Etsy is a treasure trove for those looking to sell unique, handmade items. The platform has garnered a reputation for promoting creativity and individuality. With each passing season, certain products remain steadfast in their popularity, making them great options for budding entrepreneurs.

By specializing in handmade financial planning tools, sellers can tap into a niche market that blends creativity with practicality. From beautifully designed budget planners to custom spreadsheets, there’s a piece for everyone looking to get their finances in order. Dive into this list of 30 popular items that not only cater to the financially conscious but also embody the charm and creativity that Etsy is renowned for.

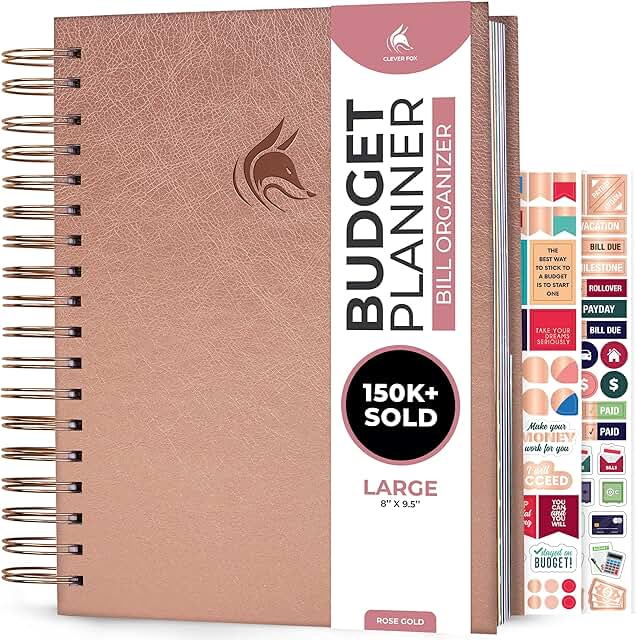

1. Custom Budget Planners

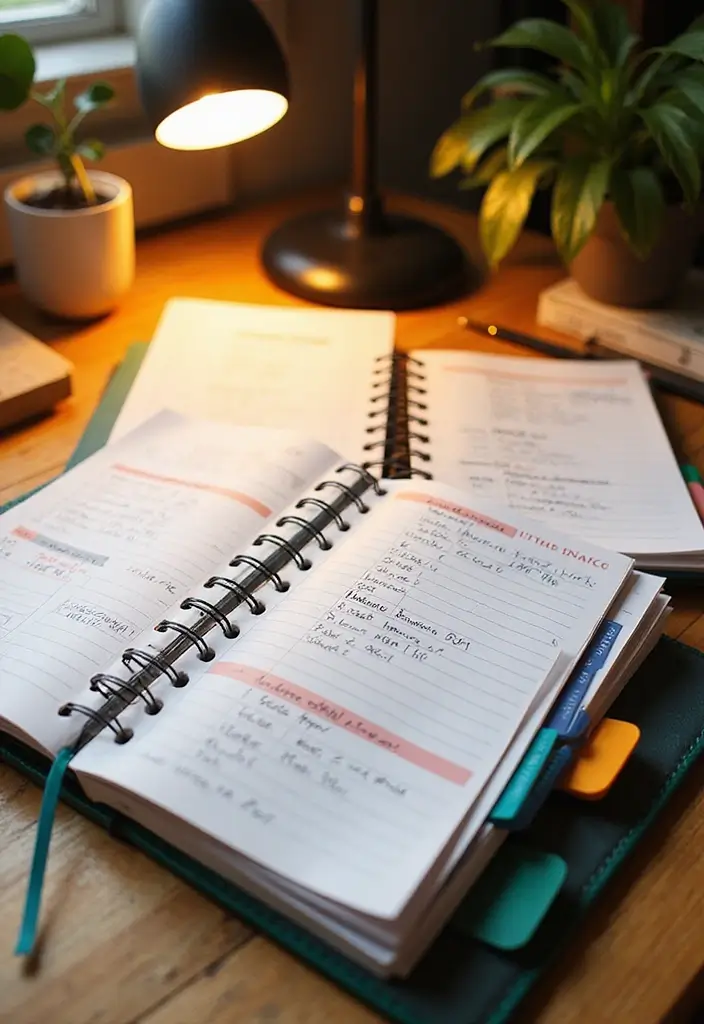

Handcrafted budget planners are an essential tool for anyone looking to take control of their finances. With personalized options like cover designs, layouts, and even special pages for tracking expenses, these planners become perfect companions for financial planning.

