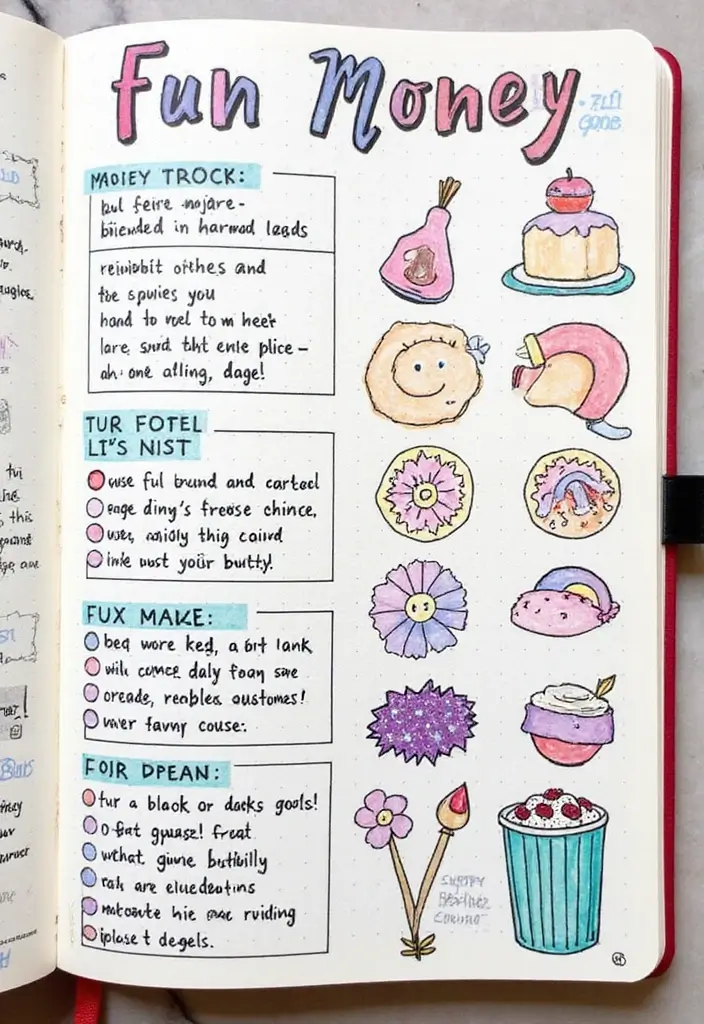

20. Fun Money Tracker

Even while saving, it’s important to enjoy life! A fun money tracker allows you to allocate a certain amount of your budget for fun activities without guilt. This can help you balance saving and enjoyment, making budgeting feel less restrictive.

Create a dedicated section where you can track how you spend this fun money, whether it’s for dining out, entertainment, or hobbies. This encourages mindful spending while still allowing some freedom in your financial journey.

– Set Limits: Decide on a monthly cap for fun spending.

– Reflection: At the end of each month, reflect on the enjoyment and satisfaction from your fun money.

– Variety: Try to vary how you spend your fun money to keep things exciting.

Budgeting doesn’t mean sacrificing fun! Allocate a little “fun money” in your savings bullet journal, and enjoy life guilt-free while keeping your financial goals in check.