These planners often feature sections for monthly budgets, savings goals, and expense tracking. Sellers can create themes such as minimalist, floral, or even whimsical styles that cater to various tastes.

Here’s how to make your budget planners stand out:

– Offer customization options for names or monograms.

– Use high-quality, eco-friendly materials.

– Consider including budgeting tips or affirmations as a bonus.

The appeal of a well-designed budget planner cannot be overstated; it’s not just about numbers, but also about making the budgeting process enjoyable.

Custom Budget Planners

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Aesthetic Budget Planner – Monthly Finance Planner with Expense Tracker,…

Amazon$7.59

Amazon$7.59

PRSTENLY Inspirational Gifts for Women, 140 Page Leather Journal Spiritu…

Amazon$9.99

Amazon$9.992. Printable Financial Trackers

In the digital age, many people prefer using printables for convenience and organization. Printable financial trackers, including expense logs and savings challenges, are always in demand because they simplify the process of budgeting.

These downloadable files allow users to print as many copies as they need, making them versatile and cost-effective. Plus, the customization potential is endless. With various designs, colors, and themes, you can create something for everyone.

Consider these tips to create appealing printables:

– Ensure they are user-friendly with clear sections.

– Use fun, engaging designs that make budgeting feel less daunting.

– Offer a package deal with multiple trackers for a discount.

By creating attractive and functional financial trackers, you can help others take charge of their finances while enjoying the creative process.

Printable Financial Trackers

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Monthly Bill Payment Checklist & Financial Planner Notebook – 4-Year B…

Amazon$6.99

Amazon$6.993. Goal-Setting Journals

Goal-setting journals serve as an excellent tool for anyone looking to achieve their financial ambitions. These journals can feature prompts for monthly goals, reflections, and even motivational quotes.

Creating a goal-setting journal that not only looks beautiful but is also functional can pave the way for success. Combining aesthetics with practicality is key.

Here are some ideas to enhance your journals:

– Include sections for both short-term and long-term goals.

– Offer tips on how to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals.

– Use inspiring visuals or illustrations to keep users engaged.

The potential for transformation is immense when individuals can articulate their goals, making these journals an impactful product.

Goal-Setting Journals

Editor’s Choice

Panda Planner 2026 Undated Daily Planner 90 Day Planner – 3-Month Goal…

Amazon$27.87

Amazon$27.87

Note to Self Mental Health Journal, Inspirational Spiral Notebook, Motiv…

Amazon$9.48

Amazon$9.48

RETTACY Bullet Dotted Journal Notebook, 192 Pages, A5 Medium Size (5.7”…

Amazon$6.39

Amazon$6.394. Expense Tracking Notebooks

Expense tracking notebooks are specifically designed to make the sometimes tedious task of tracking spending easier and more enjoyable. These notebooks can have dedicated sections for daily expenses, categorized spending, and monthly summaries.

When designing these notebooks, consider incorporating fun illustrations or motivational quotes to keep users inspired.

Here are some features that can make your notebooks appealing:

– Use perforated pages for easy removal of important notes.

– Integrate budgeting tips or monthly challenges.

– Offer a variety of sizes and styles to cater to different preferences.

Ultimately, expense tracking notebooks provide a practical solution while allowing for personalization that makes the budgeting journey fun.

Expense Tracking Notebooks

Editor’s Choice

Knibeo Mindset Inspirational Notebooks Journal – Notebooks for School, 5…

Amazon$7.99

Amazon$7.99

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Papercode Lined Journal Notebook – Luxury Journal for Writing w/ 130 Pag…

Amazon$9.99

Amazon$9.995. Debt Repayment Worksheets

For many, managing debt is a significant part of personal finance. Debt repayment worksheets can provide a structured approach to tackling financial obligations. These worksheets typically include sections for listing debts, tracking payments, and setting repayment goals.

By offering customizable debts worksheets, you allow users to create a plan that best suits their circumstances.

Consider these unique selling points:

– Provide options for visual trackers, like pie charts or graphs, to see progress at a glance.

– Include tips on snowball vs. avalanche methods for debt repayment.

– Ensure an engaging layout that simplifies complex calculations.

Helping individuals manage their debts with easy-to-use tools can lead to a more organized and stress-free life.

[affiai keyword="30 Things to Sell on Etsy That Are Always in Demand 5. debt repayment worksheets" count="3" template="grid" price="20-10000"]6. Savings Challenge Kits

Savings challenge kits have gained popularity as fun and engaging ways to encourage saving money. These kits can include worksheets, trackers, and even stickers for milestones.

Themed saving challenges, like ’52-Week Savings Challenge’ or ‘No-Spend Month’, can motivate users to reach their financial goals in a playful manner.

to enhance your kits:

– Include a vibrant design that makes the challenge visually appealing.

– Offer digital and physical versions to cater to various preferences.

– Add a community aspect, like online groups, for users to share their progress.

The charm of a savings challenge kit lies in turning saving into a game, making the process enjoyable and rewarding.

Savings Challenge Kits

Editor’s Choice

Money Vault 1000 5000 10000 Dollar Savings Challenge Box Wooden Piggy Ba…

Amazon$7.99

Amazon$7.99

SKYDUE 104-Piece Budget Sticker Set – Cash Envelope Labels & Blank Budge…

Amazon$6.98

Amazon$6.98

100 Days Money Saving Challenge Coin Envelope Budgetstorage Book, Mini 1…

Amazon$9.66

Amazon$9.667. Financial Literacy Workbooks

In an age where financial literacy is critical, workbooks aimed at educating consumers on various financial topics are in high demand. These workbooks can cover everything from budgeting basics to investment strategies.

Well-structured financial literacy workbooks that combine educational content with engaging exercises can be incredibly valuable.

Busy consumers appreciate a workbook that not only reads well but also includes practical activities. Here are some features to consider:

– Simplified explanations of complex concepts.

– Worksheets for real-life applications.

– Interactive elements, like quizzes or reflection prompts.

By promoting financial literacy, you empower individuals to make informed financial decisions.

[affiai keyword="30 Things to Sell on Etsy That Are Always in Demand 7. financial literacy workbooks" count="3" template="grid" price="20-10000"]8. Budgeting Stickers

Stickers have become a popular way to make budgeting not only effective but also fun. Budgeting stickers can be used in planners or expense tracking notebooks, adding a splash of color and creativity to financial planning.

Stickers can represent different categories, like groceries, bills, or savings goals, and help users visualize their spending.

Here’s how to make your budgeting stickers stand out:

– Use unique designs that resonate with various audiences, from minimalists to whimsical.

– Offer themed collections for holidays or specific savings challenges.

– Consider biodegradable materials for eco-friendliness.

Incorporating stickers into budgeting can transform a mundane task into an enjoyable process.

Budgeting Stickers

Editor’s Choice

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

Amazon$9.95

Amazon$9.95

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

Amazon$9.95

Amazon$9.95

772 Planner Stickers – Budget Planning Collection. Bill Due Date Reminde…

Amazon$7.97

Amazon$7.979. Cash Envelope Systems

Cash envelope systems provide a tactile and effective way to manage finances. By allocating cash for different spending categories, users can visualize their available funds.

Customized cash envelopes, adorned with beautiful designs or motivational quotes, can keep users inspired while maintaining their budget.

Consider these angles to enhance your cash envelope offerings:

– Use eco-friendly materials and unique patterns.

– Include a guide on how to implement the cash envelope system.

– Offer themes, like seasonal or minimalist designs.

These systems are appealing because they offer a hands-on approach to budgeting, allowing users to feel in control of their finances.

Cash Envelope Systems

Editor’s Choice

Bremorou Cash Wallet Pu Leather Envelope Reusable Mini Cash Holder Walle…

Amazon$5.19

Amazon$5.19

Pu Leather Cash Envelope Wallet for Women – Reusable Cash Stuffing Walle…

Amazon$4.15

Amazon$4.1510. Financial Affirmation Cards

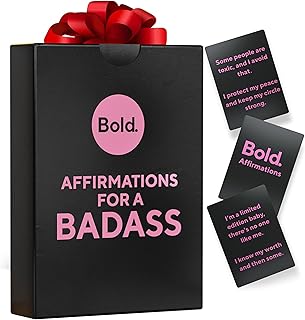

Financial affirmation cards can help users cultivate a positive mindset towards money. These cards can feature inspiring quotes or affirmations that encourage users to reflect on their relationship with finances.