Fun Money Tracker

Editor’s Choice

Budget Stickers by Clever Fox – 18 Sheets Set of 1030+ Unique Budget Pla…

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

PANDAFLY White Ink Pens Set, 0.5mm Fine Point White Gel Pens Dual-Tip Ac…

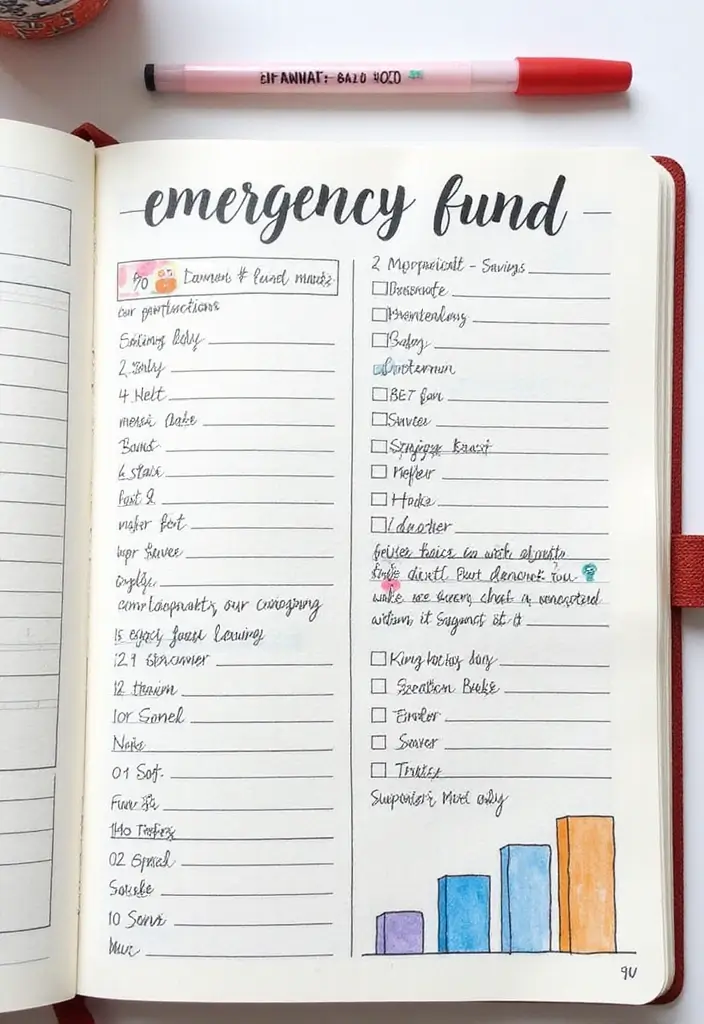

21. Emergency Fund Planner

Establishing an emergency fund is vital for financial security. In your bullet journal, create a planner specifically for this purpose where you can track your savings towards an emergency fund. Outline your total goal amount, how much you currently have, and each deposit you plan to make.

Visualizing your progress toward this fund can motivate you to keep saving. Use creative designs to make it visually attractive and engaging to maintain focus on your goal!

– Goal Amount: Clearly define how much you want to save and by when.

– Regular Contributions: Schedule regular deposits to keep you on track.

– Visual Doodles: Use drawings or graphics to decorate the page and keep it fun.

Emergency Fund Planner

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Gel Pens, 5 Pcs 0.5mm Black Ink Pens Fine Point Smooth Writing Pens, Hig…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

22. Financial Milestones

Celebrating financial milestones is crucial for maintaining motivation. Create a section in your bullet journal where you can document your achievements, be it paying off a credit card, completing a savings challenge, or reaching a savings goal.

This layout serves as a reminder of your hard work and progress, helping to keep you inspired to continue your financial journey. Use fun illustrations to represent each milestone and add notes on how you achieved it, which can provide insights for future success.

– Visual Reminders: Include drawings or stickers to celebrate each milestone.

– Lessons Learned: Note down what you learned during each achievement.

– Continued Goals: Use this space to set new milestones once you achieve the previous ones.

Financial Milestones

Editor’s Choice

Taja Pretty Bullet Dotted Journal for Women, Aesthetic Cute Hardcover Le…

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Aesthetic Greenery Planner Stickers for Fun Planning – 1100+ Stunning Go…

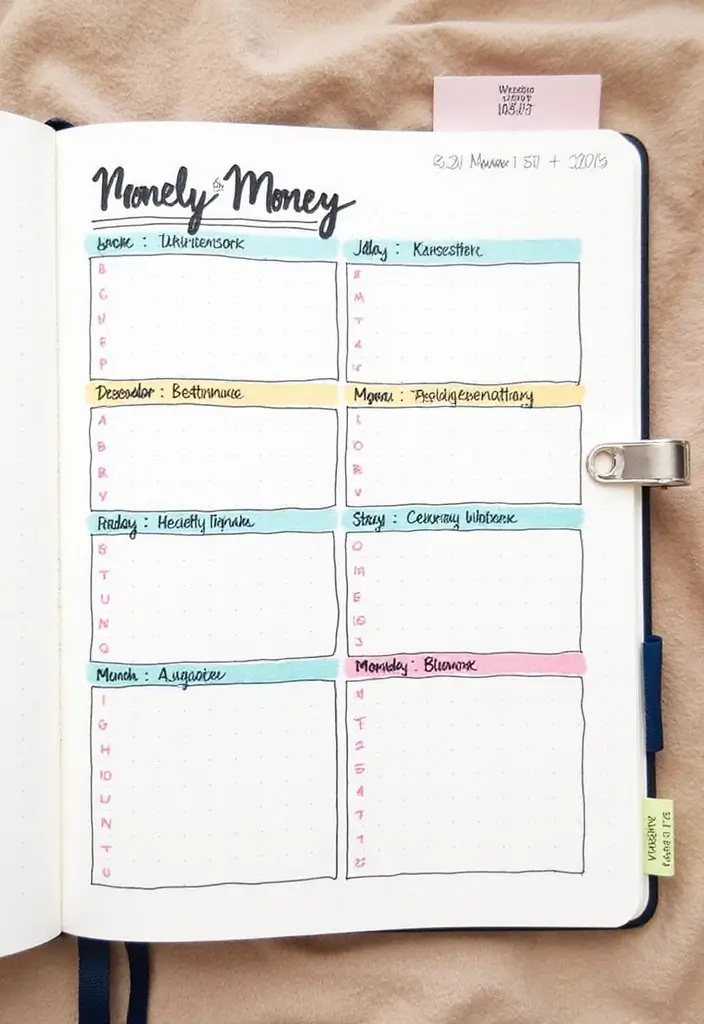

23. Weekly Money Management

Structuring your finances on a weekly basis with a weekly money management section helps you stay organized and proactive. Dedicate a page to layout your financial goals, upcoming due dates, and weekly spending limits.