Offering a set of beautifully designed affirmation cards can serve as daily reminders for users to maintain a healthy financial mindset.

These cards can come with:

– A range of themes, from self-love to prosperity.

– Suggestions on how to incorporate them into daily routines.

– Opportunities for customization, allowing for personal quotes or messages.

Creating financial affirmation cards taps into the growing mindfulness trend and adds a personal touch to financial journeys.

Financial Affirmation Cards

Editor’s Choice

Badass Affirmation Cards – 100 Daily Motivational and Inspirational Affi…

Amazon$8.99

Amazon$8.99

Badass Affirmation Cards – 100 Daily Motivational and Inspirational Affi…

Amazon$8.99

Amazon$8.99

Badass Affirmation Cards – 100 Daily Motivational and Inspirational Affi…

Amazon$8.99

Amazon$8.9911. Personalized Tax Organizers

Tax season can be daunting, but personalized tax organizers can simplify the process significantly. These organizers can include sections for income, deductions, and receipts, making tax preparation easier.

Offering customization with names or themes can make these tools feel personal and special.

To make your tax organizers more appealing, include:

– Durable materials that withstand the wear of tax season.

– Colorful designs to ease the stress of tax preparation.

– Helpful tips or checklists for preparing taxes.

By providing a practical solution for tax season, you help alleviate some of the stress surrounding finances.

Personalized Tax Organizers

Editor’s Choice

Letter Size Yearly Tax Organizer Book with 12 Separate Pockets Spiral Bo…

Amazon$15.99

Amazon$15.9912. Custom Monthly Budget Templates

Monthly budget templates offer a structured way to keep track of spending, but custom options can enhance their efficacy. By personalizing templates with specific categories or designs, users can create a budgeting experience that feels tailored to them.

These templates can be printed or used digitally, ensuring versatility.

Key features to consider:

– Clear layouts that make data easy to understand.

– Beautiful aesthetics that inspire users to engage with them.

– Space for notes or additional tracking.

Customized monthly budget templates can make budgeting less of a chore and more of a delightful, creative endeavor.

Custom monthly budget templates turn tracking finances from a chore into a creative journey! Personalize your budget to inspire better spending habits and watch your savings grow!

Custom Monthly Budget Templates

Editor’s Choice

Handmade Flexible Record Template, Reusable Planner Stencils for Journal…

Amazon$5.99

Amazon$5.99

Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. Expense…

Amazon$34.99

Amazon$34.9913. Savings Jars with Labels

Savings jars are a charming way to encourage saving habits among all ages. These jars can be personalized with labels for different goals, such as ‘Vacation Fund’, ‘Emergency Fund’, or ‘New Car Savings’.

Customized jars that are visually appealing can attract people looking for practical yet aesthetic solutions.

To make your savings jars stand out:

– Use high-quality glass or eco-friendly materials for sustainability.

– Create themed sets with multiple jars for various savings goals.

– Consider adding decorative elements that reflect different styles, from rustic to modern.

Encouraging saving through beautiful and personalized jars can inspire others to achieve their financial goals.

Savings Jars with Labels

Editor’s Choice

Piggy Bank, Coin Bank for Boys and Girls, Children’s Plastic Shatterproo…

Amazon$11.99

Amazon$11.9914. Retirement Planning Worksheets

Retirement planning can feel overwhelming, but providing worksheets that break down the process can be incredibly helpful. These worksheets can guide users through deciding savings goals and estimating retirement expenses, making the journey clearer.

By offering a structured approach, these worksheets empower individuals to plan for their futures effectively.

Consider these elements:

– Simple steps that incrementally build a comprehensive plan.

– Visual aids, such as charts or graphs, for clarity.

– Opportunities for customization, allowing users to personalize their worksheets.

Retirement planning worksheets not only aid in organization but also encourage proactive thinking about the future.