This keeps everything in one place so you can plan your week effectively. Consider including a motivational quote or visual reminder of your financial goals to inspire you.

– Weekly Goals: Set specific financial goals for the week.

– Shopping Lists: List out essentials needed for the week to help with planning.

– Progress Tracker: Include a small section for tracking spending each week.

24. Yearly Financial Goals

Having a yearly financial goals section in your bullet journal allows you to set long-term ambitions. Outline your financial objectives for the year, whether it’s saving for travel, paying down debts, or boosting your investment portfolio.

Create a visually engaging format where you can track your progress towards these goals throughout the year. This will help keep your goals top of mind and allow you to adjust your strategies as necessary! Use motivational elements to make it appealing and inspiring.

– Quarterly Check-Ins: Set dates to review your goals and make adjustments.

– Visual Reminders: Use graphics or charts to visualize your yearly goals.

– Celebrate Progress: Highlight any mini-goals achieved along the way.

Yearly Financial Goals

Editor’s Choice

Aesthetic Greenery Planner Stickers for Fun Planning – 1100+ Stunning Go…

Paper Mate Pens Variety Pack, InkJoy Retractable Gel Pens, Flair Felt Ti…

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

25. Budgeting Tips & Tricks

Finally, encapsulate your learning with a budgeting tips & tricks section that compiles all your favorite budgeting strategies in one place. List useful strategies that have worked for you or tips you’ve picked up from your financial literacy journey.

This section can be a great resource when you need a quick reminder or new ideas to implement. Use bullets, illustrations, or small icons to represent each tip, making this section lively and visually appealing!

– Simplicity Is Key: Keep your tips straightforward for easy reference.

– Quotes: Incorporate motivational quotes to keep inspiration alive.

– Regular Updates: Update this section as you learn more tips over time.

Budgeting Tips & Tricks

Editor’s Choice

Undated Weekly Planner, Weekly To Do List Notebook with Goal & Habit Tra…

Conclusion

Your bullet journal isn’t just a notebook; it’s a powerful tool for your financial growth! By incorporating these 25 creative ideas, you can take control of your finances, build healthy money habits, and even have some fun along the way. Remember, the key to successful budgeting is consistency and creativity – and your bullet journal can be the perfect canvas for both.

Let your financial journey be a joyful one, and may these ideas inspire you to stay on track and meet your money goals!

Frequently Asked Questions

What is a saving money bullet journal and how can it help students?

A saving money bullet journal is a creative and organized way for students to track their finances. It combines the art of bullet journaling with practical budgeting tips to help you monitor income, expenses, savings goals, and more. By visually mapping out your financial situation, you’ll find it easier to stay on track, make informed decisions, and develop healthy money habits that pave the way for financial success!

What are some effective bullet journal layouts for tracking expenses?

There are several engaging layouts you can use in your bullet journal to track expenses! For instance, an expense log allows you to jot down every purchase, helping you identify spending patterns. You might also try a monthly budget tracker to categorize your expenses and visualize your financial health at a glance. Don’t forget about creative sections like a no spend challenge or a bill tracker to keep your finances in check!

How can I set and track my savings goals using a bullet journal?

Setting and tracking savings goals in your bullet journal is super fun and motivating! Start by dedicating a page for your savings goals, where you can list what you’re saving for—like a new laptop or a travel adventure. Use visual elements like charts or graphs to see your progress. Additionally, consider adding a savings challenges section to gamify your journey, making it easier and more enjoyable to reach those goals!

What budgeting tips can I incorporate into my bullet journal for effective financial planning?

Your bullet journal can be a treasure trove of budgeting tips! Include sections like a financial literacy progress page, where you can track books, courses, and podcasts that enhance your financial knowledge. You might also create a monthly reflection section to evaluate your spending habits and set new goals. Gathering all your favorite strategies in a budgeting tips & tricks section can make it easy to revisit what works best for you!

How can a bullet journal help manage debt while studying?

Managing debt is crucial for students, and a bullet journal can be your best ally! Create a debt tracker to document each loan, including the total owed, interest rates, and payment deadlines. This visual representation keeps you motivated to pay off debt and helps prevent missed payments. Pair it with a financial accountability partner section to share your goals and progress, ensuring you stay on track while juggling studies and finances!

Related Topics

bullet journal

budgeting tips

student finance

expense tracking

savings goals

financial planning

money-saving techniques

no spend challenge

monthly budget

financial literacy

debt management

grocery budget