Retirement Planning Worksheets

Editor’s Choice

The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your M…

Amazon$14.87

Amazon$14.87

Roetyce Retirement Party Decorations Women Men, Green Happy Retirement G…

Amazon$12.99

Amazon$12.99

Budget Planner and Monthly Bill Organizer – Financial Planner Organizer …

Amazon$7.99

Amazon$7.9915. Financial Goal Vision Boards

Vision boards are a creative and powerful way to visualize financial goals. By allowing customers to craft their boards with images, quotes, and other inspirational items, you can encourage them to focus on their aspirations.

Consider offering kits with materials, including boards, decorative elements, and guidance on how to create an impactful vision board.

Here are some unique features to include:

– Themed kits, like ‘Travel Goals’ or ‘Debt-Free Dreams’.

– Clear instructions on how to maximize the effectiveness of a vision board.

– Suggestions for regular reflection and updates.

Financial goal vision boards encourage users to clarify their aspirations and keep their financial targets in sight.

Financial Goal Vision Boards

Editor’s Choice

Dream Gift Bundle 2026 Planner, Gratitude Journal & Budget Binder Set | …

Amazon$58.97

Amazon$58.97

Motivational Gifts For Women, Coworkers – Inspirational Gifts for Cowork…

Amazon$11.16

Amazon$11.16

BulbaCraft Vision Board Stickers for Women, Vision Board Supplies Kit, M…

Amazon$8.99

Amazon$8.9916. Customizable Spending Journals

Spending journals allow individuals to record their daily expenses in a structured way, paving the way for better financial awareness. Customizable options make them even more appealing, as users can add their categories or personal touch.

Offering sections for reflections or budgeting assessments can enrich the journaling experience.

Here’s how to enhance your spending journals:

– Use high-quality paper that feels satisfying to write on.

– Include prompts that encourage financial mindfulness.

– Offer different sizes and designs to cater to various tastes.

By promoting mindfulness around spending, customizable spending journals provide a fun, engaging method for financial tracking.

Customizable Spending Journals

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Gel Pens, 5 Pcs 0.5mm Black Ink Pens Fine Point Smooth Writing Pens with…

Amazon$6.79

Amazon$6.79

TRUSTS & ASSET PROTECTION STRATEGIES that WORK: How to Protect Your Asse…

Amazon$19.99

Amazon$19.9917. Financial Planning Workshops

Offering online or in-person workshops focused on financial planning can provide practical knowledge while fostering community. These workshops can cover topics like budgeting, investing, and saving strategies.

Creating a welcoming environment where participants feel comfortable discussing finances can greatly enhance the learning experience.

Consider these aspects to make your workshops successful:

– Use engaging presentations and interactive activities.

– Offer workshops at various skill levels to cater to a broader audience.

– Include take-home resources, like worksheets or guides.

Financial planning workshops create opportunities for learning and dialogue, empowering attendees to take charge of their financial futures.

Empower your community through financial planning workshops! Knowledge shared is a tool gained. Let’s make finances relatable and fun—because budgeting should never be boring!

Financial Planning Workshops

Editor’s Choice

McAfee+ Premium Family Unlimited Devices anti virus software 2026 for pc…

Amazon$39.99

Amazon$39.9918. Personalized Wealth-Building Plans

Personalized wealth-building plans offer a tailored approach to achieving financial goals. By providing customized assessments and actionable steps, sellers can help clients develop sustainable financial strategies.

These plans can cover topics like investment options, saving strategies, and budgeting techniques, making them comprehensive.

To create effective wealth-building plans, consider these points:

– Conduct assessments that reflect individual circumstances.

– Provide clear and actionable steps for implementation.

– Include regular check-ins to monitor progress.

Personalized wealth-building plans not only empower clients to take control but also build trust and long-term relationships.

Personalized Wealth-Building Plans

Editor’s Choice

This Is My Era 90 Day Planner 2025 – Daily, Weekly, Hourly Work and Goal…

Amazon$19.99

Amazon$19.99

19. Financial Literacy Games

Creating board games or card games centered around financial literacy can be a fun and engaging way to learn. These games can cover topics like budgeting, investing, and saving, making financial education enjoyable for all ages.

Games that involve strategic thinking and group participation can encourage discussions about finances in a relaxed setting.

To enhance your financial literacy games, focus on:

– Interactive elements that keep players engaged.

– Age-appropriate content that caters to various audiences.

– Game pieces that are visually appealing and represent financial concepts.

Using games to promote financial literacy allows learning to become a joyful experience, encouraging conversations about money in a playful manner.

[affiai keyword="30 Things to Sell on Etsy That Are Always in Demand 19. financial literacy games" count="3" template="grid" price="20-10000"]20. Budgeting Apps and Tools

With the rise of technology, budgeting apps and online tools have become popular among digital-savvy users. By creating unique budgeting tools or apps, sellers can cater to this growing market.

Offering features like expense tracking, savings challenges, and financial goal-setting can make your tools indispensable.

Key points to consider:

– Ensure user-friendly navigation and design.

– Incorporate engaging visuals to enhance the user experience.

– Provide regular updates and user support.

Creating innovative budgeting apps and tools can transform how individuals manage their finances and keep them organized.

Budgeting Apps and Tools

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.4821. Personalized Financial Coaching

Personalized financial coaching offers direct support to individuals seeking to improve their financial situations. Coaches can provide tailored advice and strategies based on individual goals and challenges.

As a seller, you can market personalized coaching sessions alongside valuable resources that enhance the experience.

Consider these aspects to make your coaching business effective:

– Identify specific areas of focus, such as budgeting, debt reduction, or investment strategies.

– Offer flexible sessions—virtual or in-person—to accommodate diverse clients.

– Provide follow-up resources to ensure ongoing progress.

By offering personalized financial coaching, you empower clients to make informed decisions and take actionable steps toward their financial goals.

[affiai keyword="30 Things to Sell on Etsy That Are Always in Demand 21. personalized financial coaching" count="3" template="grid" price="20-10000"]22. Monthly Subscription Boxes for Financial Tools

Creating a monthly subscription box filled with financial planning tools can be a fantastic way to keep users engaged and inspired. Each month could feature different themes, such as budgeting, goal setting, or financial literacy.

Including various tools like planners, worksheets, stickers, or educational materials can create a delightful unboxing experience.

for curating successful boxes include:

– Ensure a cohesive theme that aligns with users’ financial needs.

– Provide value through exclusive items or custom products.

– Encourage user feedback to refine future boxes.

Subscription boxes not only create ongoing revenue but also foster a community focused on financial wellness.

Monthly Subscription Boxes for Financial Tools

Editor’s Choice

Goal Planner | SMART Goal Setting Kit for the New You, Monthly Habits, R…

Amazon$14.99

Amazon$14.99

Mini 1000 Budget Binder with Cash Envelopes,Envelope Savings Challenge B…

AmazonCheck Price

AmazonCheck Price23. DIY Financial Planning Kits

DIY financial planning kits allow users to create their own budgeting and financial tracking tools at home. By providing all the materials needed, including instructions, you can simplify the process.

These kits can include items like blank planners, stickers, and even instructional sheets on best budgeting practices.

To enhance your kits, consider:

– Offering themes, such as minimalism or creativity.

– Including videos or digital guides to accompany the physical materials.

– Providing options for customization, allowing users to choose their designs.

DIY kits encourage creativity while empowering users to take control of their financial journeys.

DIY Financial Planning Kits

Editor’s Choice

Budget Stickers by Clever Fox – 18 Sheets Set of 1030+ Unique Budget Pla…

Amazon$12.34

Amazon$12.34

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Personal Finance QuickStart Guide: The Simplified Beginner’s Guide to …

Amazon$14.91

Amazon$14.9124. Lifestyle Finance Books

Books that blend lifestyle and finance can be hugely popular among readers seeking a more approachable way to understand money management. Writing a lifestyle finance book can provide valuable insights and practical advice, all while engaging an audience.

Consider topics like mindful spending, frugal living, or debt-free living to resonate with your potential readers.

Key elements to include in your book:

– Real-life stories and relatable examples that make the content engaging.

– Actionable tips that empower readers to take charge of their financial futures.

– Resource lists for further reading or financial tools.

Lifestyle finance books can transform how readers perceive their financial journeys, making financial literacy accessible to all.

Lifestyle Finance Books

Editor’s Choice

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

Amazon$0.00

Amazon$0.00

The Infographic Guide to Personal Finance: A Visual Reference for Everyt…

Amazon$9.99

Amazon$9.99

Your Money or Your Life: 9 Steps to Transforming Your Relationship with …

Amazon$9.55

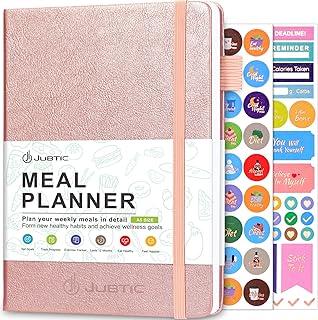

Amazon$9.5525. Budget-Friendly Meal Planning Tools

Meal planning tools can help individuals save money while ensuring they stay healthy. By offering planners or printables that focus on budget-friendliness, you can appeal to those looking to cut costs in their grocery shopping.

These tools can include grocery lists, meal prep calendars, and budgeting trackers for food costs.

To enhance your meal planning tools, consider:

– Incorporating easy-to-follow recipes that prioritize affordability.

– Offering tips on how to shop smart and reduce waste.

– Providing seasonal guides for budgeting meals based on what’s fresh.

Budget-friendly meal planning encourages healthier eating habits while promoting financial stability.

Budget-Friendly Meal Planning Tools

Editor’s Choice

JUBTIC Weekly Meal Planner Notebook, Food Journal for Women Weight Loss,…

Amazon$7.99

Amazon$7.99

MATICAN Grocery List Magnet Pad for Fridge, 6-Pack Magnetic Note Pads Li…

Amazon$7.99

Amazon$7.99

Heveboik Income & Expense Log Book – A5 Income and Expense Tracker for S…

Amazon$7.99

Amazon$7.9926. Simple Financial Checklists

Checklists are handy tools for personal finance management, providing guidance on various financial tasks. Simple financial checklists that outline steps for budgeting, saving, or investing can be beneficial for individuals at any stage of their financial journey.

By creating easily accessible checklists, you help users stay organized and focused.

Here are some features to consider:

– Use vibrant designs that make the checklists visually appealing.

– Include space for notes or personal reflections.

– Offer a digital version for easy access.

Providing practical checklists empowers individuals to tackle their financial goals with clarity and confidence.

A simple checklist can turn financial chaos into clarity. Stay organized and focused on your goals—after all, every great journey begins with a single step!

Simple Financial Checklists

Editor’s Choice

32″ x 48″ 2026 Wall Calendar Erasable Starry Sky, Wet & Dry Erase Large …

Amazon$24.99

Amazon$24.99

bloom daily planners Budget Planner Stickers for Personal Finance, Budge…

Amazon$9.95

Amazon$9.95

Budget Planner – Financial Planner | Budget Book | Bill Payment Checklis…

Amazon$11.39

Amazon$11.3927. Interactive Budgeting Tools

Interactive budgeting tools, like web-based calculators and apps, can make financial management more engaging. These tools can provide real-time feedback on budgeting efforts, helping users adapt their strategies as needed.

Creating customizable options that align with users’ financial lifestyles can enhance their experience.

Consider these features:

– Include visual elements like graphs to track progress.

– Offer prompts for goal setting or finance-related challenges.

– Ensure mobile compatibility for on-the-go access.

Interactive budgeting tools can empower users to take control of their financial situations in dynamic and engaging ways.

Interactive Budgeting Tools

Editor’s Choice

Budget Planner – Monthly Budget Book with Expense Tracker Notebook, Unda…

Amazon$8.48

Amazon$8.48

Mr. Pen Mechanical Switch Calculator – 12 Digit Large LCD Display, Pink …

Amazon$9.99

Amazon$9.9928. Personalized Financial Consulting Packages

Financial consulting packages tailored to individual needs can provide valuable guidance for those seeking financial clarity. Offering various levels of consulting can attract a diverse range of clients.

These packages can include one-on-one consultations, workshops, or digital resources that assist in achieving financial goals.

To enhance your packages:

– Provide clear descriptions of what each package entails.

– Include testimonials or success stories to build credibility.

– Offer package deals for long-term clients.

Personalized consulting packages empower clients to make informed decisions and foster a supportive financial journey.

Personalized Financial Consulting Packages

Editor’s Choice

feela 3 Pack Notebooks Journals Bulk with 3 Black Pens, A5 Hardcover Not…

Amazon$15.83

Amazon$15.8329. Community-Centric Financial Workshops

Hosting community-centric financial workshops fosters a sense of belonging while promoting financial awareness. These workshops can cover various topics and allow attendees to share experiences and strategies.

By creating a supportive environment, you encourage discussions around finances, helping individuals learn from one another.

Key elements to include:

– Choose convenient locations that facilitate attendance.

– Incorporate interactive activities to enhance engagement.

– Provide resources for attendees to continue their learning journey.

Community-centric workshops encourage collaboration and create a network of support among attendees.

Community-Centric Financial Workshops

Editor’s Choice

Spin Master Games, Suspend, A Balancing Family Game of Tricky Hangs & St…

Amazon$22.99

Amazon$22.99

Juvhot 2026 New Surprise Box Gift Box, 20 Bounces Festive Pop-Up Surpris…

Amazon$15.99

Amazon$15.99

Vaunn Wrist Arm Leg Strengtheners Pedal Exerciser with Electronic Displa…

Amazon$33.99

Amazon$33.9930. Financial Wellness Retreats

Organizing financial wellness retreats can provide a unique experience for individuals seeking to improve their financial knowledge in a relaxing environment. These retreats can combine education with self-care, creating a holistic approach to financial wellness.

Activities can include workshops, group discussions, and one-on-one coaching sessions.

To make your retreats memorable, consider:

– Choosing beautiful, serene locations for relaxation.

– Offering a variety of financial topics to appeal to diverse interests.

– Incorporating wellness activities like yoga or meditation to balance finance with self-care.

Financial wellness retreats can transform how individuals approach their finances, fostering a supportive community.

Investing in financial wellness retreats is not just about numbers; it’s about nurturing your mind and soul. Combine education with relaxation, and watch your financial future thrive!

Financial Wellness Retreats

Editor’s Choice

ASAKUKI Essential Oil Diffuser 500ml, Ultrasonic Aromatherapy Humidifier…

Amazon$19.94

Amazon$19.94

Gaiam Essentials 2/5″ Thick (10mm) Yoga & Pilates, Fitness & Exercise Ma…

Amazon$20.38

Amazon$20.38Conclusion

Embarking on an Etsy venture centered around handmade financial planning tools opens up a world of creative possibilities. As you consider these 30 items, remember that the key is to infuse your unique style and perspective.

All the products mentioned not only cater to a growing audience but also empower individuals to take control of their finances while enjoying the process. Why not get started on transforming your creative ideas into profitable Etsy products?

Frequently Asked Questions

What are the best handmade financial planning tools to sell on Etsy?

If you’re looking to dive into the Etsy market, consider selling custom budget planners, printable financial trackers, and goal-setting journals. These items are not only popular but also help customers manage their finances effectively. With the growing demand for personalized financial tools, your unique offerings can stand out in this niche!

How can I determine if my Etsy products will be profitable?

To gauge the profitability of your Etsy products, start by researching trending Etsy crafts and Etsy selling ideas in the financial planning niche. Look for items that consistently sell well and check their reviews. Additionally, analyze your production costs vs. potential selling prices to ensure a healthy profit margin. Don’t forget to promote your products effectively to attract buyers!

What are some effective marketing strategies for my Etsy shop?

To boost visibility for your Etsy shop, use social media platforms like Instagram and Pinterest to showcase your handmade items to sell. Engage with your audience by sharing tips on financial literacy or showcasing how your products can help them. Also, consider offering discounts or collaborating with influencers in the personal finance space to broaden your reach and attract more customers!

How can I create unique and appealing financial planning tools for Etsy?

To create standout financial planning tools, focus on personalization and creativity. Think about incorporating customizable options like cover designs for planners or unique layouts for trackers. Additionally, consider adding engaging elements like stickers or motivational quotes that resonate with your audience. The more unique and tailored your products, the more likely they are to attract buyers!

What are some common mistakes to avoid when selling on Etsy?

One common mistake is not optimizing your product listings with relevant keywords, such as profitable Etsy products and Etsy business tips. Also, avoid underpricing your handmade items; ensure your prices reflect the quality and effort you put in. Lastly, neglecting customer service can harm your shop’s reputation, so always respond promptly to inquiries and feedback!

Related Topics

Etsy selling

handmade finance tools

budget planners

printable trackers

financial literacy

DIY budgeting

savings kits

custom financial worksheets

profitable products

personal finance tips

successful Etsy shop

creative budgeting